Welcome to Decentraland: Where Crypto Meets Virtual Exploration

By Aidan Kalish | Crescent City Capital Market Analyst Intern

Decentraland is one of the first projects to utilize blockchain technology to power a virtual open-world platform. In it users can explore, participate in social experiences, and communicate with people from all around the world. Users can also create, experience, and monetize content and applications for fellow users. Yet this only scratches the surface of what makes Decentraland the revolutionary project that it is. Decentraland’s virtual world is considered a decentralized internet. Unlike traditional online spaces such as Twitter or Instagram, Decentraland allows people to truly own their digital assets. Using blockchain technology, users are able to make transactions on the platform itself and even buy plots of land located throughout the virtual world.

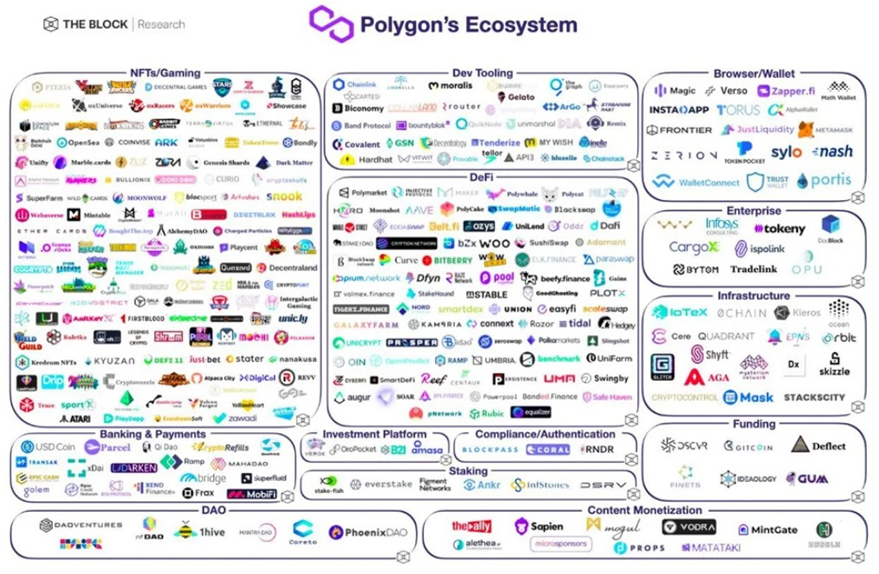

Decentraland was launched in 2017 by Ari Meilich and Esteban Ordano with the goal of creating an open-source system for users to build whatever they want within the virtual world. Whether it is a virtual store, social media platform or online casino, there are no restrictions or limits on what can be created in this decentralized space. Decentraland runs on the Ethereum blockchain but conducts transactions on a side-chain to combat scalability issues that can be found on Ethereum. Decentraland has a partnership with Polygon who provides the side-chain on the Ethereum network. This allows fast and very cheap transactions to take place within the virtual world. Decentraland is governed by its “Decentralized Autonomous Organization” (DAO). The DAO allows users to be in control of the policies created that determine how the world behaves. This is done by implementing a voting system where users can decide on a range of issues such as: the size of marketplace fees, specifics of land plot auctions and the allocation of grants to development efforts. Each user is allowed one vote per MANA token owned. This system allows the entire community to be involved in shaping Decentraland’s future.

A common question involving Decentraland is if it is the same as the metaverse. There are some similarities between Decentraland and the metaverse but there are some key differences between the two. The first is that the metaverse would be based on a centralized server system, meaning that the entirety of the virtual world exists online via a single computer system. Decentraland, on the other hand, is based on a distributed ledger system, using blockchain technology to store information on a network of decentralized computers rather than one sole server. This allows for increased security and reliability of data storage for users. The other difference is that the metaverse is still a concept to be built while Decentraland is one of the first iterations of the idea.

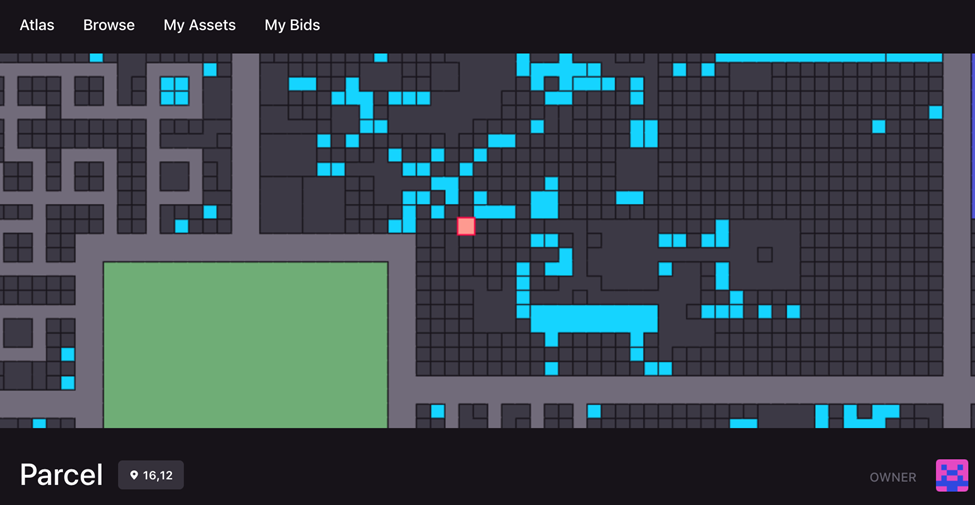

Decentralanduses two digital assets to run its economy: LAND a non-fungible token (NFT) that represents a parcel of land in which the virtual world is divided into; and MANA, an ERC-20 token that is traded on the Ethereum blockchain. LAND can only be bought with MANA. Every unclaimed LAND parcel can be purchased at the same exchange rate of 1000 MANA = 1 LAND (~$2,682 at the current MANA to USD exchange rate). Since LAND parcels are distinguishable from one another they can be traded at different prices on a secondary market. Currently, there is a total of 90,601 parcels of land. MANA is used to claim LAND as well as to make in-world purchases of goods and services.

The primary reason for buying a virtual plot of land is because of the return on investment (ROI) the plot offers. Since a LAND parcel is an NFT the owner truly owns the digital asset, and since it exists on the blockchain, its authenticity can be verified by anyone. The owner of a LAND parcel may decide to hold onto the plot and let it appreciate in value before deciding to sell it. Another option for the owner could be to rent the plot for exclusive virtual events. Many parallels can be drawn between LAND parcels and real world real estate such as functionality and possible revenue streams.

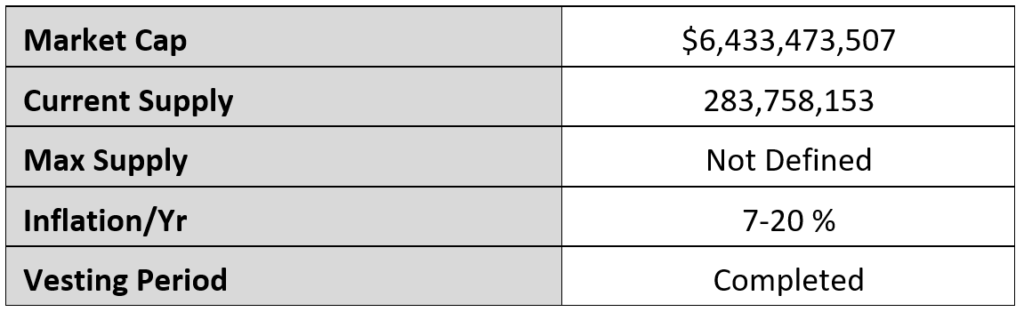

At the time of writing MANA has a market cap of $4.8 billion and a fully diluted market cap of $5.7 billion. About 1.82 billion MANA tokens, 82% of the total 2.19 billion supply, are currently in circulation. The token had one of the largest gains in the past year being valued at $0.08 on January 1st, 2021 to reaching a high of $5.20 on November 26th, 2021. Since hitting that high the price of MANA has fallen, opening on January 1st, 2022 at $3.27 and at the time of writing is valued at $2.61. Despite its price crash, the popularity of MANA will likely rise among investors as major tech companies have begun to explore this emerging field, with Samsung partnering with Decentraland to open a pop-up store and special experiences within the virtual world. With the potential for collaborations with more big-name brands and the exposure that comes with them, Decentraland’s MANA token will likely continue to be highly profitable.

The utility of MANA has a strong appeal to those who are interested in being involved in virtual worlds. The MANA token allows the user to truly own the value of their time spent online as well as giving the user voting power in the DAO to help shape the future of Decentraland. MANA also has an appeal for those who want to further diversify a portfolio and are not looking to be directly involved with Decentraland. The MANA token can be invested in solely as a cryptocurrency which has a good track record of growth or as a means to invest in LAND parcels that can serve as a truly unique asset. Overall, Decentraland is still a very young project that is only beginning to what it has to offer. Investment opportunities will continue to multiply and as activity on the platform continues to increase, the currently low price of MANA helps support an argument for current investment.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. Please conduct your own due diligence before making any investment decisions.

References:

https://docs.decentraland.org/

https://decentraland.org/whitepaper.pdf

https://coinmarketcap.com/currencies/decentraland/