A Case for Cryptocurrencies and the Blockchain

Written By: Dustin Damron | October 25, 2020

‘A New Bretton Woods Moment’

Just 10 days ago, to the chagrin of governments around the world who have ceaselessly and almost carelessly printed an endless supply of money, the International Monetary Fund (IMF) released a speech that appears to have mostly gone unmentioned by the mainstream media. The crypto community however, whom I have colloquially dubbed the ‘Bitcoin Bubbas’ and ‘cryptosphere’, have been abuzz by this news. It is as if they have likened the IMF’s news to a call to arms – a rallying cry for the need to adopt cryptocurrencies as means to fight ineffective fiscal and monetary policies that are implemented by governments world-wide.

Invoking policies from John Maynard Keynes – a British economist who would later become a director of the Bank of England, and whom also published many economic works detailing how governments could mitigate the adverse effects of economic recessions and depressions through the use of fiscal and monetary policies (Encyclopaedia Britannica, 1998) – Mrs. Kristalina Georgieva, a Managing Director of the IMF, twice mentioned Keynes and a ‘new Bretton Woods moment’ (Kristalina Georgieva, 2020). It is important to note that Keynes played an integral role in negotiations at Bretton Woods. Moreover, it should be mentioned that Keynes’ policies are still widely discussed today in economic circles around the world.

Bretton Woods, NH circa 1944

If you are unfamiliar with Bretton Woods, let us take a moment to review some key information that may help us understand the significance of the IMF’s recent speech. Bretton Woods refers to the ‘Bretton Woods Agreement’ or ‘Bretton Woods System’ in which delegates from 44 countries around the world met in Bretton Woods, New Hampshire to negotiate an agreement to improve international economic cooperation and growth, as well as to establish a new foreign exchange system that could stop countries from devaluing others’ currencies (Chen, 2020).

The agreement also resulted in the U.S. dollar becoming the world reserve currency, created the ‘Gold Standard’ to peg the value of one dollar to $35/oz. of gold, and created the International Monetary Fund as well as the World Bank (Siripurapu, 2020).

It may be safe to conclude that Bretton Woods was among the most defining points in world-wide economic and monetary policy.

Deciphering the IMF’s Message

Now, let us take a look at why the IMF’s ‘new Bretton Woods moment’ is so important; what could it mean? For starters, if the Bretton Woods Agreement was such a defining moment in economic and monetary policies around the world, what does it say when a managing director of the IMF is calling the situation that the world is currently facing ‘a new Bretton Woods moment?’ One might assume that the IMF is calling for the establishment of a new world reserve currency, or a revaluation of the dollar so that it is once again pegged to the value of gold. Perhaps the IMF wants to create a new international bank aimed at improving global liquidity, reducing national debts, or any other number of functions that a bank with the IMF’s stature would possess. And these would be reasonable assumptions based on what we know resulted from the 1944 Bretton Woods ‘moment.’ But, without understanding each of the individual components that made up the Bretton Woods Agreement, it may be too difficult to determine how to properly interpret the IMF’s message. However, in all likelihood we can reasonably expect our debt to continue to accumulate until decisive action is taken to resolve the current global economic crisis which has been exacerbated by COVID-19.

So, we are left to speculate about the many implications that a ‘new Bretton Woods moment’ could have on economies around the world and how it may impact us as individuals.

Reserve Currency Status, Debt and Designation

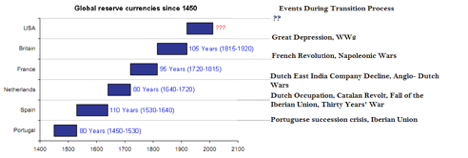

Data shows that the U.S. is now the largest debtor nation in the world, whereas China is now the largest creditor nation in the world (World Bank, Central Bank of the Republic of China, 2020). This is in stark contrast to a time when the U.S. was the largest creditor nation in the world, earning it a designation as the right to provide the world with its currency as a reserve currency.

Credit for image: https://www.cfr.org/backgrounder/dollar-worlds-currency

Historically, it seems that each time a nation has gone from being a creditor nation to that of a debtor nation, there has been a ‘passing of the buck’ where a new nation gains the right to have its currency serve as the reserve currency of the world. The below image is a depiction of the length of time that each nation has held the world reserve currency status. Following that image is another that shows the progression on a map.

Credit for image: Business Insider (Roche, 2014)

Google Maps: Numbering depicts progression of reserve currency status holders before U.S.

Could this mean that China’s yuan will become the new de facto world reserve currency after the U.S. loses its ability to provide credit to the world? It is entirely possible (Business Insider; Roche, 2014). However, it is generally believed that the dollar will continue to remain the most important reserve currency for the next several decades. Moreover, some economists believe that “the dollar playing a smaller global role is nothing to fear, and that it would in fact benefit the United States,” (Siripurapu, 2020) going so far as to state, “Absent a catastrophic U.S. policy error, I would expect the dollar to remain the most important reserve currency for the next several decades.” – Brad W. Setser, CFR Senior Fellow

Are Cryptocurrencies and the Blockchain the Answer?

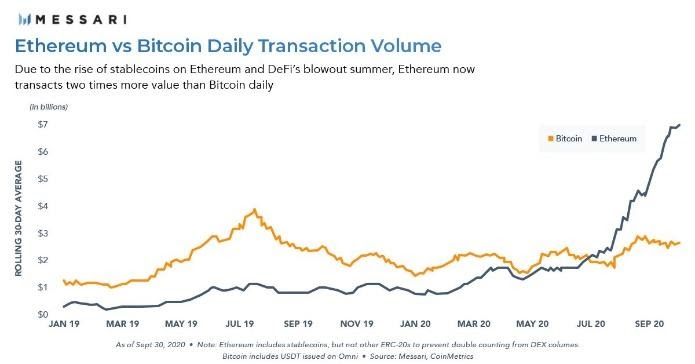

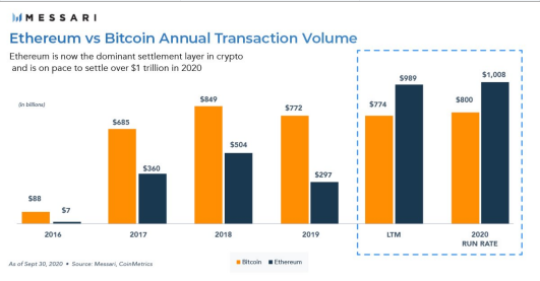

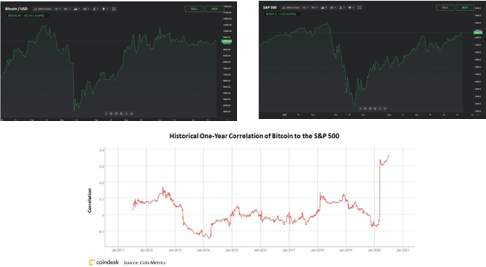

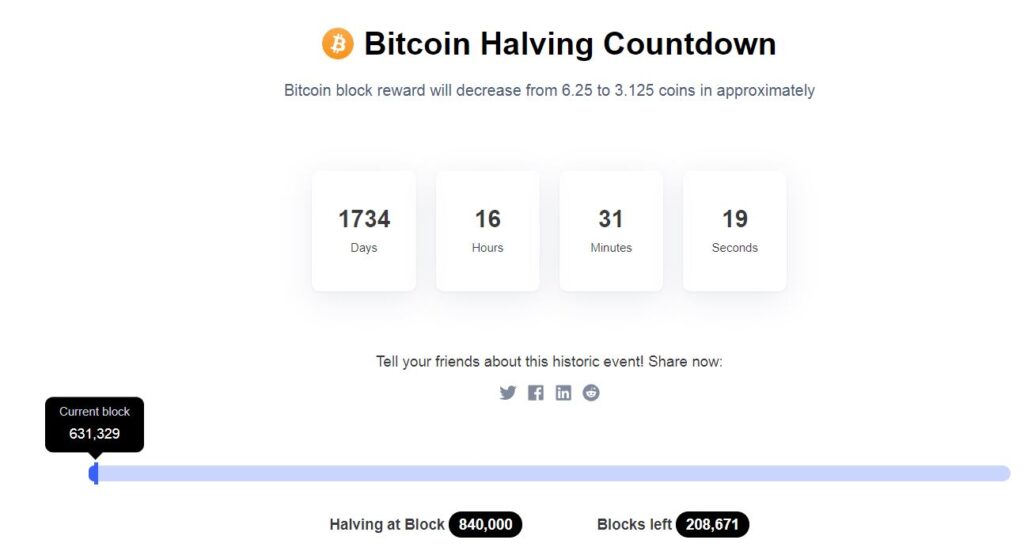

Finally, we arrive at what the ‘cryptosphere’ deems to be a case for Bitcoin and cryptocurrencies. The general consensus seems to be that cryptocurrencies and the blockchain will allow for a more transparent nature of how monies are allocated and spent. There is an argument that cryptocurrencies and the blockchain will do for banking what the internet did for information sharing. The supporting commentary goes like this – because the nature of cryptocurrencies and the blockchain are decentralized, and inflationary rates are instead deflationary and built into the code for every cryptocurrency – gone are the days of monetary manipulation polices such as quantitative easing and adjusting inflation rates.

But how does all of this equate to a need for cryptocurrencies to solve this ‘new Bretton Woods moment?’ Well, cryptocurrencies open up markets to the world. They are indiscriminate, interchangeable, and have the capacity to be transferred in mere minutes, often in only a matter of just seconds, across borders around the world and without the need for intermediaries like a bank. The ability to print, or mint, additional supply is fully incumbent upon the particular coin but typically does not exist due to the nature of establishing the maximum supply requirement when creating the cryptocurrency. Providing additional liquidity to the cryptocurrencies market comes in the form of equities and securities from traditional markets that are sold for fiat currency and exchanged for cryptocurrency. This design defeats the Federal Reserve’s ability print unlimited amounts of money and alter monetary policy according to their likening.

Imagine a world where your savings are not devalued by runaway inflation rates that offset any interest you have accumulated. Imagine having the ability to easily loan your money by creating a contract on the blockchain that only executes when all conditions are met, not at the behest of a broker or loan officer – who, by the way, charge additional fees for their involvement. Imagine the time and money you can save by executing a transfer of funds on the blockchain, where transaction fees are literally pennies and settlement time is completed in minutes, rather than days, and the entire process takes only a few moments and can be done on your mobile device. Imagine having the ability to create and submit an improvement proposal (for the functionality of any cryptocurrency and its blockchain) for all users to vote on, without the need to send a helpless plea to your representative in Congress. Well, I am asking you to imagine the world of the blockchain and cryptocurrencies. It sounds, to me, like the beginning to a solution for complications that have plagued our fiscal and monetary issues of former times.

Disclaimer: The views, thoughts, and opinions expressed here are solely those of the author in his private capacity and do not necessarily represent the views of Crescent City Capital.

References

Encyclopaedia Britannica. (1998, July 20). John Maynard Keynes. Retrieved October 24, 2020, from https://www.britannica.com/biography/John-Maynard-Keynes

Chen, J. (2020, August 28). Bretton Woods Agreement and System: An Overview. Retrieved October 24, 2020, from https://www.investopedia.com/terms/b/brettonwoodsagreement.asp

Siripurapu, A. (2020, September 29). The Dollar: The World’s Currency. Retrieved October 24, 2020, from https://www.cfr.org/backgrounder/dollar-worlds-currency

Kristalina Georgieva, I. (2020, October 15). A New Bretton Woods Moment. Retrieved October 24, 2020, from https://www.imf.org/en/News/Articles/2020/10/15/sp101520-a-new-bretton-woods-moment

Roche, C. (2014, June 11). Why The US Dollar Will Eventually Stop Being The World’s Reserve Currency. Retrieved October 25, 2020, from https://www.businessinsider.com/why-the-us-dollar-will-eventually-stop-being-the-worlds-reserve-currency-2014-6