Arbitrum(ARB): Scaling Ethereum

By Tyshe Jiang | Crescent City Capital Market Analyst Intern

What is Arbitrum

Arbitrum is a layer-2 scaling solution for Ethereum that aims to improve the network’s transaction speed and reduce fees. It is built using optimistic rollups called Arbitrum Rollup, which are a type of Layer-2 scaling solution that bundles multiple transactions into a single batch, resulting in faster transaction processing and lower gas fees. Arbitrum was created in 2021 by Offchain Labs, a blockchain company that is focused on building scalable and secure blockchain solutions.

Ethereum is decentralized and stable, and it allows smart contracts written in a programming language that many crypto developers use. Meanwhile, it is home to a thriving decentralized finance industry. It is, however, quite restricted. The Ethereum blockchain only supports roughly 20-40 transactions per second (TPS); if this limit is reached, users are forced to fight with one another for their transactions to be included, which raises costs.

Arbitrum’s Optimistic Rollups

Arbitrum Rollup chains operate as a sub-module within Ethereum. Unlike conventional, Layer 1 Ethereum transactions, the platform do not need Ethereum nodes to execute every Arbitrum transaction; instead, Ethereum treats Arbitrum as “innocent until proven guilty.” Layer 1 “optimistically presume” that activity on Arbitrum is obeying the regulations. If a violation happens, the claim may be contested on L1; fraud will be shown, the invalid claim will be ignored, and the malicious party will be monetarily fined. Through this Arbitrum races ahead at 40,000 TPS. Transactions cost several dollars to complete on Ethereum, while they cost about two cents on Arbitrum.

The most significant distinction between Arbitrum and Optimism is how the system settles disputes on Layer 2. Both projects are optimistic rollups that employ a challenge system that allows any validator to contest a block on the chain. This is where the two projects’ technologies diverge. Optimism re-executes the disputed transaction on Layer 1 and determines whether the party is correct.

However, the Arbitrum team recognized that this method might greatly contribute to network congestion. Optimism must provide a huge quantity of data to Layer 1 in order to compute and settle the disputed transaction. Instead, Arbitrum subdivides the challenge indefinitely until the disputed information is so little that it can be promptly conveyed to and resolved on Layer 1. Because they both employ optimistic rollups, they both demand some faith in the validators. Arbitrum’s bridge between Layers 1 and 2 will presume the transaction is legal if all validators for a dApp collaborate in a malicious attack and no one disputes it.

Arbitrum Nova

Arbitrum consists of two separate networks —— Arbitrum One and Arbitrum Nova. They are based on different technologies.

In August 2022, Arbitrum launched Nova, which is a new chain-based on AnyTrust technology and aimed to grow the Ethereum blockchain. Different from Arbitrum One chain, it was constructed with Offchain Labs’ Rollup technology. Arbitrum Nova lowers the costs more than Arbitrum One, making it one of the most cost-effective blockchains in operation. Its major role is to facilitate high-throughput DApps, particularly those focused on gaming.

Unlike Arbitrum One, transaction data is forwarded to the data availability Committee (DAC), and only data availability certificates — not entire transaction data — are sent to the L1. Because the DAC is mandated to offer data availability to end users, Arbitrum Nova is arguably more centralized than Arbitrum One. The DAC currently has only a few members, including Infura, Offchain Labs, Google Cloud, and Reddit. Arbitrum Nova, in brief, adds various trust assumptions in order to reduce expenses.

ARB Token

Arbitrum decided to airdrop its new ARB token on March 23, 2023, allowing holders to vote on protocol decisions. Arbitrum is therefore completing its long-awaited move to a DAO (decentralized autonomous organization). In total, 12.75% of the ARB token supply would be airdropped to different Arbitrum ecosystem early players and DAOs. The average airdrop quantity is 1,250 tokens. Other users may earn far more, with over 4,000 addresses set to receive 10,250 ARB tokens per address.

The Arbitrum DAO will employ the ARB token for governance. Token holders will be able to vote on decentralized governance choices that will be enacted on-chain once passed. The voting procedure will take between 21 and 37 days before the proposal may be passed and implemented.

Recent Updates

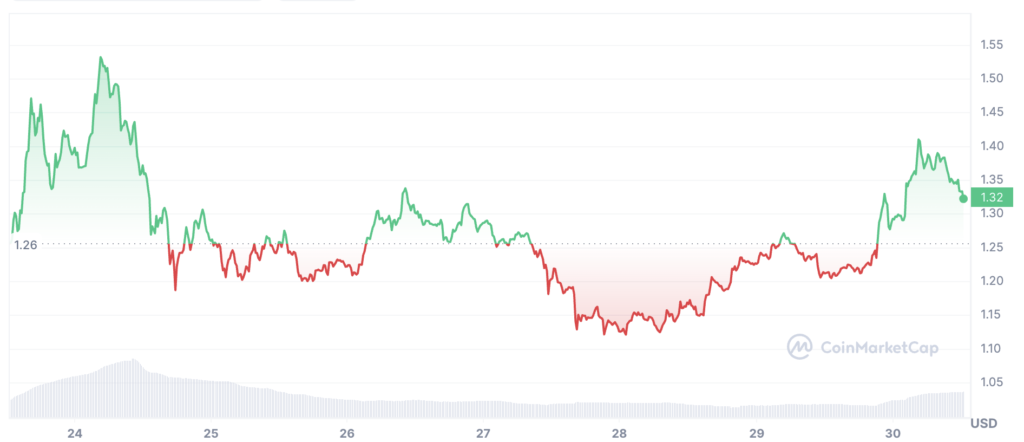

The Arbitrum price on March 30th is $1.36 USD with a 24-hour trading volume of $1,664,265,878 USD. It has a circulating supply of 1,275,000,000 ARB coins.

Summary

Arbitrum is a Layer-2 scaling solution that improves Ethereum’s scalability by bundling transactions together, which increases the network’s throughput and reduces transaction fees. Meanwhile, Arbitrum uses optimistic rollups, which are a secure and trustless way to scale Ethereum. This means that users can be confident that their transactions are secure and that the network is resistant to attacks. However, there are some aspects that needed to consider. First, if users are withdrawing directly from Arbitrum to Ethereum, they must typically wait 1 week before receiving their funds on L1. Users can use fast-bridge applications, but these platforms could not ensure security. Meanwhile, Arbitrum has many competitors such as Polygon and Optimism. Polygon is a Layer-2 scaling solution that uses sidechains to improve Ethereum’s scalability. It offers fast and cheap transactions and supports the deployment of decentralized applications.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. Please conduct your own due diligence before making any investment decisions.

References:

https://coinmarketcap.com/currencies/arbitrum/

https://decrypt.co/resources/what-is-arbitrum-speeding-up-ethereum-using-optimistic-rollups

https://coinmarketcap.com/alexandria/article/what-is-arbitrum