FRAX: The First Fractional-Reserve Stablecoin

By Tyshe Jiang | Crescent City Capital Market Analyst Intern

What is FRAX

Frax is the leading fractional-algorithmic stablecoin system, which means it’s a stablecoin partially collateralized and partially stabilized algorithmically. FRAX was founded in 2020 by Sam Kazemian, who came up with the idea of a fractional-algorithmic stablecoin.

Hybrid Stablecoin

There are two spectrums of designs: Collateralized stablecoins and Purely algorithmic designs. Both of them have some pros and cons. Collateralized stablecoins can provide a tight peg with high confidence, but have custodial risk and sometimes require on-chain overcollateralization. Algorithmic stablecoins are more scalable but would be more volatile and erode confidence in their usefulness due to no collateral. Frax is the first stablecoin to combine these two designs so that it creates a scalable, trustless, extremely stable, and ideologically pure on-chain money.

Two Token System

The Frax protocol is a two-token system comprising Frax (FRAX) and Frax Shares (FXS). FRAX is the stablecoin, which is always pegged to $1 and the collateral ratio could adjust based on the market demands. When FRAX is below $1, the platform will increase the collateral ratio by 0.25%. When FRAX is above $1, the collateral ratio will be reduced by 0.25% to keep the FRAX always at $1. Meanwhile, the platform uses Chainlink oracle to get the true price of USD instead of an average of stablecoin pools, which allows FRAX to be more stable and have greater resiliency.

FXS is the governance token, which is non-stable and holds rights to the utility of the system. Unlike MakerDAO, the parameters in the community are fewer to avoid lots of disagreements. Therefore, Frax employs the vote-escrowed vesting system. Token holders can stake their FXS and obtain veFXS in exchange, which represents their staked FXS and voting power in governance. The longer the lockup time for FXS, the larger the farming boost users receive to stake their tokens. This encourages longer stakes and a smaller proportion of FXS in circulation.

The market capitalization of the FXS token should be estimated as the future expected net value creation from the seigniorage of FRAX tokens in perpetuity, cash flow from minting and redemption fees, and usage of unused collateral. Furthermore, as FXS’s market value rises, so does the system’s capacity to maintain FRAX. As a result, the objective of the design is to maximize the value of the FXS token while keeping FRAX as a stable currency.

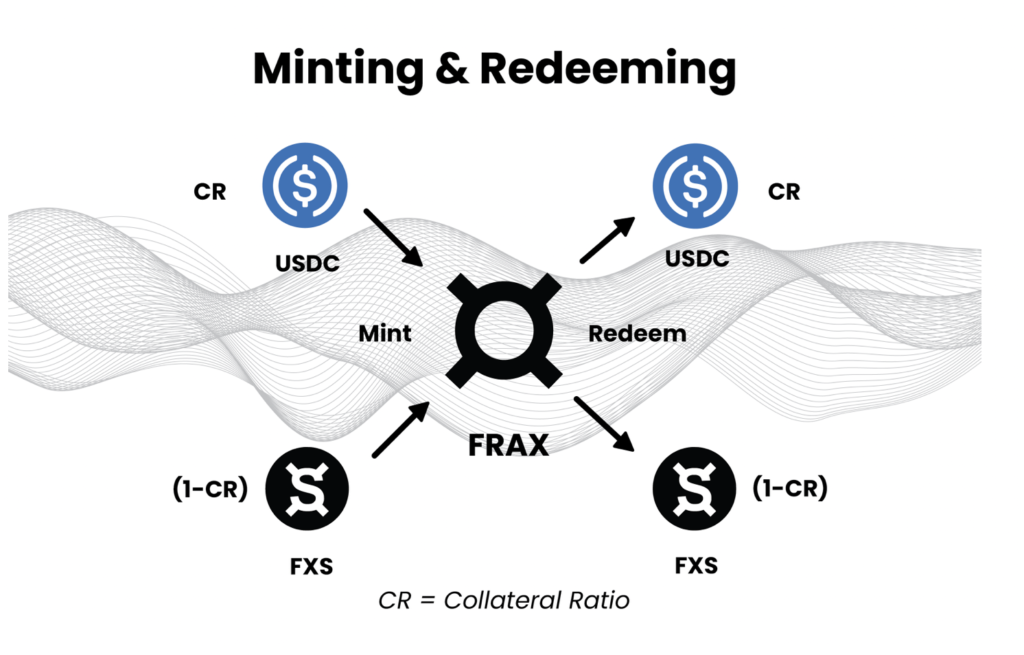

Minting and Redeeming

Minting and redeeming are the two mechanisms to keep the FRAX price stable. When the market price of the FRAX is above $1, then there is an arbitrage opportunity to mint FRAX by placing $1 worth of value into the system and selling the token for above $1 in the open market. Meanwhile, when the market price of the FRAX is below $1, then there is an arbitrage opportunity to redeem FRAX by purchasing cheaply on the open market and redeeming FRAX for $1 worth of value in the system.

The collateral ratio would control the value required for collateral and FXS burning amount. During FRAX expansion and retraction, the protocol would change the collateral ratio. During growth, the protocol decollateralizes the system, requiring less collateral and more FXS to be deposited in order to mint FRAX. This reduces the amount of collateral required to back all FRAX. The procedure recollateralizes at periods of retraction. This raises the system’s collateral ratio as a percentage of FRAX supply, improving market trust in FRAX as its backing grows.

Recent Updates

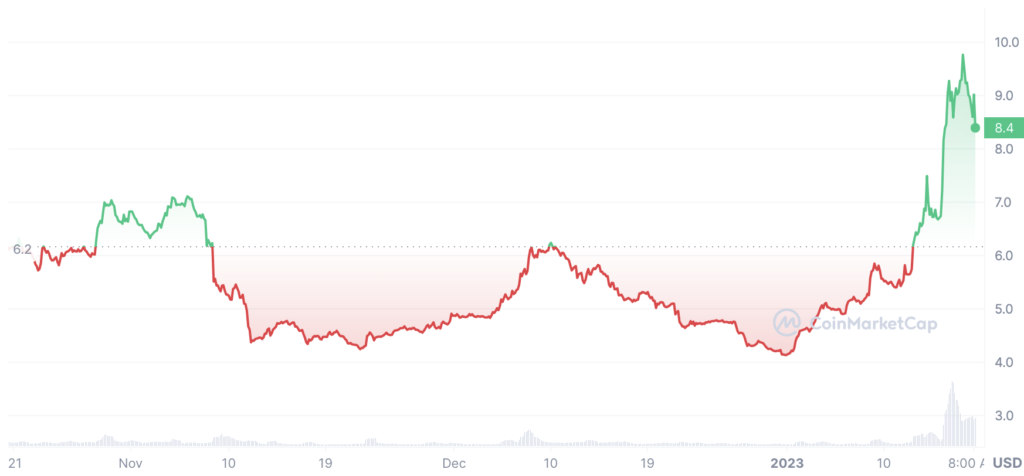

The FXS price on Jan 18th is $8.48 USD with a 24-hour trading volume of $54,519,521 USD USD. It has a circulating supply of 72,959,576 FXS coins. On Jan 15th, FXS exploded by 35% to trade above $9.00. The reason behind this surge is because of the Ethereum staking on Frax Share. Frax Finance now has over 65,326 ETH staked in the smart contract. Therefore, Investors are finding staking on Frax Finance more lucrative compared to other similar platforms in the market.

Summary

After the Luna was crushed, people’s confidence in Algorithmic Stablecoins declined, but the risk of Collateralized Stablecoins lies in the volatility of the underlying collateral. FRAX combines the two to synthesize their advantages and avoid disadvantages. In particular, the increase in Ethereum staking has also made more users aware of FRAX.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. Please conduct your own due diligence before making any investment decisions.

References:

https://docs.frax.finance/overview

https://phemex.com/academy/what-is-frax-fxs