Siacoin: Decentralized Cloud Storage Platform

By Yvonne Zhang | Crescent City Capital Market Analyst Intern

What Is Siacoin (SC)?

Siacoin (SC) is the native utility token of Sia, a pioneering blockchain-based, decentralized cloud storage platform that was first announced in May 2014 and officially launched in June 2015. Sia represents a significant shift from traditional cloud storage models, acting as a secure and trustless marketplace where users can lease out their unused storage space. The platform employs smart contracts to enforce storage agreements, ensuring a reliable and automated system of transactions. Siacoin serves as the primary medium of exchange within this ecosystem, facilitating payments for storage services. By leveraging blockchain technology, Sia ensures the integrity and reliability of storage agreements, while smart contracts automate and enforce the terms, reducing the need for intermediaries. This approach is fundamentally different from traditional cloud storage services, as it eliminates central points of failure and offers enhanced security and privacy. The economic model is designed to benefit both storage providers and users, with providers incentivized to offer secure and reliable storage, and users gaining access to more affordable and decentralized storage options.

Goals and Vision

Sia’s goal is to become the backbone storage layer of the internet, offering a decentralized alternative to traditional cloud storage services. This vision involves not just providing a more secure and private storage solution but also one that is cost-effective. However, the platform faces challenges in terms of increasing adoption and awareness, as decentralized storage is still a relatively new concept that requires both technological understanding and trust from potential users. Scalability remains another critical challenge, as the platform must handle many transactions and storage requests without compromising performance.

Technology

The Sia blockchain employs a multifaceted approach to security, central to which is its use of a proof-of-work (PoW) consensus algorithm. This method, as highlighted by Sia co-founder Vorick in June 2017, is pivotal in safeguarding the network. In PoW, miners compete to add new blocks to the blockchain, with a majority consensus required for record confirmation. This process inherently links the feasibility of an attack to substantial energy and hardware costs, thereby deterring potential malicious actors due to the high expenses involved.

Complementing this, Sia introduces an innovative security measure where hosts are required to put up collateral to participate in network operations. This collateral requirement serves as a disincentive for bad actors, as engaging in malicious activities or failing to fulfill storage obligations could result in a loss of their collateral. Furthermore, the resilience of Sia’s network is one of its standout features. The distributed nature of its storage system ensures that the network can withstand various forms of disruptions. In scenarios such as massive natural disasters or significant geopolitical events, the network’s integrity remains intact as long as a minimum of 10 out of 30 hosts remain operational, allowing for the retrieval of files. This level of redundancy offers a stark contrast to traditional centralized storage systems, where a single point of failure could lead to complete data loss.

Competitive Landscape

Against Traditional Cloud Storage Providers

In the competitive landscape of cloud storage, Sia and its native token, Siacoin, navigate a challenging environment, contending with both traditional cloud storage providers and emerging decentralized storage solutions within the cryptocurrency domain. On one front, Sia aims to rival established giants like Amazon Web Services, Google Cloud, and Microsoft Azure. These traditional providers dominate the market with robust infrastructure and a range of services. However, Sia’s decentralized nature and the potential for lower costs present a compelling alternative. Its model, which leverages a distributed network of individual hosts, offers not only competitive pricing but also enhanced security and privacy due to its data distribution and encryption methods. Despite these advantages, Sia faces significant hurdles in adoption and trust, as traditional providers are well-established and perceived as more reliable, especially by enterprise clients.

Within the Crypto Space

In the cryptocurrency space, Sia’s competition includes other blockchain-based decentralized storage projects like Filecoin and Storj. These projects share Sia’s vision of disrupting traditional cloud storage models but also vie for the same market share. The success of Siacoin in this arena depends on Sia’s ability to differentiate itself through factors such as pricing, security features, user-friendliness, and network stability. Building a strong community and a robust ecosystem of developers and users is crucial, as it drives innovation and adoption. Furthermore, performance and scalability are key considerations; Sia must demonstrate that it can efficiently and reliably handle large-scale storage needs to be a viable competitor in this emerging field.

Recent Updates

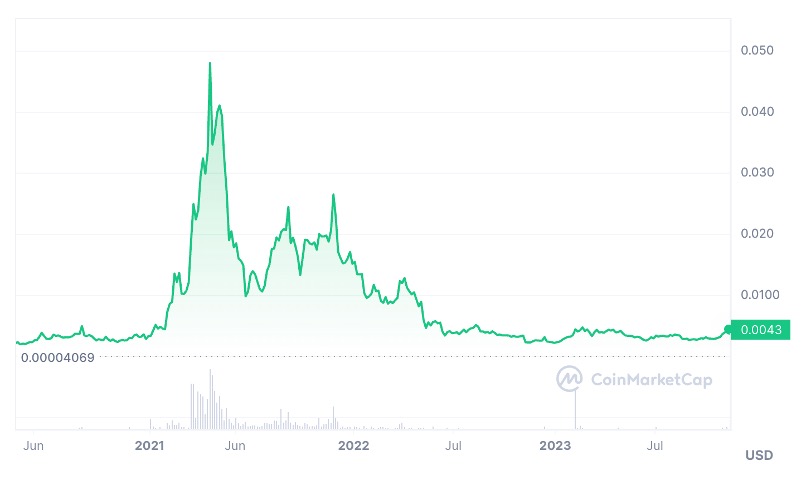

The live Siacoin price on November 12th is $0.004090 USD with a 24-hour trading volume of $8,109,947 USD. Siacoin is up 4.96% in the last 7 days and up 44.55% in the last month. The current CoinMarketCap ranking is #156, with a live market cap of $227,575,181 USD. It has a circulating supply of 55,647,445,296 SC coins and the max.

Analysis:

The potential for Siacoin to surpass its previous all-time high is closely tied to advancements and developments within the Sia platform, particularly in cloud storage technology. As Sia continues to innovate and improve its offerings, it could attract more users and increase the demand for Siacoin. Enhancements like a user-friendly interface and more efficient storage solutions can significantly impact its adoption rate.

The price of Siacoin, like many other cryptocurrencies, is influenced by broader market trends. The crypto market has historically seen cycles of highs and lows, as evidenced in 2021. A general upswing in the crypto market could positively impact Siacoin’s price, as investor sentiment in the crypto space often drives the value of individual cryptocurrencies.

Siacoin’s price fluctuation

Bitcoin’s price fluctuation

In the cryptocurrency market, a notable correlation exists between the price fluctuations of Bitcoin and Siacoin, reflecting a broader trend observed across many cryptocurrencies. Bitcoin, as the most dominant and established cryptocurrency, often sets a precedent for market behavior, influencing the sentiment and price movements of smaller cryptocurrencies like Siacoin. This correlation suggests that when Bitcoin experiences a price increase or decrease, Siacoin often follows a similar pattern, albeit with its unique fluctuations. However, it’s important to note that while the overall trend might be similar, the magnitude and timing of these movements can vary significantly between the two. Bitcoin, with its larger market capitalization and more established investor base, tends to have more gradual and sustained price trends. In contrast, Siacoin, being a cryptocurrency with a smaller market cap, often exhibits more rapid and pronounced price changes. This difference in the behavior of the two cryptocurrencies highlights the influence of Bitcoin on the broader crypto market while also underscoring the individual market dynamics of smaller coins like Siacoin. For investors and market analysts, this correlation is a critical factor to consider, as it indicates that while Siacoin has its unique market drivers, it is still significantly influenced by the trends and sentiments surrounding Bitcoin.

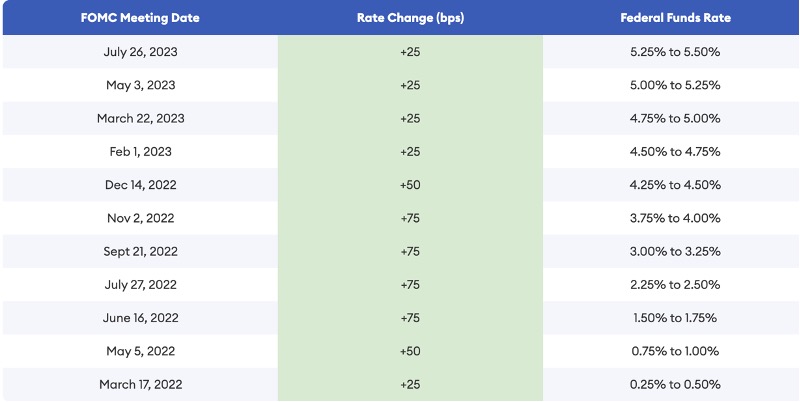

The relationship between external economic factors, such as the federal funds rate, and the price of cryptocurrencies like Siacoin is a nuanced aspect of financial market dynamics. When the Federal Reserve increases the federal funds rate, it often signifies a tightening of monetary policy, which can lead to a stronger U.S. dollar and higher borrowing costs. This shift tends to make traditional investments, such as bonds or savings accounts, more appealing due to their increased returns, potentially drawing investment away from riskier assets like cryptocurrencies. Consequently, a rise in interest rates can dampen investor risk appetite for high-risk investments, including Siacoin and other cryptocurrencies.

This reaction is partly due to a change in investor sentiment, as cryptocurrencies are sometimes viewed as hedges against traditional financial systems or inflation, a perception that can be challenged in a high-interest rate environment. While the immediate response to a hike in interest rates might be a drop in cryptocurrency prices, the long-term impact can vary, influenced by broader economic conditions, technological advancements in the crypto space, and overall market sentiment.

Furthermore, given the global influence of the U.S. economy, changes in its monetary policy can resonate worldwide, affecting global investment patterns and, by extension, cryptocurrencies. This interplay between the federal funds rate and cryptocurrency prices underscores the sensitivity of digital assets to traditional economic indicators, highlighting the importance for investors and market participants in the cryptocurrency space to stay attuned to broader economic trends and policy changes.

Summary:

Siacoin (SC) represents a significant innovation in the realm of cloud storage, anchoring the Sia platform’s vision of a decentralized, blockchain-based alternative to traditional storage solutions. Despite facing challenges in adoption and scalability, Siacoin’s market performance shows promise, influenced by both advancements within the Sia platform and broader trends in the cryptocurrency market. The notable correlation of Siacoin’s price with Bitcoin’s movements, along with its sensitivity to external economic factors like the federal funds rate, highlights the complex interplay between digital and traditional financial markets. As Siacoin navigates this dynamic landscape, its success will hinge on its ability to innovate, scale, and gain trust among potential users, positioning itself as a viable contender in the competitive cloud storage market.

Reference:

https://coinmarketcap.com/currencies/siacoin/

https://coinmarketcap.com/currencies/bitcoin/

https://www.forbes.com/advisor/investing/fed-funds-rate-history/