Celestia: Modular Blockchains for a scalable future

By Andy Wang | Crescent City Capital Market Analyst Intern

What is Celestia?

Celestia has emerged as a pioneering force in the realm of modular blockchain networks, targeting the scalability issues that plague conventional monolithic blockchain systems. This network achieves a separation of execution and consensus processes, and incorporates data availability sampling (DAS) into its core layer. This innovative approach positions Celestia as a scalable and user-verifiable modular blockchain infrastructure.

Inaugurated with the ambition to forge a blockchain solution of unparalleled scalability, Celestia distinguishes itself as a trailblazer in the modular blockchain domain. The architecture of Celestia represents a transformative concept that not only enhances scalability but also brings additional benefits. These include the creation of trust-minimized bridges, the establishment of independent chains, the implementation of an effective resource pricing model, and the maintenance of credible neutrality. The Celestia mainnet made its debut at the close of October 2023, marking a significant milestone in blockchain evolution.

How Does It Work?

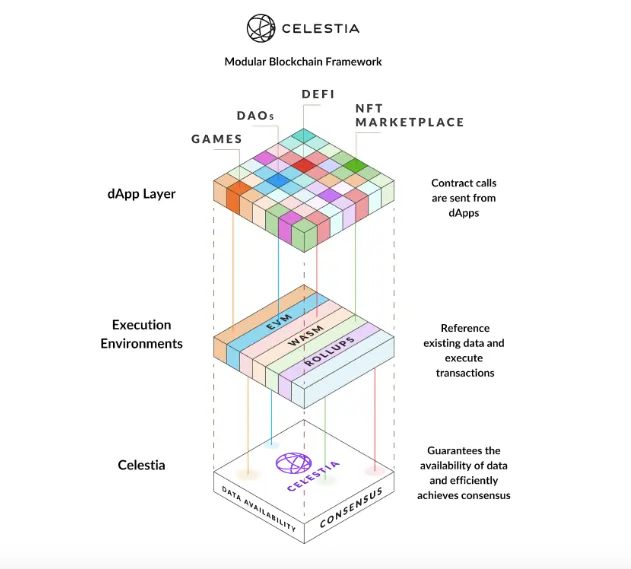

Celestia achieves scalability through its modular design, separating the tasks of execution, consensus, the novel primitive and DAS, it has pioneered. This design allows nodes to selectively execute transactions relevant to their applications, resulting in a system that can support immense user demand without compromising on decentralization or security.

Technologies like data availability sampling and fraud/validity proofs are tools to ensure light nodes operate under nearly the same security guarantees as full nodes while consuming significantly fewer resources.

What are modular blockchains?

Modular blockchains are a type of blockchain where developers can break down the components of the system into smaller, more manageable pieces. This allows them to easily customize and adjust any one aspect of the blockchain without needing to completely overhaul the entire network. By modularizing their blockchain, developers have greater control over how their system functions, allowing them to quickly adapt it to different scenarios and conditions.

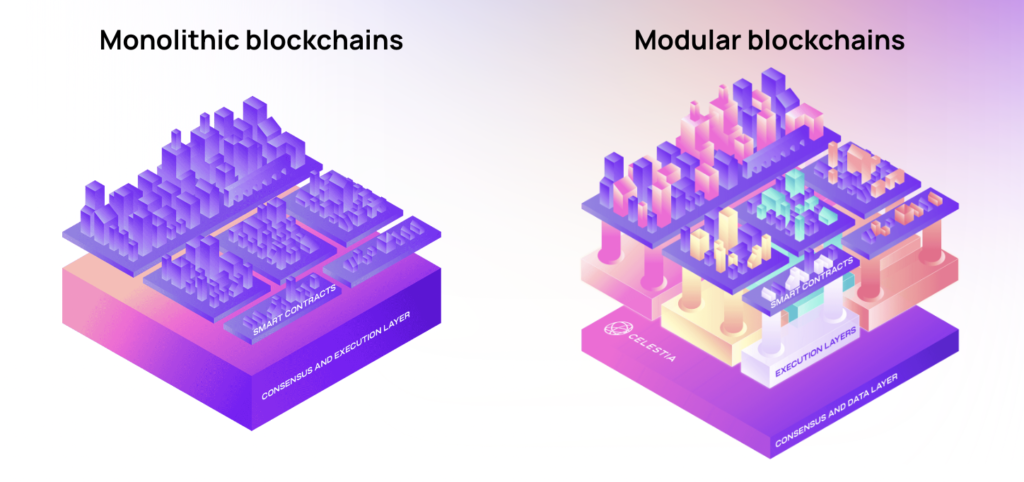

Monolithic Blockchains vs. Modular Blockchains

From the above image, I believe it is clear the difference between monolithic blockchains and modular blockchains.

Monolithic blockchains have everything built on a single chain. This means all transactions have to go through one consensus mechanism and the size of data on it must stay within certain limits for it to function properly.

Conversely, modular blockchains offer more flexibility by separating the responsibilities of handling these various layers. Developers can choose between different modules to customize the execution, consensus, data availability, and settlement functions of their blockchain. This customization allows them to create specialized networks tailored for specific applications and use cases, while still keeping the core functionality of the blockchain intact.

Therefore, this makes modular blockchains the ideal option for organizations that need a reliable and efficient blockchain infrastructure that can easily be adjusted according to their needs.

How does Celestia work?

Celestia stands out as a fundamental layer-1 blockchain that concentrates exclusively on sequencing transactions and ensuring their data is accessible. It deliberately refrains from engaging in smart contract execution or computation tasks. These functionalities are delegated to rollups or alternate blockchains, reflecting Celestia’s commitment to a modular and adaptable infrastructure over a one-size-fits-all approach. This modular design allows for a vast array of combinations, enabling users to create a sovereign rollup that defines its own rules for execution. Essentially, users have the liberty to select their preferred execution and settlement layers, while leveraging Celestia’s robust data availability capabilities.

- Data availability sampling

What makes Celestia excel in data availability is through DAS? This is accomplished by letting multiple resource-limited light nodes — which are nodes that can run on cheaper hardware and slower internet connections than other node types — check if the data is correctly encoded by randomly sampling block transactions. Since Celestia doesn’t need to worry about transaction validity, block verification only needs to handle data availability verification and light nodes won’t have to download entire blocks.

- Erasure encoding

To gauge whether data is being encoded correctly on blocks, light nodes make use of erasure encoding. When sending or storing information, light nodes add extra information for redundancy and recovery to protect the data being transmitted. If data gets lost in the middle of data transmission and storage, light nodes will make use of the extra information to fill in the gaps and recover the original data. Erasure encoding goes much deeper and involves parity backup information using Reed-Solomon’s algorithm, more of which can be explored on the official Celestia website on its data availability layer.

What is TIA: understanding TIA token utility

As the native token of the Celestia blockchain, TIA is an essential part of how developers will build on Celestia and use it for data availability. According to Celestia’s white paper, TIA tokens will have the following uses:

- Bootstrapping new rollups

A core tenet of Celestia’s vision is blockchain deployment simplification such that anyone can effortlessly launch and deploy their own blockchain. With TIA tokens, developers won’t need to issue tokens to complement their blockchain’s launch. Like ETH on Ethereum-based rollups, developers can choose to bootstrap their chain quickly by using TIA as a gas token and currency. In doing so, developers can instead focus on creating their application or execution layer without fretting about token creation and issuance.

- Paying for blobspace

TIA tokens are key to how developers build and interact with Celestia. To publish data on Celestia and use it for data availability, rollup developers submit PayForBlobs transactions, which consist of typical transaction information like sender identity, the data to be made available, the data size, the namespace, and a signature. These transactions will require a fee, which is paid for in TIA tokens.

- Staking rewards

As a permissionless network based on CometBFT and the Cosmos SDK, Celestia uses the proof-of-stake consensus mechanism to secure its network. Like in other Cosmos networks, users can help secure the network by delegating their TIA tokens to a Celestia validator for a portion of their validator’s staking rewards. Notably, Celestia supports in-protocol delegation and will start with an initial validator set of 100

- Decentralized governance

Centralization among founding developers can be a red flag for many blockchain projects. Fortunately, Celestia leans towards decentralized governance regarding overall decision making. Unlike some governance tokens which require staking to unlock voting rights, users simply need to hold TIA tokens to have the right to vote and submit governance proposals to alter existing network parameters, fund ecosystem initiatives, and manage the community pool. Said pool will also receive 2% of all Celestia block rewards.

Market Recap:

The Celestia price on November 8th is $2.36 USD with a 24-hour trading volume of $77,195,848 USD. Celestia is up 1.01% in the last 24 hours. The current CoinMarketCap ranking is #110, with a live market cap of $332,354,501 USD. It has a circulating supply of 141,043,528 TIA coins.

Analysis and Future Forecasts

Celestia Coin has been in existence since 31 October 2023. Since then, the lowest price recorded for the crypto is $2.08 (one day after its launch). On the other hand, the highest price recorded for it is $2.80 (on 02 November 2023).

So frankly, there’s not much we can approximate and indicate from its less than 10 day launch. The broad sentiment is well-below the average brought-sold line. The price seems to be stabilized in a range from $2.274 to $2.480.

Hence, let’s switch to more fundamental analysis to discuss this first-ever modular blockchain.

The Celestia project is propelled by a group of distinguished blockchain experts who have concentrated their expertise on crafting the essential framework to advance the concept of modular blockchain architecture. The project is co-founded by Mustafa Al-Bassam and Ismail Khoffi, whose experiences in hacktivism and distributed systems provide a solid foundation for the project’s innovative direction. The operational strategies are led by Nick White, Celestia Foundation’s COO and a seasoned professional in the blockchain industry, who also co-founded the Harmony protocol.

In terms of why Celestia is gaining popularity, the project’s unique approach to blockchain infrastructure—prioritizing modularity and flexibility—places it at the forefront of the industry’s evolution. Celestia’s detachment from the traditional ‘all-in-one’ blockchain model allows for unprecedented customization, where users are empowered to choose their execution layers, fostering a new level of efficiency and scalability within the blockchain ecosystem.

The modular blockchains represent a breakthrough in the blockchain trilemma that developers and users are often faced with. As a blockchain’s throughput is often held back because of limited network resources and balancing with blockchain essentials like security and decentralization, Celestia certainly seems like a breath of fresh air in how it’s handling the scalability aspect of things.

Addressing the team’s capabilities, Celestia’s leadership has demonstrated their prowess in the space through active involvement in the development of the modular paradigm, showing potential to significantly influence the blockchain infrastructure landscape. Figment, a key infrastructure provider for Celestia, has been instrumental from the outset. Their belief in the modular approach as the next evolutionary step in blockchain technology is backed by their commitment to provide ongoing support post-mainnet launch, a testament to their confidence in Celestia’s future.

Figment’s role extends beyond mere advocacy; their active participation in Celestia’s Mocha and Arabica testnets underscores their readiness to offer the necessary support for both the network and its stakeholders. With the launch of Celestia, Figment is set to offer staking services to token holders, aiming to establish a trusted platform for earning rewards and enhancing network security.

The broader vision for Celestia is to lay down the foundational elements for a range of new primitives to be developed atop its platform. Given Celestia’s potential applications, there’s a strong sense of optimism about its ability to succeed in reshaping blockchain utility.

Figment’s reputation as a leading staking infrastructure provider, with over $3 billion in staked assets and a significant market share of staked ETH on its validators, further reinforces the perceived value and anticipated success of Celestia. Their comprehensive staking services cater to over 250 institutional clients, ensuring robust returns, rapid API development, and secure staking solutions—elements that contribute to the fundamental appeal of Celestia in the market.

Even the Techopedia quotes from one of Celestia’s representatives, saying, “Mainnet launch signifies more than just Celestia going live. It’s the start of a new era. An era of verifiability where anyone can run a secure light node. An era of collaboration in which blockchains can openly build on top of each other. An era of abundant blockspace that allows any developer to deploy their own blockchain.”

The discussions surrounding the Celestial coin are because it surpassed a $370 million market cap following its launch. Adding to it, TIA had a 60 million token airdrop. This airdrop is worth $6 billion. This means a huge chunk of traders ‘free money’ earning the token a significant buzz in the crypto world. Furthermore, this airdrop skyrocketed the demand for the token. Credit to the hype, it earned the title of the most searched crypto asset on coinmarketcap.

In conclusion, the project may be underrated, but from my perspective it might have achieved an overrated price because of the hype created around it. Although I’d love to buy this hype, I will wait to see what’s happening with the project in the coming months, perhaps new partnerships? New innovation? Price movement on a more technical side since the fundamentals are well-established?

Reference

https://figment.io/insights/what-is-celestia/

https://coinmarketcap.com/academy/article/what-is-celestia

https://everstake.one/blog/celestia-the-first-modular-blockchain

https://www.tradingview.com/chart/VrTWdVLu/?symbol=COINBASE%3ATIAUSD