Ether as a Triple Point Asset

Written By: Cameron Tuths| Jan 20, 2022

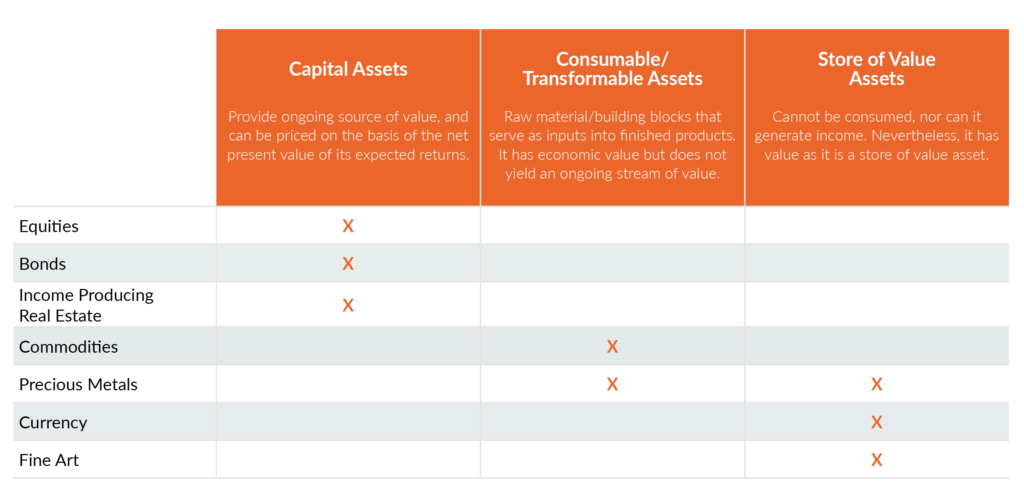

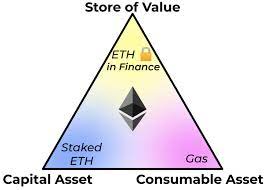

There are three types of assets that all financial instruments fall under. This was “discovered” by world-renowned economist Robert J. Greer in 1999. While occasionally an asset may be classified in two of these categories, Ether is bound to be the first asset to fall into all three of these categories, making it an enticing investment opportunity. David Hoffman has affectionately coined the term “Triple Pointe Asset” to describe this unique trifecta.

Let’s start by defining the three asset classes:

Store of Value: is an asset that will not deteriorate or expire, maintains its value through time, and is seen as a holder of wealth instead of an appreciating investment, yet its value can rise as seen in the rise in gold prices.

Commodity: these are one-time use assets because the commodity can produce something useful and desired. For example, crude oil is a commodity that can be used to run an engine. This commodity has value until it is used.

Capital Assets: produce capital in the form of cash flow, dividends, or returns. A stock is a capital asset as it often returns dividends and is seen as an investment because the investors are hoping that the value of their shares will rise and can then be liquidated for a profit.

As seen in the chart below, many precious metals like gold and silver are considered both stores of value and commodities. In addition to maintaining their value well, these assets have many industrial use applications, in which case it would be classified as a commodity if used in that manner.

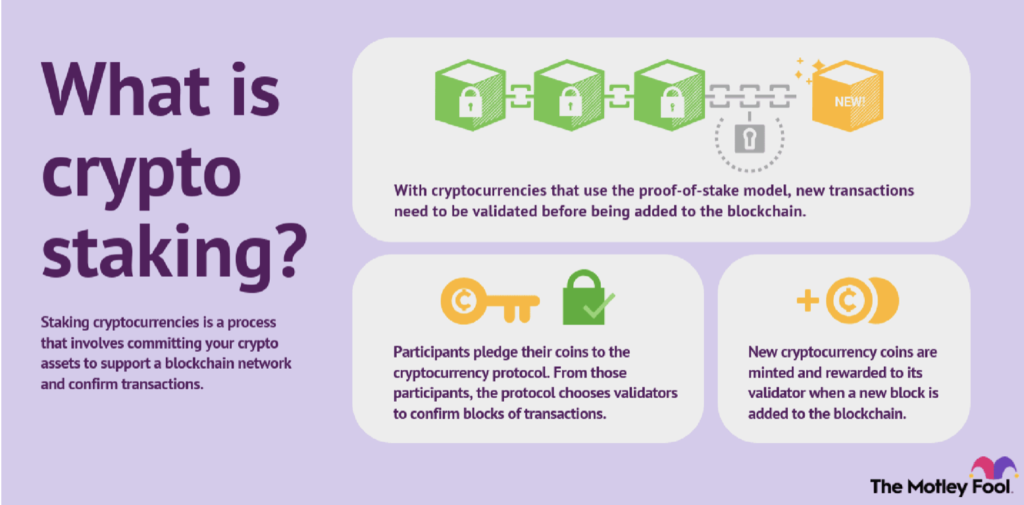

Ether is a Capital Asset because staking your Ether grants you a share in the Ethereum network, a claim on Ethereum’s transaction fees (gas fees), and the right to work on the Ethereum network. These are all returns granted to the investor once they purchase and stake their Ether, similar to owning a dividend-paying stock. The ability to add to the Ethereum network is unique to this investment and is something that will see increased interest as the network continues to mature.

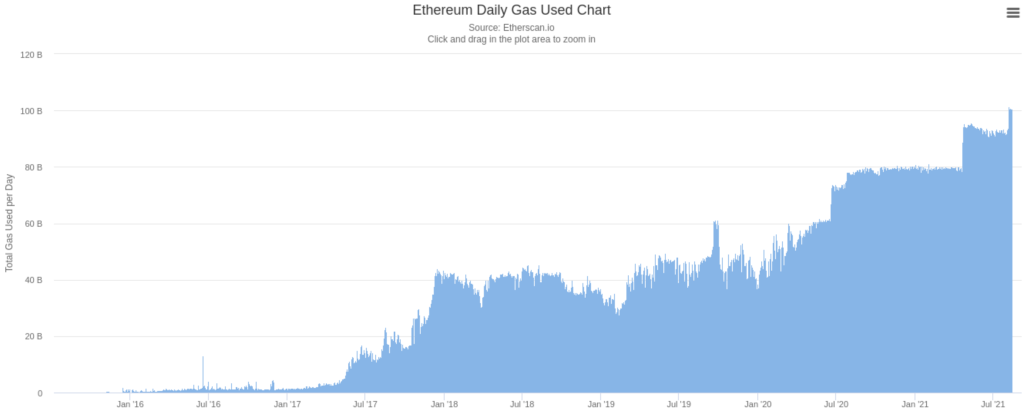

As a commodity, Ether is better understood as the gas for the Ethereum network. Whenever transactions are completed on the Ethereum network, Ether must be used as a transaction fee “gas,” and thus, Ether is a commodity on the Ethereum network. Just as oil’s price rises as supply decreases, Ether’s price increases as the demand for Ether keeps growing, yet supply decreases.

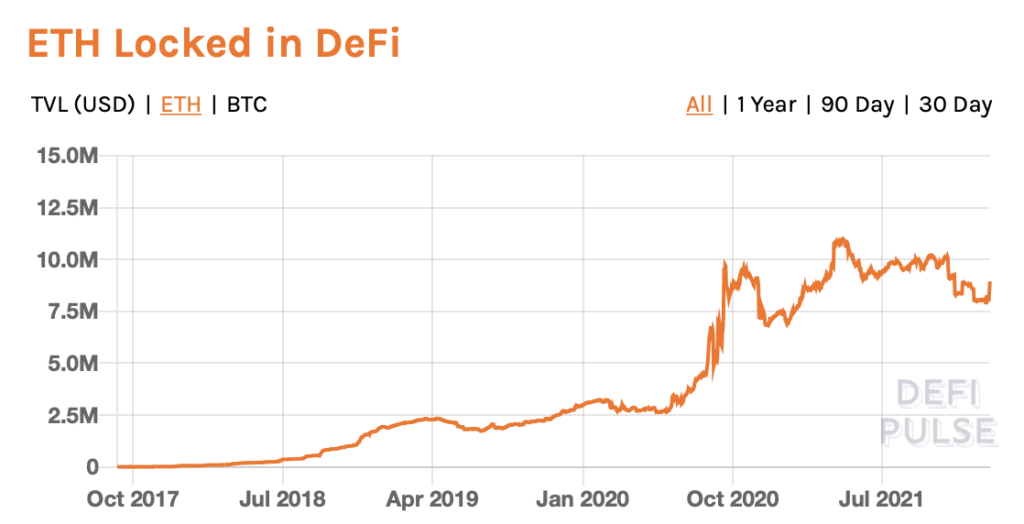

Lastly, Ether is a store of value for multiple reasons. Ether is being used as collateral, as seen in today’s developing DeFi economy. The “Eth locked in Defi” metric measures the amount of Ether that is currently “locked” as collateral, and this figure has constantly risen. The stablecoin Dai requires more Ether to be “locked” than the value of Dai being transacted. Assuming Dai and other Ether-backed applications can continue this progress, Ether is set to become significantly more in demand. This will further make Ether more valuable, bettering its store of value ability and even granting returns. Possibly more important is the EIP-1559 proposal called “London,” which will “burn” or remove a specified amount of Ether from circulation every transaction. This will make Ether a deflationary asset, increasing its price over time.

To review:

Staked ETH = Capital Asset

Consumed ETH (gas fees) = Consumable/Transformable Asset

ETH Locked in DeFi/Decreasing supply = Store-of-Value ETH

Eth = Triple Point Asset

References:

[1] David Hoffman, Ether: The Triple Point Asset, https://newsletter.banklesshq.com/p/ether-a-new-model-for-money

[2] Lyle Daly, https://www.fool.com/investing/stock-market/market-sectors/financials/cryptocurrency-stocks/what-is-staking/

[4] J.P. Morgan Center for Commodities, Robert Greer, https://business.ucdenver.edu/commodities/robert-greer