The Aftermath of the Drop

Written By: Isha Goel | June 3 2021

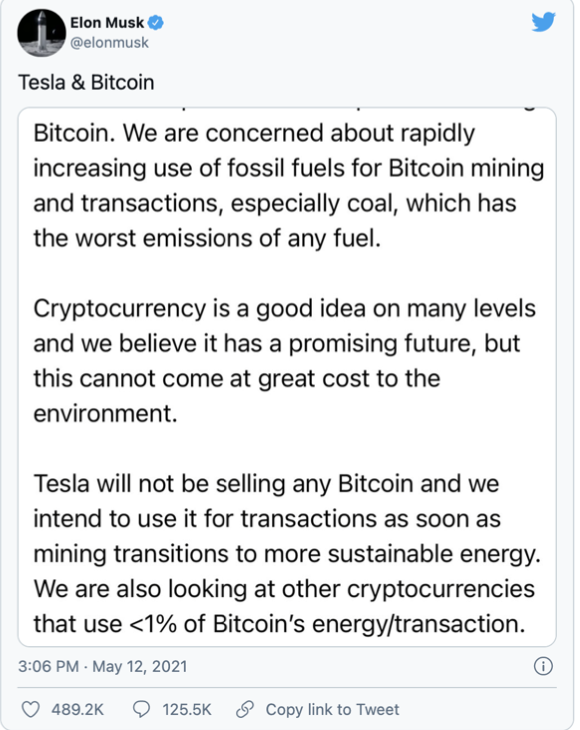

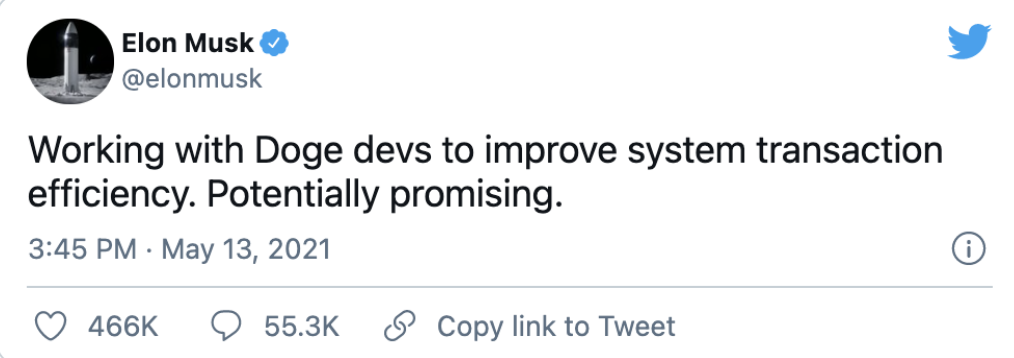

Cryptocurrency is once again on the upswing after the major drops in treading prices that resulted from Elon Musk tweets and the Chinese Governmental speculation. The aftermath has been messy but such a volatile market appears to be recovering with the result of two announcements this week.

Selective Recovery From the Drop

On June 1st, Coinbase announced that Dogecoin (DOGE) would begin trading on June 3rd through its cryptocurrency platform given that there is enough liquidity. This new listing provides the opportunity for the cryptocurrency to be available to a new breed of investors. While the entire market had been on a downward trend for the majority of May, it appears that this announcement has rallied trading prices for DOGE back up past the $0.35 resistance.

Bitcoin’s (BTC) price significantly dropped as well, from $58,000 to nearly $30,000 in the eight days to May 19. However, this cryptocurrency has not been able to make as strong of a comeback as the price narrows in. In the past day, the price has only gone up by 1% to $37,200 in comparison to DOGE, which has gone up by 18%. If BTC breaks clear above $38,000, that could indicate a larger increase in the future. As shown on the training chart below, the triangular price patterns represent the higher lows and lower highs over the past two weeks.

Credit for image: Coinbase

Kraken Takes the Opportunity

The Coinbase rival Kraken took advantage of the cryptocurrency spike and announced that starting on June 2nd, it will be allowing users to buy and trade over 50 crypto tokens on their mobile application. With Kraken sitting at the 4th largest digital currency exchange in the world by trading volume, Chief Product Officer Jeremy Welch claimed that ‘this consumer app is our first major foray into supporting wider consumer adoption in a much more simplified, easy-to-use interface.’

After having launched in Europe earlier this year, it is looking to land a larger presence in the U.S. market. The crypto exchange is in talks of raising another round of funding and before the major drop-off in May, was even considering going public in 2022 via a direct listing in a manner similar to what Coinbase had done. Kraken has positioned itself as the platform with ‘the lowest fees in the industry’ and attributes much of its success to its speedy verification and onboarding times.

Given that cryptocurrency regulations are a major concern within the industry, Kraken has taken a different approach than Coinbase in protecting its holdings. While crypto holdings on Coinbase are FDIC insured up to $250,000 per U.S. customer, Kraken has explicitly stated that ‘while the company takes “great care to protect the assets” of clients from loss, exchanges do not qualify for deposit insurance programs, nor should they function as cryptocurrency wallets.’ The exchange is registered with the U.S. Treasury Department’s FinCEN and complies with all requirements when operating so that is not of concern for potential users.

Work Cited

Crawley, Jamie. “Kraken Crypto Exchange Releases Mobile App in US.” CoinDesk, CoinDesk, 2 June 2021, www.coindesk.com/kraken-mobile-app-crypto-exchange-released-us.

Godbole, Omkar. “Dogecoin Cheers Coinbase Listing as Bitcoin’s Range Play Continues.” CoinDesk, CoinDesk, 2 June 2021, www.coindesk.com/dogecoin-rallies-bitcoin-constrained.

Jindal, Aayush. “Bitcoin, Ethereum Still Consolidate, DOGE Rallies On Coinbase News.” Cryptonews, Cryptonews, 2 June 2021, cryptonews.com/news/bitcoin-ethereum-still-consolidate-doge-rallies-on-coinbase-10540.htm.

Sigalos, MacKenzie. “Coinbase Pro Opens up to Dogecoin after Cryptocurrency’s 6,000% Gain This Year.” CNBC, CNBC, 2 June 2021, www.cnbc.com/2021/06/01/coinbase-pro-opens-to-dogecoin-after-currencys-6000percent-gain-this-year.html.

Sigalos, MacKenzie. “Coinbase Rival Kraken Launches Mobile App in U.S. to Capitalize on Crypto Surge.” CNBC, CNBC, 2 June 2021, www.cnbc.com/2021/06/02/kraken-launched-mobile-app-in-us-for-bitcoin-and-ethereum-purchases.html.