Injective Protocol: The Next Generation DEX

By Tyshe Jiang | Crescent City Capital Market Analyst Intern

What is Injective

Injective Protocol is a decentralized exchange (DEX) platform that utilizes the technology of Injective cryptography to provide a secure and decentralized trading platform. The protocol is built on top of the Cosmos SDK, which allows for the creation of sovereign blockchains that can communicate with each other via a decentralized inter-chain messaging system. Injective Labs debuted its first project as the first fully decentralized exchange protocol in DeFi in April 2020.

Nowadays, decentralized exchanges allow people to trade in a completely permissionless and decentralized way, but also they are slow and expensive to use. Then, Injective Labs would like to find a solution and build a decentralized exchange that is not only fast and cheap but also interoperable to trade spot markets and even people’s own derivatives. Therefore, the goal of Injective Protocol is to provide a decentralized trading platform that is fast, secure, and transparent. The platform uses a novel approach to trading by creating synthetic assets that are backed by real-world assets. This allows for the trading of assets that might not be available on other platforms, such as futures contracts and derivatives.

Injective Protocol Exchange Structure

The objective of Injective Protocol is to reduce obstacles to entry to decentralized finance (DeFi) markets, eliminate gas costs while keeping fast transaction speeds, and give everyone a distinctively decentralized and infinite trading experience. Injective Protocol offers many critical aspects to accomplish this robust functionality:

One of the key features of Injective Protocol is its use of decentralized order books. This means that users can create and execute trades without relying on a central authority. Instead, the platform uses a decentralized network of validators to process transactions and maintain the integrity of the order book.

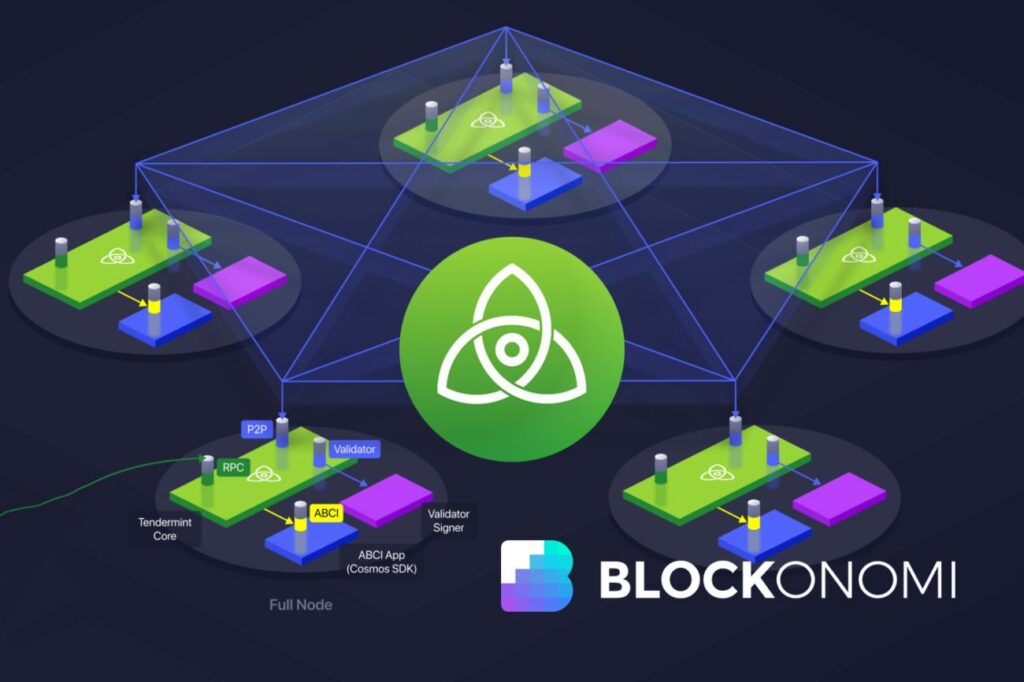

The Injective Chain, built on the Cosmos Tendermint standard, is a completely decentralized sidechain relayer service that serves as a Layer-2 derivatives platform, trade execution coordinator (TEC), and decentralized order book. Injective provides unrestricted access to a cross-chain decentralized derivatives marketplace. Meanwhile, the Injective Chain also employs a two-way peg for Ethereum (ETH). It has a decentralized application execution framework that is Ethereum Virtual Machine (EVM) compatible (dApps). The Cosmos Gravity Bridge, which allows for the movement of value between the Cosmos Hub and Ethereum, serves as the foundation for Injective’s peg-zone design, while the EVM execution framework is built on Tendermint’s Ethermint EVM implementation. This allows for strong cross-chain interoperability and liquidity.

Injective Protocol Smart Contracts

There are five types of Ethereum-based smart contracts:

Injective Coordinator Contracts make the platform easier to use both Injective’s derivative transactions on Ethereum and the Injective Chain. Staking contracts are intended to handle the essential functionality for Injective Protocol stakeholders via rewards, slashing, delegation, and governance methods. Injective Futures contracts are smart contracts that enable traders to develop, execute, and employ decentralized everlasting swaps on any market of their choosing. Smart contracts that handle the two-way peg between Ethereum and the Injective Chain are known as injective bridge contracts. Injective token contracts are ERC-20 contracts that are developed for the many applications of the INJ token.

INJ Token

The INJ token is the native utility token of the Injective Protocol platform. It serves several key functions within the ecosystem, including First, INJ token holders have the ability to vote on platform proposals and governance decisions. This includes proposals related to network upgrades, fee changes, and other important decisions. Second, validators are required to stake INJ tokens in order to participate in the network. This incentivizes them to act honestly and to work towards the best interests of the platform. Then, INJ tokens are used to pay transaction fees on the platform. These fees are used to incentivize validators to process transactions and maintain the integrity of the network. Last but not least, INJ tokens can also be used for liquidity mining on the platform. This involves providing liquidity to certain trading pairs on the platform in exchange for rewards in INJ tokens.

Recent Updates

The INJ price on April 5th is $5.54 USD with a 24-hour trading volume of $58,387,077 USD. It has a circulating supply of 80,005,555 INJ coins and a max. supply of 100,000,000 INJ coins.

On April 2nd, Injective releases Liquid Staking with stride. stINJ (the official liquid-staked form of INJ) was made possible by Stride, a specialized app chain for liquid staking. Users may access considerably more liquidity and yield-creation possibilities across the Injective ecosystem with stINJ. Injective stakeholders will get an exclusive Stride (STRD) airdrop, allowing the community to participate in controlling the Stride DAO, which assisted in the creation of stINJ. From this, Liquid Staking improves capital efficiency and maximizes yield for users, in addition to allowing users to earn passive income through staking.

Summary

It is remarkable that centralized exchanges have been the heart of crypto markets in an industry established on decentralization, freedom, and anonymity. Several exchanges’ coin custody methods are unclear, certain platforms are vulnerable to identity theft, and there are frequent server outages, allegations of insider trading, and exorbitant fees that harm small traders. To circumvent these constraints, Injective Labs has been working on an exchange that prioritizes decentralization. This implies that customers no longer have to furnish KYC data, transfer custody of their funds to another platform, or pay extra fees. Right now, the regulatory environment for cryptocurrencies is still evolving, which could potentially lead to regulatory risks for the INJ token and the platform as a whole.

References:

https://www.gemini.com/cryptopedia/injective-protocol-layer-2-decentralized-exchange-dex

https://coinmarketcap.com/currencies/injective/