Why Continue Trading in a Volatile Market?

Written By: Isha Goel | June 10 2021

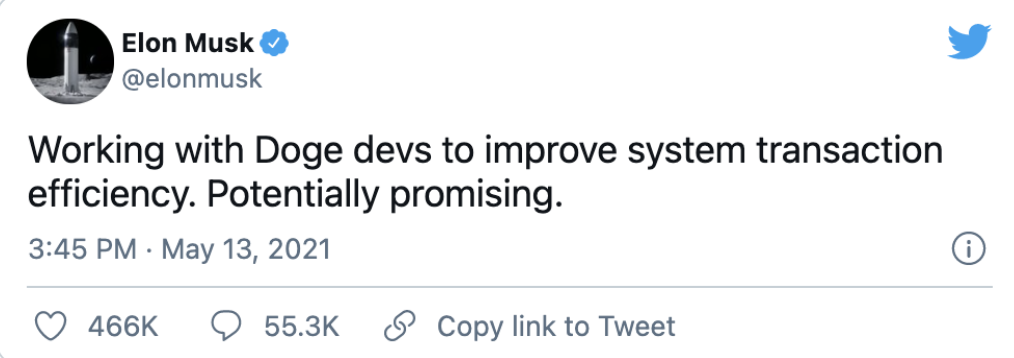

The volatility of the cryptocurrency market has made for more uncertain trading decisions among retail investors. As prices continue to drop, many have begun questioning buys and sells in hopes of not losing more money while maintaining participation as to not miss out. Overall, the market has still seen significant activity and the popularity of cryptocurrency trading has led to emerging trends within the industry.

The Market Continues to Grow

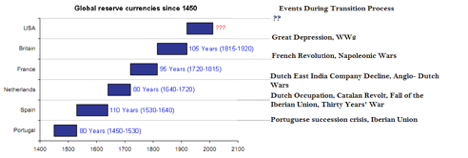

In comparison to traditional asset classes, cryptocurrency has been producing considerably higher returns in recent months. As many other industries continue to recover from the COVID-19 pandemic era, this market has shown upwards of 200% in gains while Nasdaq and the S&P 500 have experienced more moderate recoveries. Even in this elusive time, it is important to look at the larger picture in determining trading positions. Based on a research report by Facts and Factors, ‘the global Cryptocurrency Market was estimated at USD 792.53 Million in 2019 and is expected to reach USD 5,190.62 Million by 2026. The global Cryptocurrency Market is expected to grow at a compound annual growth rate (CAGR) of 30% from 2019 to 2026.’

New Digital Currencies Are Up-and-Coming

In just the past three years, many new currencies have been proliferated as a result of the market’s growing popularity. While there were only 2,000 about a few years ago, now there are more than 5,000 cryptocurrencies in existence. This rapid increase has given traders the opportunity to become more comfortable with the world of crypto trading through discovering new currencies. Tezos and Cardano appear to be two of the major inventions leading this growth.

As environmental concerns center crypto conversations, Tezos is popular as ‘the pioneer of the more energy-efficient Proof of Stake design.’ This leading open-source blockchain consumes over two million times less energy than other similar frameworks like Bitcoin or Ethereum. This allows developers to prioritize innovation and the network reached more than 1.2 million contract calls between April and May, thus ‘signaling fast-growing adoption of the open-source software to power a global suite of NFT marketplaces and DeFi applications.’ The ecosystem is quickly becoming a popular choice ‘for global brands and institutions such as F1 team Red Bull Racing Honda, iconic gaming publisher Ubisoft, financial services giant Societe Generale, and more.’ Huge Brooklyn announced on June 8 that it has been named Agency of Record for the Tezos Foundation. The agency will work with the ecosystem in its brand development and marketing strategies in order to create a more engaging experience for the community, likely bringing in more retail investors.

Cardano is the fifth-largest cryptocurrency by market capitalization and a recent rival looking to overtake both Bitcoin and Ethereum. The blockchain platform is centered around Ouroboros, ‘ a pioneering proof-of-stake protocol that immediately distinguished Cardano from previously invented cryptocurrencies that instead relied on proof-of-work protocols.’ While Bitcoin is the oldest and most well-known crypto asset and Ethereum’s compelling integrated applications have allowed it to gain significant market share, Cardano offers a multi-faceted solution: ‘It solves Bitcoin’s excessive energy usage problem while also challenging Ethereum’s captivating smart contracts.’ The proof-of-stake model means that the cryptocurrency is used as a scarce asset. Infosec’s Howard Poston further explained the model as a long-term opportunity. He said that ‘like putting money into a CD or stocks, stakers promise not to spend their money in exchange for the opportunity to create blocks and earn block rewards. The probability of being selected to create a certain block is roughly proportional to the percentage of the total stake that the user controls.’

Cryptocurrency Portfolios Should Remain Diversified

As many invest in Bitcoin as a safe haven, traders are finding new opportunities to experiment with other currencies including Ripple, Cardano, and Tezos. These altcoins are having an 18%, 165%, and 364% rate of user growth respectively.

Credit for image: Investopedia

Considering risk is key in such a volatile trading environment. By placing a larger percentage of one’s portfolio in more stable coins, traders then have more leeway to experiment with riskier investments and maintain the potential for long-run profits. If many coins perform well simultaneously, it will then lead to larger returns. Price jumps and drops will become marginally less speculative by developing a diversified portfolio with minimal correlations in order to hedge against the full market risk.

Work Cited

Bezek, Ian. “Cardano Has Some Advantages to Ethereum; Here’s Why Crypto Investors Might Want to Own Some.” U.S. News & World Report, U.S. News & World Report, 8 June 2021, money.usnews.com/investing/cryptocurrency/articles/should-you-invest-in-cardano.

Creative, Dotdash. “The Three Biggest Cryptocurrency Trends of 2021.” Investopedia, Investopedia, 9 Mar. 2021, www.investopedia.com/the-3-biggest-cryptocurrency-trends-of-2020-5084903.

Facts & Factors. “At 30% CAGR, CryptoCurrency Market Cap Size Value Surges to Record $5,190.62 Million by 2026, Says Facts & Factors.” GlobeNewswire News Room, Facts & Factors, 12 Apr. 2021, www.globenewswire.com/news-release/2021/04/12/2208331/0/en/At-30-CAGR-CryptoCurrency-Market-Cap-Size-Value-Surges-to-Record-5-190-62-Million-by-2026-Says-Facts-Factors.html.

“How To Diversify Your Crypto Portfolio and Why It Matters.” Cryptonews, Cryptonews, 26 Jan. 2021, cryptonews.com/news/how-to-diversify-your-crypto-portfolio-and-why-it-matters-8442.htm.

“Huge Brooklyn Appointed as Agency of Record to Work on Tezos.” Business Wire, 8 June 2021, www.businesswire.com/news/home/20210608006047/en/Huge-Brooklyn-Appointed-as-Agency-of-Record-to-Work-on-Tezos.