The Bitcoin Halving and Miner’s New Challenge

By Nicolas Abington | Crescent City Capital Market Analyst Intern

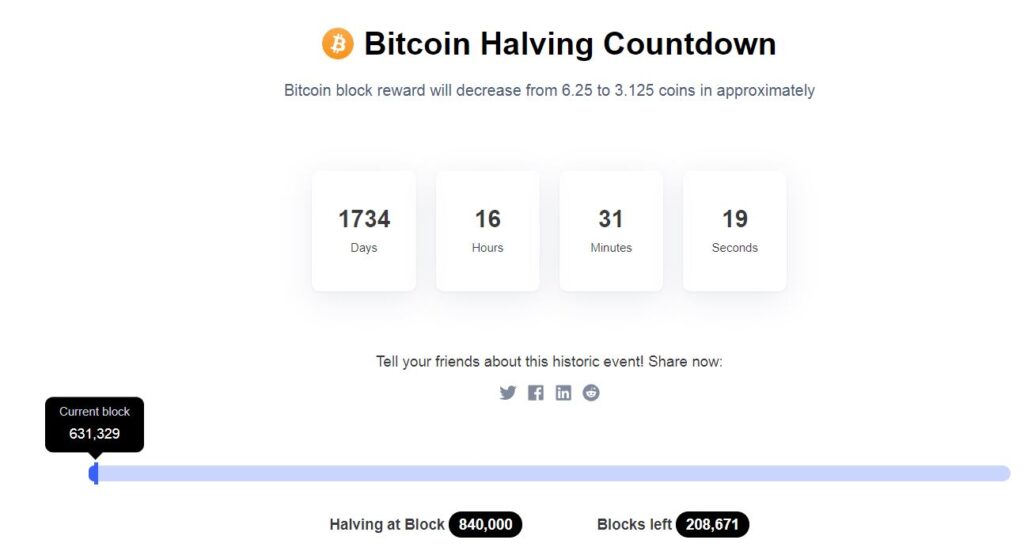

As many of us are already aware, the Bitcoin halving occurred on May 12 cutting the supply released into the market from 12.5 Bitcoins to 6.25 Bitcoins approximately every 10 minutes. Two months prior to this event Bitcoin and almost all financial markets underwent a consolidation event where Bitcoin fell from $9,045 to $5,013 per BTC in less than 24 hours. Since then, BTC has made a full recovery finding a support level in the low $9,000.

This type of volatility is typical to the cryptocurrency market and instead of focusing on Bitcoin’s price volatility from the Bitcoin halving, the more pertinent question is how this event has affected miners. According to Omkar Godbole of Coindesk, Bitcoin miners had begun to scale back or shut down operations following the halvening. Minors are beginning to scale back operations due to the fact that my name has become unprofitable at the current Bitcoin price levels using the mining rigs at their disposal.

While this is a bad sign for Bitcoin mining companies, the bulls of the market look at this as an opportunity to make some long term gains. Regardless of speculation though, the Bitcoin halving will challenge miners to look for alternative ways to make a profit in this more difficult environment. As we head into the future of a post halving environment, the focus on innovation will be key to keeping Bitcoin and cryptocurrency in general alive.

Sources

https://eng.ambcrypto.com/bitcoins-hashrate-drops-even-further-as-inefficient-miners-drop-out/

https://www.coindesk.com/bitcoin-price-bounced-miners-switching-off-post-halving

https://www.blockchain.com/charts