Ocean Protocol

By Chris Kilbourn | Crescent City Capital Market Analyst Intern

OCEAN: Thesis

The primary business model of Web 2.0 tech companies involved extracting free content from users and selling their usage data for revenue. While proponents of Web3 purport to upend this dynamic by democratizing the sale of user-generated content, none have put forth a viable method by which user data could be financialized and sold by users themselves. The Ocean Protocol provides the framework for a new generation of assets backed by information and an ecosystem that can be used to create marketplaces for their exchange. By financializing data in this way, the Ocean Protocol will foster a robust global economy around the internet’s most valuable resource.

Qualitative Analysis

Ocean Protocol is an ecosystem that can be used for the sale of data sets, and it accomplishes this through two primary mechanisms. First, it allows users to publish data sets and wrap them in ERC-20 tokens, which can subsequently be purchased by consumers. Second, it provides the Ocean Market, a DEX which is tuned for the publication and transfer of these data tokens. Users who publish data sets are able to establish automated market makers by creating a liquidity pool of the tokens that represent their wrapped data. Through these liquidity pools, all manners of data can be exchanged using the infrastructure of decentralized finance.

By providing these marketplaces, Ocean creates a more complex method for the dissemination of data than any that currently exist and complements the role traditionally filled by blockchain oracles. While oracles allow institutional data providers to port data from off-chain APIs for sale on chain, Ocean allows intermediaries to create marketplaces that can deal in the off-chain data these oracles provide as well as the assets of individual users who command their own data on-chain.

The significance of this system is two-fold. First, it empowers individual users to monetize data in ways which were previously not possible. Second, it allows for the creation of marketplaces by large-scale data aggregators which are tailored to their specific use cases. While an oracle allows consumers to purchase intact data sets from institutional producers – a decentralized finance contract purchasing asset price data from the API of a centralized exchange, for example – the Ocean Protocol allows a data aggregator to create a marketplace that assembles data from vast populations and publishes these data sets for sale to consumers. The opportunities this provides for the monetization of previously unavailable data are difficult to overstate.

For one example, Ocean has partnered with Dimitra, an agricultural technology company that gathers crop yield data from small farmers. Individual farmers are able to tokenize their data on the Ocean Marketplace and sell it to Dimitra, who in turn analyzes the industry-wide data before releasing it as a data set of its own to provide valuable information about the agricultural supply chain to people in the industry.

In this instance, small farmers around the world are able to monetize data about their farming practices to create an additional source of revenue for themselves while assisting the industry in cutting costs and increasing yield. As a service, the Ocean Protocol is ideal for use by all research organizations and data analysts and primed for integration with data provided by global IoT networks. In these and countless other ways, Ocean stands to facilitate the open exchange of information in a global data economy that already accounts for trillions of dollars a year.

Quantitative Analysis

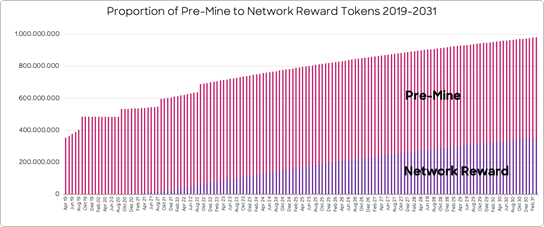

Ocean has a circulating supply of 434M with a total supply of 613M and a maximum supply of 1.4B. Its initial exchange offering was in 2019 and its tokens were distributed to a handful of different tranches, each with a different vesting schedule. While some of the discrepancy between circulating and total supply is due to its staking mechanism, the lion’s share is accounted for by these locked tokens. Most will be unlocked by Q3 of 2022, at which point all of the emissions will come from network rewards distributed to node operators and service providers.

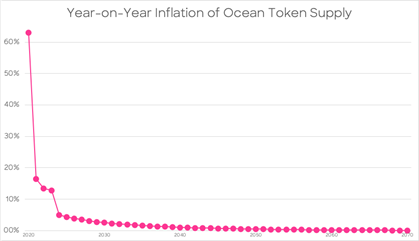

These network rewards peaked in 2021 and are scheduled with an unusually long half-life, such that 50% of network rewards will not be distributed until 2031. What this means is that the majority of token inflation has already occurred and what remains will occur at a very low rate over a very long period of time. Network rewards are released over a 50-year period and the maximum supply of 1.4B will not be in circulation until 2070.

The founders of the Ocean Protocol are veterans in the blockchain space and have specifically designed their tokenomics to result in growth unhampered by inflation which is commensurate with the adoption of their product. Simply put, any inflation due to token distribution will be completed within the next six months, and inflation will decline to 5% by 2024. Diagrams are included here to illustrate token emissions and token inflation rate, but it suffices to say that there is little to fear in the way of dilution.

Price Entry / Exit

The price of Ocean has been in a descending triangle pattern for the past six months and currently sits at resistance around $0.54. If it bounces off of resistance, a good entry point would be above support at $0.41, with a stop around the previous low of $0.31. If Ocean breaks through its resistance and out of the descending triangle, it should be observed to see if its previous supply zone flips to support. In this case, an entry of $0.535 would be recommended, with a stop at $0.40.