The Future of Traditional Finance and Crypto in Light of Fed Remarks.

By Cameron Tuths

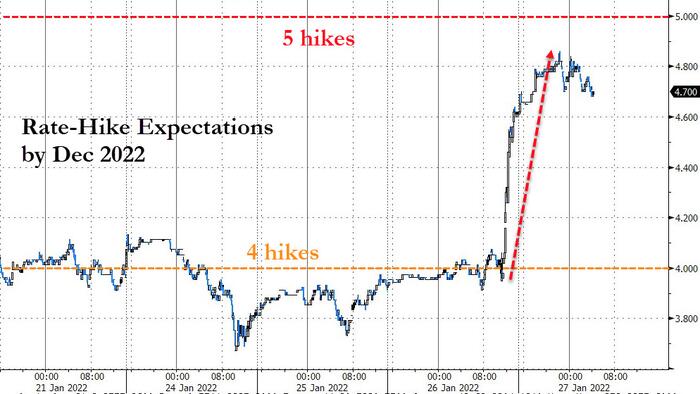

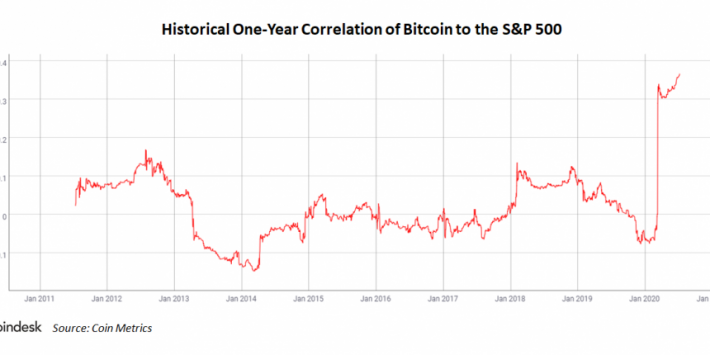

Chairman Jerome Powell of the Federal Reserve spoke publicly yesterday in an address to the country. In his speech, he indicated a strong likelihood that the Fed will soon raise the federal funds rate to curb runaway inflation. The news was a surprise to nobody as rate hikes have seemed imminent for months, and many argue it should have been done earlier in 2021 when the inflation problem was not as severe and the economy seemed to be roaring out of its covid-induced tightening period. With consumer prices indicating a seven percent increase in 2021, the highest in 40 years, inflation is an issue that the Fed must handle in the immediate future. The chairman will most likely raise rates in March of this year, with models predicting anywhere from 3-5 hikes before the year is over. Many on Wall Street had seen this coming for months, and once their holiday bonuses cashed in at the end of the year, they went about rebalancing their portfolios towards more risk-off assets. The significant change to the world of crypto in 2021 was the introduction of institutional investors, which brought a rise in prices during the summer months. These institutions will continue to act as institutions do, meaning when they perceive murky waters ahead, indicated by rising interest rates, high inflation, and geopolitical issues, they will shift away from risky investments relatively quickly. This is in part responsible for the recent sell-off of crypto at the start of the new year.

Further pulling money from crypto is the announcement that the Fed will end their quantitative easing policy by letting their holdings expire starting in March to shrink their balance sheet. Government bonds comprise the bulk of the Fed’s assets, and by letting them expire, they will create a large depression in the bond market. This, in turn, will force bond yields up and costs down until the gap that the Fed left is filled by investors. This is in an active effort to reign in the risk curve of the broader markets through what Milton Friedman referred to as the portfolio balance channel. Due to these converging factors, a less than stellar performance in the crypto space is to be expected as rate hikes are announced and implemented over the coming year. Reassuring for crypto investors is that in the last cycle, when stocks and crypto followed each other into the red at the onset of the pandemic, both came out the other side better than they had gone into it. Stocks rebounded out of their dip to new peaks, 30% increased over pre-pandemic highs. On the other hand, Bitcoin came out of the same slump to new highs that were over 260% increased over pre-pandemic highs. Coming out of the tightening cycle that we are currently entering, it is expected that crypto markets will have an opportunity to eclipse summer 2021 prices and reach new peaks.

In the coming years, it is expected that crypto and the world of decentralized finance can decouple themselves from the traditional financial world so that rate hikes and bond prices have less of an impact on coin prices. While traditional markets often trade off of macro trends and the state of the general economy, DeFi can grow into its own sector as it has inherent value and can prosper in a tight economy. Once the full extent of Web 3.0 and blockchain technology is realized, investors will feel more comfortable with crypto and can consider the space to be less risky in future market cycles. We can also look forward to a world where the Fed chairman’s words no longer have the world reaching effects that chairman Powell’s currently does, as seen by the instant market plunges that his speech caused midday yesterday.

References:

- Howard Schneider and Ann Saphir, https://www.reuters.com/business/finance/inflation-fighting-fed-likely-flag-march-interest-rate-hike-2022-01-26/

- Fed, https://www.federalreserve.gov/newsevents/pressreleases/monetary20220126a.htm

- Jeff Cox, https://www.cnbc.com/2022/01/23/inflation-surge-could-push-the-fed-into-more-than-four-rate-hikes-this-year-goldman-sachs-says.html

- Fed, https://www.federalreserve.gov/monetarypolicy/bst_fedsbalancesheet.htm

- Agence France Presse, https://www.barrons.com/news/fed-pulling-back-on-stimulus-preparing-for-rate-hikes-01643217307?tesla=y