Equity Markets and Bitcoin

By Louis Lustenberger – Crescent City Capital Market Analyst Intern

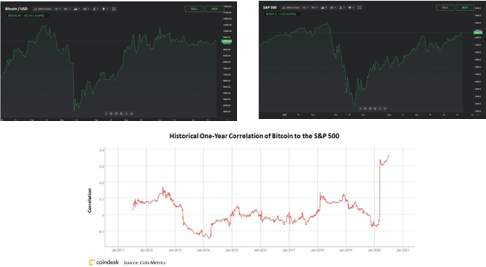

Since the Fed’s aggressive expansionary monetary policy, Bitcoin has seen continued growth, and equity prices have soared. In late September of 2020, Bitcoin fell in tandem with the S&P 500 as renewed coronavirus fears and uncertainty over the 2020 U.S. election caused sharp losses in the equity markets. According to a report by Skew, these trends indicate a much stronger short-term correlation as levels of investor uncertainty and expected volatility remain high.

In July of 2020, the one-year correlation between BTC and the S&P reached 0.367. That same month, the one-month correlation between the two reached a multi-year high of 0.79. In mid-September, the S&P 500 hit an all-time high, and the total market capitalization of the crypto market also posted a high. Kevin Kelly, a former equity analyst at Bloomberg, believes more consistent correlations will occur as the cryptocurrency space matures.

Sources

https://www.coindesk.com/bitcoin-reaches-record-high-correlation-to-sp-500

https://currency.com/why-bitcoin-correlations-with-the-s-p-500-are-worrying-right-now

https://www.coindesk.com/equity-markets-turmoil-could-push-bitcoin-below-10k-say-analysts