The NEAR Protocol

By Chris Kilbourn | Crescent City Capital Market Analyst Intern

I. Thesis

The NEAR Protocol is a layer one blockchain network that uses a proof of stake consensus mechanism to validate its transactions. It boasts higher than average throughput with lower than average costs, and its ongoing implementation of dynamic sharding as a scaling solution is likely to maintain these network benefits as it grows. NEAR has the stated goal of building the infrastructure that will underlie web3 and it gears its ecosystem towards scalability, interoperability, and user experience towards that end. Due to its coherent vision of the open web and active role in encouraging its development on the network, the NEAR protocol is likely to become a significant rival to other layer ones as the use cases it focuses on supplant the current internet structure.

II. Qualitative Analysis

Metric Comparisons with Proof of Stake Layer 1s

As a layer 1 blockchain platform, NEAR is responsible for providing the decentralized infrastructure upon which the applications and networks in its ecosystem depend, and it utilizes a delegated proof-of-stake (DPOS) mechanism to achieve consensus among validators. There are a variety of metrics upon which the strength of this mechanism can be gauged, and a number of these have been included below with the measures of comparable layer one protocols. As NEAR uses a proof-of-stake consensus algorithm, it is compared here to SOL, AVAX, ALGO, and FTM on metrics that measure platform performance and decentralization.

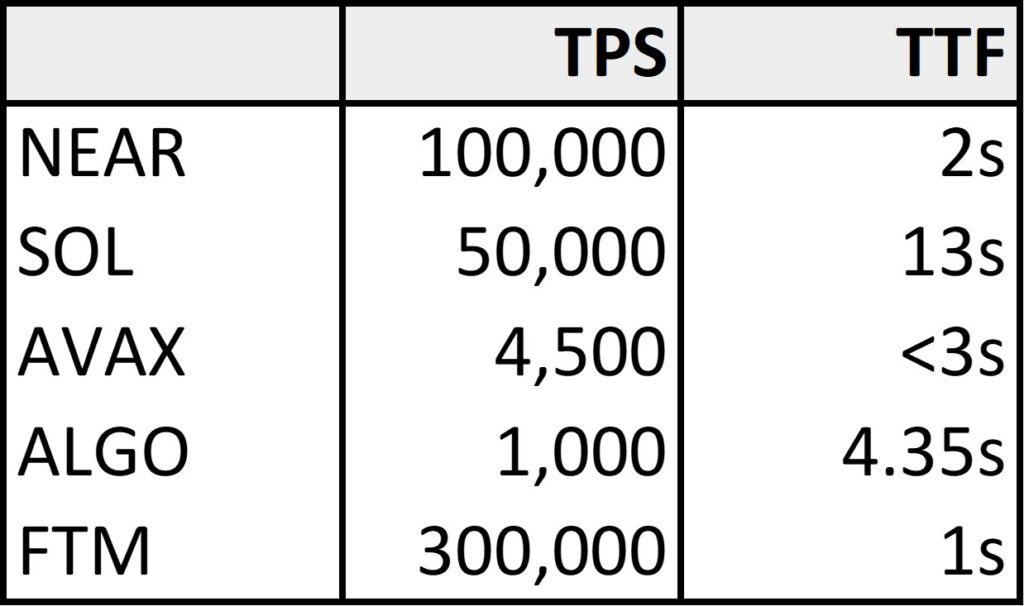

Platform Performance (Transactions per Second and Time to Finality)

NEAR stands up well to other layer ones in terms of its throughput capacity, though this metric (transactions per second) is notoriously manipulable and subject to discrepancies in the ways protocols choose to take its measure. Although time to finality (TTF) is itself affected by transaction volume, it may provide a better sense of network speed. By this measure, NEAR finalizes transactions in approximately 2 seconds, faster than the strong majority of layer one blockchains. NEAR’s theoretical speed of 100,000 TPS reflects its capacity when fully sharded, suggesting that TTF may remain highly competitive even after the network sees considerably wider adoption. By both of these measures, NEAR is the second fastest of these networks.

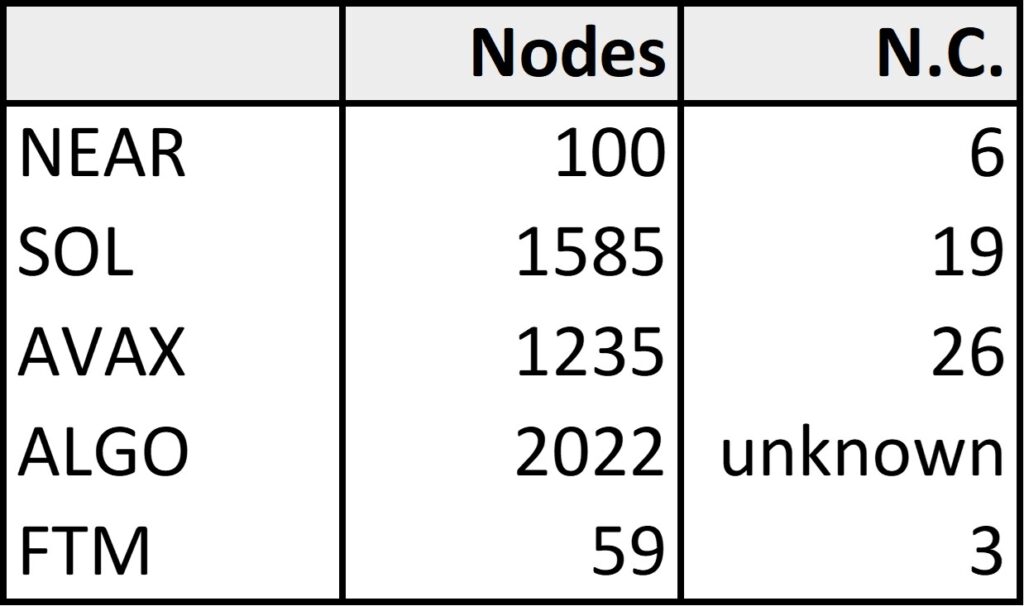

Decentralization (Number of Nodes and Nakamoto Coefficient)

NEAR’s speed is competitive, but this is perhaps enabled by sacrificing a degree of decentralization. While not as poor as FTM, it nonetheless lags behind more established layer ones with only 100 nodes at the time of writing. NEAR has, however, embarked on the second phase of its Nightshade sharding implementation and seeks to have 200-400 validators online by the time it is complete. In order to encourage that process, the protocol recently reduced the seat price for a validator node from 3.6M NEAR to 67,000, thus reducing the barrier to entry and creating the conditions for more validators to come online.

These metrics paint the picture of a layer one ecosystem that is competitive in terms of speed, security, and scalability but makes sacrifices in centralization. This is perhaps a reasonable avenue to widespread adoption in NEAR’s case, as relative centralization is likely responsible for its current speed and the progressive unrolling of its scaling solution will enable it to further decentralize as it grows – potentially without losing throughput capacity. NEAR plans to implement Nightshade in full by Q3 of 2022, so it may be worthwhile to continue observing and see whether its number of validators improves by then.

Non-Quantitative

Setting the above aside, layer one performance metrics are only indirect predictors of future revenue inasmuch as they signify an ecosystem’s attractiveness to users and developers. As revenue itself is always a function of transaction volume, the number of users on a layer one is the true determining factor, and there are several unquantifiable variables that contribute to NEAR’s likelihood of success in this regard. Chief among these are the stated emphasis on building an ecosystem tailored to web3 applications and the deliberate pursuit of network effect through composability and interoperability.

Emphasis on Web3

Simply put, the NEAR Foundation has a coherent vision of what life will look like on the open web and uses its $800M ecosystem fund to encourage web3 applications with real world use cases. Examples are profuse. Myriad is a social media platform with a secure chat app and 2D metaverse that can be accessed on mobile phones. NearPay, a bridge between NEAR and fiat that comes with a debit card to be used in the real world, attracted 18,000 users in its first week. DeBio is a platform for tokenizing data from blood samples and distributing them to labs around the world, allowing for anonymous, decentralized medical testing. This degree of innovation is uncommon and contributes to the developer-centric community that NEAR has sought to create, while also establishing NEAR as a major competitor in the world which end users will ultimately inhabit.

Emphasis on Interoperability

One of the hallmarks of this world will be users’ ownership of their own content and identities and their ability to move freely between protocols that engage with this migratory data. From a development standpoint, this means these protocols must be interoperable with other applications both on and off their native blockchains. The NEAR Foundation vocally anticipates this and has focused on the interoperability of the NEAR protocol in a variety of different ways.

Foremost among these is Aurora, an EVM-compatible layer 2 protocol that allows developers to run Ethereum-based applications on the NEAR blockchain. The Aurora Network accounts for a sizable portion of the activity on NEAR at this stage and acts as a significant on ramp by which Ethereum users become acquainted with the ecosystem. Through bridges with other layer ones (e.g. Ethereum, Solana, Terra, Fantom), Aurora is the means by which outside tokens can be transferred into the NEAR ecosystem. To date, this primarily serves the purpose of collateralizing tokens for use in defi protocols, but CEO Illia Polosukhin has suggested in videos that as the technology progresses, this will enable the movement between chains and protocols by users with persistent identities – and the free interaction of disparate blockchain protocols.

Another vehicle for cultivating such inter-chain communication is the Octopus Network, which provides a software development kit for app-specific blockchains that it subsequently links together. While similar to Polkadot in its networking of autonomous layer one protocols, Octopus itself is on NEAR and all of the app chains it produces bridge to it out of the box.

In sum, this paints the picture of an ecosystem with a clarity of purpose and brand identity that is growing in a more coordinated direction than any other layer one. This executive planning is achieved through financial incentives that, to date, have gone primarily to infrastructure projects designed to create the conditions in which an open and community-based internet can thrive. Through this emphasis on building towards the real world use cases that will be relevant to the lives of web3 users, it is highly likely that NEAR will attract builders who onboard new users into the space and ultimately contribute to its success.

III. Quantitative Analysis

Tokenomics

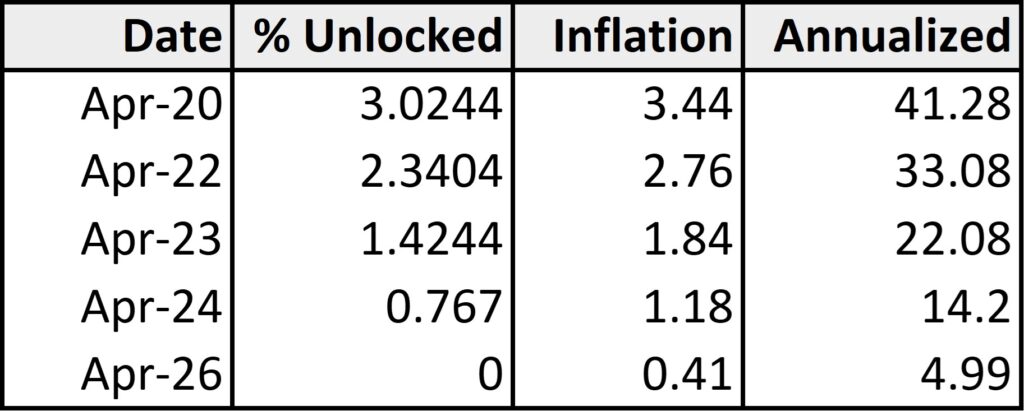

NEAR has a circulating supply of 647.5M with a total supply of 1B. The inflation due to rewards emissions is fixed at a rate of 5% per year, though 70% of transaction fees are burned, which ultimately detracts from the 5% inflation rate. The amount of $NEAR burned will naturally go up as the network sees greater volume, so it is anticipated that inflation will trend downwards over time.

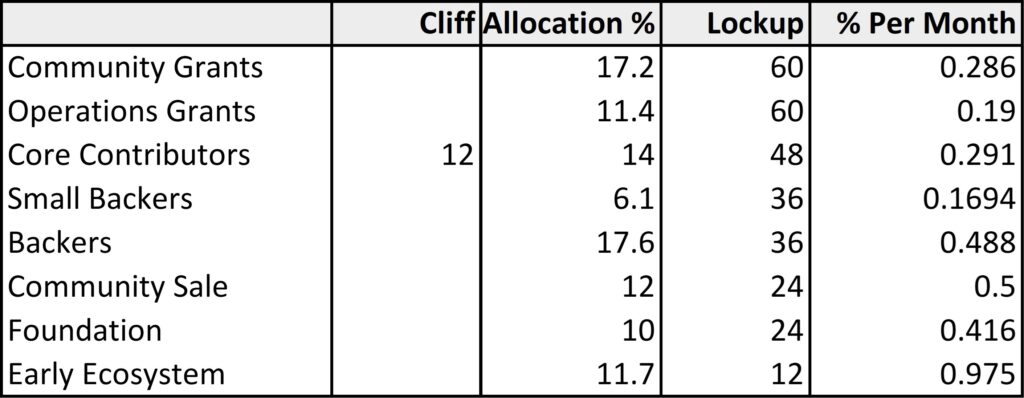

Many of the tokens distributed during the token generation event follow an elaborate vesting schedule, contributing to additional inflation as locked tokens steadily become available. These tokens were divided between a number of categories, to include core contributors, backers, small backers, community sale, early ecosystem, foundation, operations grants, and community grants.

As several of the categories were divided between tranches with different lockup periods, and the amounts distributed to each tranche are unavailable, figures here were determined based on the longest lockup period per tranche and thus the worst-case scenario for inflation. The reality is inevitably lower.

Token Allocations and Vesting Schedules

Inflation Due to Token Unlock

Token unlocks follow an elaborate though predictable schedule, and thus staking emissions are compounded by the introduction of these tokens into supply. As staking emissions are 5% per year, or 0.416% per month, estimated total inflation will be not higher than 2.75% per month beginning in April of 2022. This is somewhat steep at 33%, though not unheard of compared to other layer ones (AVAX stands at 39.9%, for one example.)

When examining these token allocations, it bears mentioning that the foundation specifically avoided the concentration of stake by limiting the amount of Series A funding they accepted from any one source. As a rule, no backers were given more than 3.5% of the initial supply, and few ended up with more than 1%. Between this deliberate effort to reduce concentration of supply and the fact that any vesting cliffs are behind us, it is unlikely that NEAR will experience any pronounced dump due to the sudden introduction of supply.

Price Action

NEAR has consistently outperformed since its initial distribution, though the case could be made that this coincided with an “alt season” in which excess risk was undertaken by a market flooded with liquidity. Following a dramatic shift in market conditions brought on by macro policy changes, it is currently unclear how alternative layer ones will perform going forward. This being the case, it may be more relevant to ask how NEAR will perform relative to comparable tokens.

One way to measure this would be to compare price action since the Fed announced the drawdown of Quantitative Easing on November 3rd. As this was the catalyst for the precipitous decline in crypto prices, NEAR’s relative price action during this period may provide insight into how it would fare in a more austere macro environment.

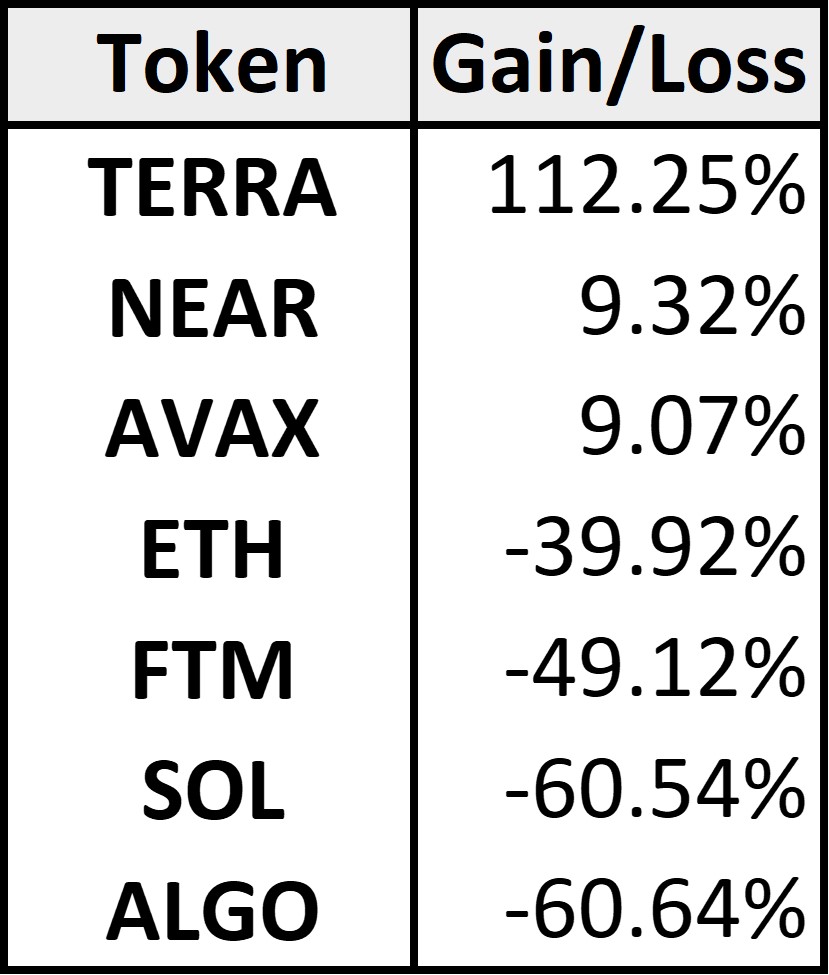

Performance of Layer One Protocols November 3rd, 2022 – Present

Terra is a clear outlier due to the performance of its Anchor defi protocol, but it is questionable whether this is sustainable or a reasonable indicator of its inherent value. Among the remaining projects, NEAR saw the greatest increase in price since the Fed began tapering, notably outperforming Ethereum’s benchmark layer one price by nearly 50%.

One possible interpretation of this data is that the volatility of a layer one’s native asset is proportionate to its exposure to defi applications. Experimental defi protocols are a magnet for risk-on capital in search of short-term yields – referred to in other contexts as mercenary liquidity – which make them prone to severe instability. FTM, which fell 49.12% in the period since November 3rd, provides a counterpoint to Terra’s success, as its price has newly imploded since the failure of a high profile defi project last week. These dramatic swings in layer one asset prices may be correlated with liquidity rapidly entering ecosystems in pursuit of the returns offered by specific defi projects, before exiting just as quickly after yields dry up.

With liquidity likely to wane further amidst the continued tightening of monetary policy, this type of speculative capital may find more reliable yields elsewhere, and much of the noise clouding short term price action will likely quiet down. At such a time, amidst the continued development of real-world use cases for blockchain technology, more and more of the new liquidity entering the space will come from users employing these native tokens to complete the transactions for which they were actually designed. In this type of environment, NEAR, with its consistent and focused push for applications that onboard new users to the open web, will continue to show an edge over its competitors and emerge as a leading layer one protocol in the web3 era.