Algorand(ALGO): The Future of Finance?

By Andy Wang | Crescent City Capital Market Analyst Intern

What Is Algorand?

Algorand is a pioneering decentralized network, conceived by MIT professor and computer scientist Silvio Micali. Launched in June 2019, it addresses the Blockchain Trilemma by effectively balancing speed, security, and decentralization. This permissionless and open-source blockchain network welcomes anyone to build upon it, focusing predominantly on payment processing with exceptional efficiency.

Key to its design is the Proof-of-Stake (PoS) consensus mechanism, where ALGO, its native cryptocurrency, plays a central role. Holders of ALGO are rewarded, underlining Algorand’s commitment to equitable community participation and incentive distribution. With the capability to process over 1,000 transactions per second and finalizing transactions in under five seconds, Algorand stands out for its high throughput, essential for widespread global adoption and various applications.

Algorand emerges as a viable alternative to Ethereum, especially for decentralized application (dApp) developers and DeFi traders seeking solutions to Ethereum’s rising gas fees. Its capacity to host dApp development and provide scalability makes it a strong contender in the blockchain space.

The platform also introduces the Algorand Standard Asset (ASA) protocol, allowing the creation and integration of new tokens, including popular stablecoins like USDT and USDC, into its ecosystem. These tokens benefit from Algorand’s higher throughput and lower transaction fees compared to Ethereum. Recognizing its potential, Algorand has been selected to host the Marshall Islands’ Central Bank Digital Currency (CBDC), marking its significance in the financial technology landscape.

Algorand’s architecture encompasses high-performance layer 1 blockchains, offering robust security, scalability, and transaction finality. These layer 1 solutions enhance the core protocol, including consensus protocol changes and sharding, to improve system scalability.

Managed by the Algorand Foundation, this blockchain is accessible to businesses and individuals alike. Its development priorities include performance, interoperability, scaling, and both layer-2 smart contracts and public-private models. Algorand also addresses payment scalability and off-chain computing through layer-2 scaling solutions. Notably, it assures the integrity of transactions even amidst malicious activities and network issues, a significant advancement over existing cryptocurrencies that experience temporary forks and longer transaction verification times.

How Algorand Works?

Since 2020, Algorand has introduced a dual-layer smart contract system that differs significantly from previous models. This system includes:

- Layer 1 (On-Chain): This layer is dedicated to executing straightforward and common transactions directly on the blockchain. An example of this is atomic transfers, which involve multiple parties agreeing to exchange funds on the blockchain.

- Layer 2 (Off-Chain): This layer caters to smart contracts that need advanced tools due to their size, complexity, or computational demands. Essentially, smart contracts that are too large, intricate, or require extensive processing are handled off the blockchain.

In essence, Algorand’s architecture allows simpler smart contracts to be run on the blockchain, while more complex ones that require additional processing time are executed off the blockchain. This two-tiered approach enables Algorand to achieve higher efficiency compared to traditional single-layer blockchain systems.

For transaction validation, Algorand uses a pure proof-of-stake protocol. This system allows any holder of at least 1 ALGO to stake their tokens and participate in the validation process. The protocol randomly selects participants to confirm transaction blocks, with the selection probability proportional to the number of ALGO tokens staked. Participants who contribute to validating transactions are rewarded for their involvement.

What Makes Algorand Unique?

Algorand distinguishes itself not so much by unique functionalities but through its enhanced performance in areas common to programmable blockchains like Ethereum. It supports smart contract execution, decentralized app (dApp) development, and cryptocurrency token creation, similar to other blockchains, but with notable improvements:

- Scalability and Efficiency: Algorand is engineered for scalability, utilizing a modified proof-of-stake consensus mechanism that enables efficient transaction processing. This design allows for impressive transaction speeds of around 1,000 transactions per second.

- Developer Accessibility: The blockchain is highly accommodating for developers, supporting a wide array of programming languages. The Algorand website lists support for Java, JavaScript (both node.js and browser), Go, Python SDKs, REST APIs, and several community SDKs including Rust, Swift, PHP, Dart, C#, and more.

- Reliability and Stability: Since its inception, Algorand has maintained a record of zero downtime, an achievement that stands out in the blockchain space. This contrasts with other blockchains like Solana, which have experienced multiple outages.

- Consistency in Ledger Management: Algorand’s blockchain is designed to never fork, meaning its ledger does not split into different paths when adding new blocks. This feature ensures the unity of the Algorand project and eliminates the risk of double-spending on its blockchain.

Algorand’s PPoS Mechanism:

Algorand implements a distinctive form of Proof of Stake known as Pure Proof of Stake (PPoS). This version of PoS is exceptionally inclusive, featuring a minimal staking threshold for users to join and help secure the network — participation requires just a single ALGO token. This is in stark contrast to Ethereum 2.0, which demands a minimum of 32 ether (ETH) for staking, creating a significantly higher entry barrier. However, this lower staking requirement in Algorand could potentially impact network security, as participants might have less motivation to maintain optimal network behavior if their staked value is relatively low.

Recent Market Recap:

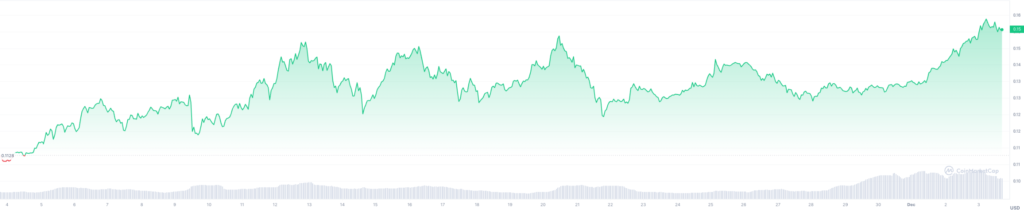

Looking at ALGO’s recent monthly movement, the road was bumpy but the price ultimately was in an upward trend. Perhaps, let’s combine its historical movement and the 2023 movement.

ALGO reached its all-time-high of $3.28 shortly after launching on 21 June 2019, and raised $122,400,000, making it one of the best presales at the time. The price then dropped significantly, reaching lows of $0.01263 on 17 March 2020. However, as the 2021 crypto bull market picked up momentum, ALGO pumped, reaching $2.3811 on 13 September 2021. Since then, the price has significantly sold off, partly due to the SEC classifying ALGO as a security in some of its recent lawsuits.

Another factor that damaged ALGO’s price was that its biggest DeFi application, Algofi, shut down due to a string of adverse events, rendering it unable to perform to its expected standard. The dApp held over 50% of the value within the Algorand ecosystem, massively impacting Algorand’s growth.

The Algorand price on the date of December 3rd, 2023 is $0.150377 USD with a 24-hour trading volume of $124,504,175 USD. Algorand is up 2.07% in the last 24 hours. The current CoinMarketCap ranking is #52, with a live market cap of $1,203,935,337 USD. It has a circulating supply of 8,006,099,073 ALGO coins and a max. supply of 10,000,000,000 ALGO coins.

While the Algorand price has undoubtedly caused difficulties for holders, it also opens the possibility of massive upside potential if it recovers.

Future Forecast With Fundamental Analysis:

Shifting our focus to a more fundamental point of view, Algorand is a quality blockchain project, and it’s easy to see why it has built a passionate following in the crypto community.

The protocol is designed for high performance and delivers with fast transactions and low fees. There’s a very knowledgeable team behind it, headed by Micali, which gives it credibility. Since it supports so many programming languages, it’s easy for developers to use.

There aren’t any glaring weaknesses with Algorand, but it has strong competition from a number of smart contract blockchains. Scalability has also become a point of focus among these projects, so Algorand no longer has an advantage there.

Here we have to bring up the blockchain trilemma. It is a concept that highlights the difficulty in achieving optimal levels of decentralization, security, and scalability in blockchain networks. Traditionally, it has been believed that a blockchain platform can only achieve two of these three goals concurrently. However, Algorand’s unique consensus algorithm and network architecture enable it to successfully reconcile all three properties simultaneously.

Algorand’s solution to the blockchain trilemma has garnered a positive response from the crypto community, as its consensus method is regarded as decentralized, scalable, and secure, making it a viable technology in the blockchain space. By addressing the blockchain trilemma head-on, Algorand is poised to become a major player in the future of finance and a disruptive force in the blockchain industry.

For example, Algorand was notable for being able to process 1,000 transactions per second, much higher than Ethereum’s 30 transactions per second. But, unfortunately Ethereum is upgrading and will reportedly be able to process up to 100,000 transactions per second. Solana is estimated to handle up to 65,000, although it has dealt with frequent outages. Therefore, that’s the risk we will have to take into account.

Another thing I have to point out is Algorand’s partnerships. Thanks to Algorand’s scalability and user-friendliness, it has fostered collaborations with diverse industries. For instance, Circle, the company behind USD Coin, leverages Algorand for seamless fund transfers between banks, card networks, and digital dollars. The Republic of the Marshall Islands, pioneering a national digital currency, selected Algorand for its infrastructure, also collaborating with Koibanx in August 2021 for blockchain development in El Salvador. In the entertainment sector, Xfinite is utilizing Algorand for its cryptocurrency token and decentralized apps. ClimateTrade, a Spanish firm focused on sustainability, chose Algorand’s blockchain to monitor carbon credits. Additionally, Watr, a Swiss-based supply chain ecosystem for commodities, partnered with Algorand, designating its protocol as the first public instance of the Algorand mainnet. These partnerships highlight Algorand’s broad applicability and growing influence in various sectors.

On its website, Algorand describes itself as “the future of finance.” It’s no wonder that Algorand has become such a hot name, with a core team focused on creating the greatest technology possible in the DeFi and NFT space as well as some of the most coveted partnership lists out there.

Algorand, led by one of the world’s finest living cryptographers, seems to be the most definite contender to lead the smart contract race in the world of Ethereum, Cardano, Polkadot and various other blockchains.

The future of Algorand blockchain depends upon the amount of effort that the team will put forward to make it distinctive from competitors and its ability to solve current blockchain challenges.

In a nutshell, with its strong partnership and development team, being able to address the trilemma simultaneously, despite some downsides and adverse news, now is a good time to bid and buy.

Reference:

https://www.algorand.foundation/

https://www.investopedia.com/algorand-algo-definition-5217725

https://developer.algorand.org/docs/get-details/algorand_consensus/

https://algorandtechnologies.com/

https://coinmarketcap.com/currencies/algorand/

https://kriptomat.io/cryptocurrencies/algorand/what-is-algorand/#Who_Are_the_Founders_of_Algorand

https://cointelegraph.com/learn/five-major-challenges-in-the-blockchain-industry