Solidly, ve(3,3), and the Latest in Defi Tokenomics

By Christopher Kilbourn | Crescent City Capital Market Analyst Intern

There are a handful of men with an E.F. Hutton-like grip on the defi world, and rest assured that if ever Tetranode consults on a project by Andre Cronje, it’s time to listen. Himself the founder of the legendary Yearn Finance and the more recent KP3R protocol, Cronje’s latest effort sees him teaming up with the recently disgraced Dani Sesta for the latter’s attempt at a redemption arc after his willful and high-profile association with a serial con artist.

Is Sesta’s involvement a blazing red flag? For our purposes today, the question might be irrelevant. Many – perhaps most – defi protocols prompt the user to define for himself what exactly counts as a Ponzi scheme, anyway. To those who believe in the future of decentralized finance, however, it’s an article of faith that the infrastructure of an alternative global capital market is being developed in front of us in real time, and the financial instruments we see emerging almost weekly in the first quarter of 2022 will someday come to define its major actors. With a bit of effort, the focus can remain on the brilliance and novelty of the mechanisms themselves, regardless of whether they were originally designed for a get rich quick scheme by a huckster who commands an army of amphibious otherkin.

This week’s experiment is the Solidly Exchange, and in keeping with Cronje’s previous work, it continues to play at the frontier of experimental tokenomics. The major components in this department come from two existing protocols, from which it lifts and syncretizes elements to produce a new type of automated market maker (AMM). These protocols are Olympus and Curve, and the mechanisms they contribute are (3,3) and (ve.) What follows is a brief refresher on the protocols themselves, and a bit more detail to familiarize ourselves with their unique methods of incentivizing protocol growth.

Olympus (3,3)

As discussed in the above referenced piece, Olympus is a DAO launched last year with the lofty goal of operating as a de facto central bank and issuing a crypto-native reserve currency – a native token that could be used as a medium of exchange across the crypto world, backed by a basket of cryptocurrencies held in the DAO’s treasury. Unlike the average defi protocol, the DAO’s ultimate goal is not price appreciation but the widespread and irrevocable integration of its native token into the innerworkings of decentralized finance. Who could have guessed that a man named Zeus would be more interested in power than money? This certainly appears to be the game, though, and its tokenomics differ drastically from its predecessors to achieve that end.

Nowhere is this departure more pronounced than in the area of emissions. Where a protocol aiming to drive token price as high as it can go is forced to tame inflation, to increase a token’s supply without tanking the market requires a treasury to both encourage and mitigate it.

In the case of Olympus, there is a mechanism in place for each. Simply put, the bonding mechanism is designed to attract new liquidity into the treasury and issue new OHM in exchange. Thus, as long as new liquidity is being bonded into the treasury, there is a perennial and corresponding expansion in the supply of OHM. How then does the protocol manage to dilute its tokens so aggressively without placing enough downward pressure on the price to trigger a selloff? On one hand, by its revolutionary concept of protocol-owned liquidity (POL), which places a “risk-free” floor to the token’s value, since the token is backed by the perpetually expanding treasury. But the other method is in its approach to staking.

Enter the (3,3) meme. (3,3) refers to the protocol’s tokenomic method of incentivizing staking using a model informed by its creator’s background in game theory. To oversimplify the meme for the sake of brevity, when you have two hypothetical OHM holders who each have the option to stake, bond, or sell, the maximum benefit for all parties occurs when both stake their OHM and thus take them out of circulating supply. The worst outcome is when both parties sell their OHM, both missing out on staking benefits and offloading at a presumed discount due to the universal sell pressure.

The tokenomics put in place by the Olympus DAO incentivize staking over selling by diluting the circulating supply of OHM as aggressively as they do, then distributing an artificially inflated amount of tokens as staking rewards. For all parties involved, holding without staking is hardly an option due to the relentless token dilution. But more subtly, it becomes disadvantageous to sell, as well – with upwards of 8,000% APY return, it’s difficult to justify cutting off the flow of staking rewards as long as OHM isn’t in active freefall. More on that another day, but suffice it to say that (3,3) as a meme refers succinctly to a system of enabling the aggressive expansion of supply through a tokenomics structure that incentivizes staking through POL-mitigated dilution.

Curve (vE)

The second of SOLID’s intellectual forefathers is Curve Finance, and its contribution is the original system of vote escrow it applies to its reward tokens. After the Bene Gesserit mind training of a crash course in OHM tokenomics, Curve is thankfully straightforward. Simply put, it is an AMM specifically for low-volatility currency pairs, overwhelmingly used to provide liquidity for stablecoins. The fees are low, the depth reduces slippage, and impermanent loss is virtually unheard of. If ever you’ve dreamt of exchanging $7,000 in DAI for $6,998 worth of USDC, Heaven has an easily memorized URL and you can get there on the Metamask app.

Where Curve gets interesting is in the incentives it offers liquidity providers and the unexpected arms race that developed last year over the tokens involved in their governance. There’s a short list of places on the internet where you can exchange $15 Million in USD stablecoins with minimal slippage, and there’s a reason Curve is one of them. The liquidity pools offer highly competitive rewards, with providers receiving trading fees and earning yield from the use of their deposits in other defi protocols. All rewards are paid in Curve’s native token, CRV.

Where things get interesting is in the protocol’s system of governance. Curve pioneered their own system of vote escrow, in which liquidity providers rewarded with the native token could lock their CRV on the smart contract in exchange for a governance token called veCRV. The longer providers committed to lock their CRV, the more veCRV they would be rewarded with – and the more veCRV a provider had, the more influence they had over the governance decisions that affect the protocol’s functioning.

Chief among these decisions is the yields distributed to different liquidity pools. In other words, if you receive CRV for providing liquidity on the CVX-USDC pair, you can lock that CRV and use your veCRV to vote for higher rewards for the CVX-USDC pair. And if you happen to be a defi protocol who produces CVX – you can probably fill in the blanks from there.

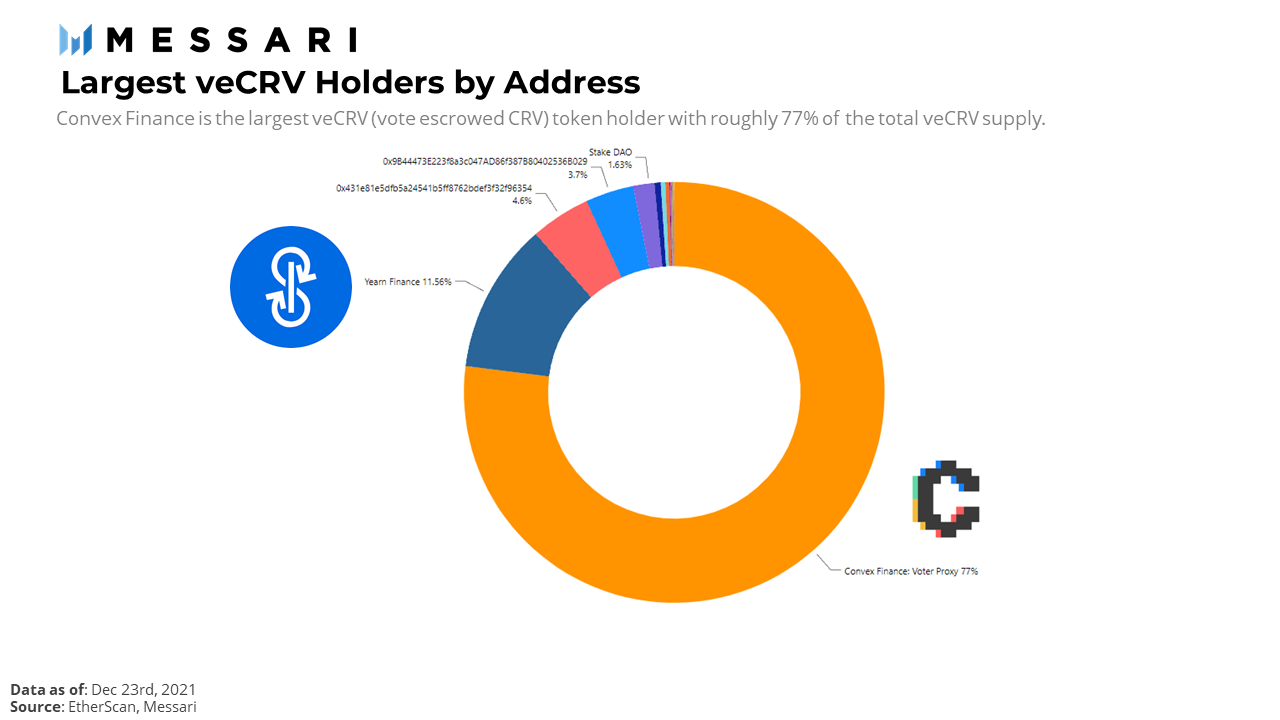

The Curve Wars began when protocols realized that they could use their own treasuries to provide liquidity on Curve for both yield and CRV, which they could use to privilege the liquidity pools of their native tokens with higher CRV rewards. Convex Finance was formed for no other reason than to take advantage of this defi life hack, offering users rewards for staking their CRV not on Curve, but on Convex. They ultimately grew to be the largest single holder of CRV, and voted CVX’s rewards through the roof, causing the price of the token to skyrocket – like a strange Dallas Buyers’ Club for LP rewards. Arguably, however, the true winner was still Curve, who successfully implemented a vote escrow system that incentivized protocols to mobilize massive amounts of capital to compete with each other over who could provide the greatest amount of liquidity on their AMM.

SOLID

Solidly is an AMM that implements both Olympus’s (3,3) tokenomics and Curve’s (ve) vote escrow system – but where Solidly differs is that it’s being launched with Curve-style protocol wars in mind, essentially designed to attract liquidity providers as its first priority. Its launch took place earlier this week, and took the form of an airdrop to the top 20 FTM protocols by total value locked. This means that these protocols will now compete to provide liquidity on Solidly, being rewarded with a heavily inflationary SOLID token which can be vote escrowed for veSOLID.

The brilliance of this approach lies in its appropriation of Olympus’s inflationary (3,3) strategy. Olympus designed its tokenomics to mandate staking and thus enable a long-term expansion of the OHM circulation. It then employed its own protocol-owned liquidity system to amass OHM liquidity pairs in its treasury, and deployed these liquidity pairs to AMMs across the defi world to both earn trading fees and establish itself as a widely utilized reserve currency.

When Solidly uses the same gambit on their own token, they won’t be amassing liquidity pairs to stake on other people’s exchanges – they’ll be producing a token that keeps score in an arbitrary race for protocols to accumulate as much as possible. Because the amount of LP rewards a protocol receives will be solely determined by the amount of SOLID they have, there is no point at which they will not want more.

Then, with liquidity provisioning being the only way to compete in this race, Solidly will have the deepest liquidity of any exchange on FTM and make the lion’s share of its revenue off of the trading fees from its highly competitive exchange. Finally, by employing the vote escrow system by which governance rights are only granted when reward tokens are locked, they are providing an even greater incentive to stake and thus prevent the dilution’s downward pressure on price.

The emissions schedule on SOLID is set to pick up dramatically within the next six weeks, which means staking rewards will begin to accelerate around the same time. Whether or not Andre’s latest experiment will take off is as yet undetermined, but Solidly is certainly worth watching as its trial run unfolds. Much like the vote escrow and (3,3) systems themselves, the Solidly approach could form a new model for decentralized finance which all future AMMs will follow.

https://olympusdao.medium.com/the-game-theory-of-olympus-e4c5f19a77df

https://dyor-crypto.fandom.com/wiki/Olympus_(OHM)