Week of June 17, 2019 Market Analysis

By Jing Zhu | Crescent City Capital Market Analyst Intern

Facebook Introduces Libra

On June 18th, Facebook came out with the Libra coin. This new cryptocurrency uses cryptography to verify transactions, which will launch next year. Users of Facebook’s Messenger App will be able to access Libra coins through a digital wallet. Because Facebook has many users worldwide, it hopes that Libra will develop into a global coin that can be used in all transactions. This means that Facebook wants to provide financial services to millions of people who either do not have a bank account or cannot send money overseas. The Libra coin could potentially help out small businesses and those in third world countries.

Calibra is the regulated subsidiary that will provide access to the Libra coin and separate financial data from social media data. Facebook and more than two-dozen partners (including MasterCard Inc., PayPal Holdings Inc., and Uber Technologies Inc.) have formed a consortium that will govern Calibra and the Libra coin.

Libra v. Bitcoin

Both Bitcoin and Libra are digital coins that allow users to exchange monetary value online, but major differences between the two exist. Facebook wants to establish a payments network on which users can buy goods and pay each other. Bitcoin, on the other hand, is more of a payment mechanism. According to WSJ, Bitcoin has evolved into a sort of “digital gold” to store value rather than exchange it. Furthermore, Facebook claims that Libra will be backed up by real assets (like bank accounts and short-term government securities), so it will not be as volatile as Bitcoin. This could be beneficial to users. By avoiding dramatic fluctuations in value, Libra could possibly be better suited for everyday transactions.

While Facebook touts Libra as a better alternative to Bitcoin, it may be unlikely to affect the price of Bitcoin. Some see Libra as nothing more than PayPal with blockchain thrown into the mix, while others say that it could lead to more widespread adoption of traditional cryptocurrencies. In either of these cases, Libra is simply a variation of the traditional monetary system. It may not impact Bitcoin price because Bitcoin is (and still remains) the world’s first and most popular cryptocurrency. Bitcoin is an apolitical store of value and medium of exchange. Libra is different from that and has no effect on the “digital gold” market.

Libra: Potential Problems

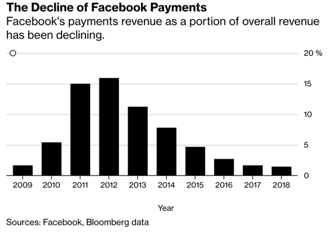

Libra will likely encounter skepticism from regulators who believe that Facebook has too much power and is lax on privacy. Facebook is already under scrutiny over how it handles peoples’ private data. In fact, when Facebook came out with Libra on June 18th, the French finance minister, Bruno Le Maire, immediately voiced his opposition. He claimed that Libra should not be a replacement for traditional currencies. Additionally, Facebook has a historically unimpressive record in payments and commerce. While Libra could change that, it might take some time for people to trust and learn more about incorporating the coin into transactions.

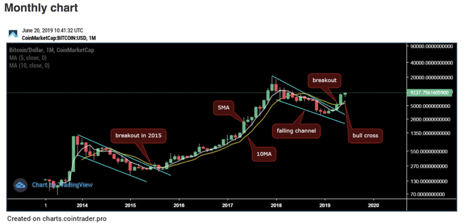

Please see chart below:

Bitcoin Price Stalling

The price rally appears to have stalled at around the $9250 mark. Bitcoin has failed at least twice in the past four days to break the resistance level above $9300. However, as of later today, the price recently broke $9500. There is a bullish indicator of a golden crossover (where the white and yellow lines intersect). Some traders expect that the price may be looking to test the $10,000 mark sooner rather than later.

1.“Libra Coin? What You Need to Know About Facebook’s Answer to Bitcoin by Parmy Olson for WSJ published 6/18/19

2. “How Will Facebook’s Libra Cryptocurrency Affect the Bitcoin Price?” by Kyle Torpey for Forbes Magazine published 6/19/20

3. “Facebook Wants Its Cryptocurrency to One Day Rival the Greenback” by Kurt Wagner, Olga Kharif, and Julie Verhage for Bloomberg published 6/18/20

4. “Bitcoin Price Rally Stalls as Open Futures Hit Record Highs” by Okmar Godbole for Coindesk published 6/20/19