Sui: The New Game-Changer Blockchain?

By Andy Wang | Crescent City Capital Market Analyst Intern

What Is Sui?

Sui is a layer-1 proof-of-stake blockchain with smart contract capabilities. It’s an effort by Mysten Labs, which was founded by ex-employees of Meta’s Project Libra. While Libra was a permissioned blockchain and stablecoin payment system that didn’t fully launch, some of its developers went on to work on projects like Aptos and Sui. It’s important to note that Sui and Mysten Labs are not based on Diem and have no relationship with Aptos, but they share common origins.

Being a layer 1 blockchain means Sui provides the underlying infrastructure for a system of validations and transactions, much like the Ethereum or Bitcoin networks. But what sets it apart from other L1s is its focus on instant transaction finality, reduced latency, and increased transaction speed.

In short, Sui aims to increase its scalability without compromising on security by using a combination of the native programming language Move, parallel processing of transactions, and delegated proof-of-stake consensus mechanism.

This way, Sui allows for fast, private, and secure digital asset ownership accessible to everyone.

How Does Sui Work?

Sui operates in epochs (24 hours), with a committee of validators managing each epoch. Users can delegate their stakes to validators, which allows them to consolidate voting powers and earn a share of the fees. The Sui network maintains its security as long as two-thirds of the overall stake is assigned to honest parties. Validators can scale horizontally, and the network uses a dynamic approach to gas fees, aiming for more predictable costs.

- Programming Language:

The Sui blockchain uses the Move programming language, which is slightly different from core Move, based on the Rust programming language. Move was developed to represent digital assets and perform safe operations over them. It contrasts with Ethereum’s Solidity in various ways, such as its design around objects rather than accounts.

- Transaction Execution:

To increase scalability, Sui uses parallel transaction execution. To explain, most blockchains execute transactions sequentially, meaning one by one. Sui blockchain executes transactions in parallel instead. This allows it to process up to 120,000 transactions per second (TPS) compared to Ethereum’s 15 TPS and Solana’s 4k TPS.

Another interesting feature of the chain is how it differentiates transactions into two categories: simple and complex.

For simple transactions, such as sending tokens from one account to another, a transaction may bypass the consensus protocol and process almost instantly. By removing the need for unrelated assets to go through the relatively longer and more expensive consensus process, Sui is able to increase its throughput.

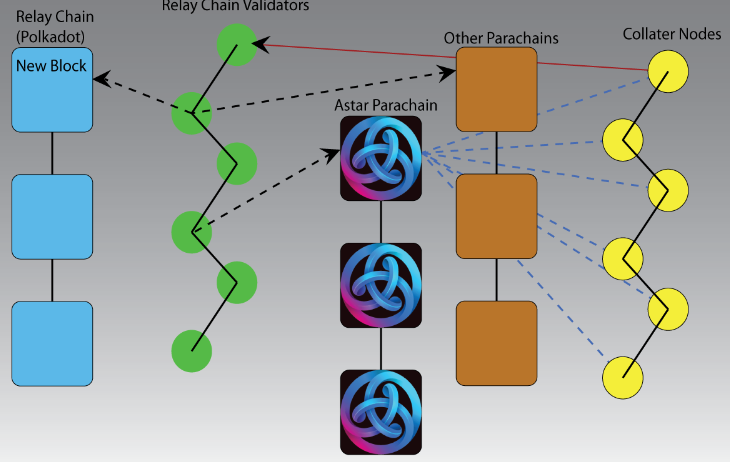

For complex transactions, Sui leverages Narwhal and Bullshark.

To explain, Narwhal is a directed acyclic graph (DAG)-based mempool. It decouples transactions from its consensus engine, Bullshark, and ensures that pending transactions requiring consensus are quickly identified.

Bullshark is for the specific ordering of transactions and allows slower validators to contribute.

This high transaction speed can be a game-changer in terms of scalability and user experience

- Consensus Mechanism:

Sui employs a Delegated Proof-of-Stake (DPoS) consensus mechanism, where SUI token holders select from a fixed set of 100 validators to process transactions during 24-hour epochs based on staked amounts. Validators receive SUI rewards for their services, which, after deducting a commission, are distributed to delegating token holders. While this system offers efficiency and faster transaction processing, the limited number of validators raises concerns about centralization and potential network vulnerabilities. However, the presence of 2,000 full nodes in the SUI network aims to bolster its decentralization.

What Is DPoS and How Does It work?

Delegated Proof of Stake is a blockchain consensus mechanism where network users vote and elect delegates to validate the next block. Like a traditional proof-of-stake mechanism, DPoS uses a collateral staking system. However, it also uses a specific democratic process designed to address POS’s limitations. This allows it to offer a more affordable, efficient, and fair way to validate transactions.

The Delegated Proof-of-Stake consensus mechanism works using a democratic process. The network users vote to delegate the block validation rights to delegates, also called witnesses or block producers.

There is a limit on the number of delegates chosen for each block, and it differs for each blockchain using this consensus mechanism. This means the delegates of one block might not be the delegates of the next. To choose these delegates, users vote on them by pooling their tokens into a staking pool and linking those to a particular delegate. The delegate with the most tokens may then validate a block, and receive the corresponding transaction fees as a reward. Then, the delegate distributes the rewards to users who supported them based on each user’s stake.

It is important to note that voters maintain control over the system. Which means, users can also vote out delegates if they make malicious attempts on the network. As such, delegates with a strong reputation are usually elected as witnesses.

Market Recap

The live Sui price on 18 September 2023 is $0.447807 USD with a 24-hour trading volume of $59,977,974 USD. Sui is up 0.83% in the last 24 hours. The current CoinMarketCap ranking is #85, with a live market cap of $354,563,672 USD. It has a circulating supply of 791,777,575 SUI coins and a max. supply of 10,000,000,000 SUI coins.

Analysis and Future Forecast:

Let’s start with Sui’s fundamentals. Sui, a pioneering Layer-1 project, addresses the Blockchain Trilemma, aiming for an optimal balance between decentralization, security, and scalability. It achieves enhanced scalability through its unique dual-execution method, allowing specific transactions to achieve near-instant finality. For security, Sui employs the Move programming language, equipped with the Move Prover tool to bolster smart contract verification and deter potential breaches. Emphasizing decentralization, Sui acknowledges its multifaceted nature and strategically reduces hardware prerequisites, positioning itself prominently among leading L1s. Spearheaded by elite Web2 engineers and developers, and backed by substantial capital from esteemed investors, both Sui and its counterpart, Aptos Labs, are poised to revolutionize crypto adoption, targeting a global audience and aiming to onboard the next billion users.

Further, what about the technicals? Here, we use RSI(Relative Strength Index). As we all know that RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. The RSI can do more than point to overbought or oversold securities. It can also indicate securities that may be primed for a trend reversal or corrective pullback in price. It can signal when to buy and sell. Traditionally, an RSI reading of 70 or above indicates an overbought situation. A reading of 30 or below indicates an oversold condition.

Here, we take a look at its historical movement and recent month’s movement. Historically, the oversold condition is more than overbought condition, indicating investors are still waiting and examining whether Sui can be the new game-changer blockchain. When SUI first hit the open market on 3 May 2023, it was worth $1.71. Perhaps worryingly for potential investors, this price still serves as an all-time high for the coin. After that, it slipped down gradually, dropping below the dollar on 24 May. SUI has not been worth more than $1 since 31 May.

Part of the reason for that is down to the crypto market shrinking following the news that the SEC was suing the two largest crypto exchanges. While SUI was not listed as one of the authority’s targets, it still took a hit and it reached $0.558 on 10 June.

After that, it tried to fight back. It reached $0.8816 on 22 June, but dropped again. On August 17, it reached an all-time low of $0.451. Since then, it has recovered somewhat. But. on 11 September 2023, it dipped to a new low at $0.418. As of 18 September 2023, based on looking at the 30 days moving chart, I believe there is a support at $0.435, and another support at $0.426. And the RSI index stays in a range between 40 to 70, also acting as a support. Therefore, I’d say Sui price is ready for another bounce.

Given that Sui is still nascent, it is yet to demonstrate its full force. It also has to withstand intense competition from other leading blockchain protocols such as Ethereum, Solana, Flow, and so on if it wants to ride the wave. Because it is new and does not yet have a wide audience, the Sui blockchain is known to underpin a relatively small number of projects so far, with SoWork and Lucky Kat Studios being the most prominent.

The Sui blockchain looks rather promising, and its technical features, development approach, and aspirations seem to have hit it off with a number of blockchain evangelists. It is also true to say that Sui will have to endure stiff competition from other blockchains and must continue upgrading its ecosystem if it wants to enjoy wider adoption.

As Sui gains momentum and attracts more developers, the demand for the SUI token is poised to rise. An expanding ecosystem, coupled with a growing user base, can potentially elevate the token’s value. Sui’s superior transaction speed sets it apart from other blockchains, and if it sustains this edge while introducing distinct features, it stands a chance to secure a substantial market share, further bolstering its price. Additionally, as the utility of the SUI token diversifies—be it for staking, governance, or transaction fees—its demand is likely to surge. With a controlled or effectively managed supply, such demand could lead to a favorable price trajectory.

Reference:

https://coinmarketcap.com/currencies/sui/

https://crypto.com/university/what-is-dpos-delegated-proof-of-stake

https://decrypt.co/138608/sui-token-and-network-launch-what-you-need-to-know

https://www.tradingview.com/chart/VrTWdVLu/?symbol=BINANCE%3ASUIUSDT