The Case for Solana

By Cameron Tuths

The Solana ecosystem ($SOL) is a rapidly growing decentralized blockchain network that allows for incredibly fast and cheap transactions at a time when Defi companies are vigorously fighting for market share. The Solana network has seen a suite of new projects being built on the platform in recent months and aims to claim a larger portion of the growing crypto network as the Defi economy expands. Solana is a highly functional open source project that relies on blockchain technology’s permissionless nature to provide decentralized finance (DeFi) solutions. The idea and preliminary work on the project began in 2017, yet Solana wasn’t officially launched until March 2020.

“The Solana protocol is designed to facilitate decentralized app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the blockchain’s underlying proof-of-stake (PoS) consensus.

Because of the innovative hybrid consensus model, Solana enjoys interest from small-time traders and institutional traders alike. A significant focus for the Solana Foundation is to make decentralized finance accessible on a larger scale.”

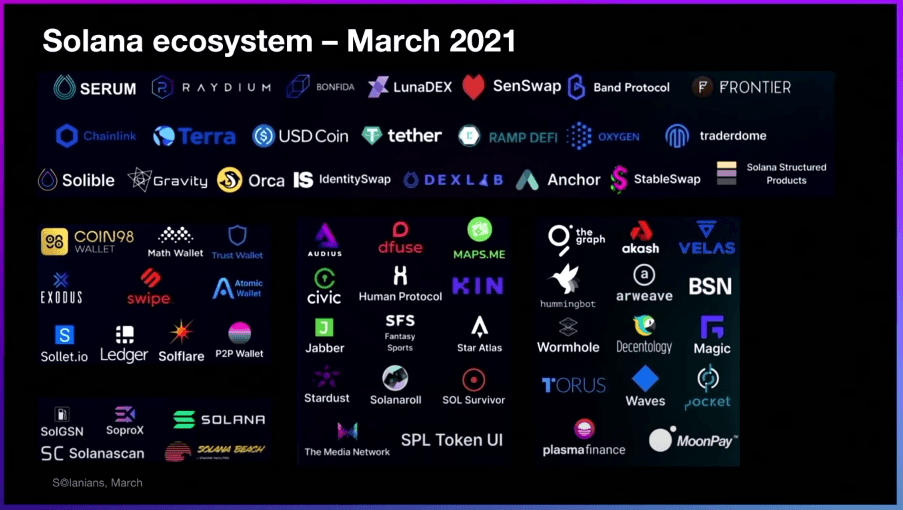

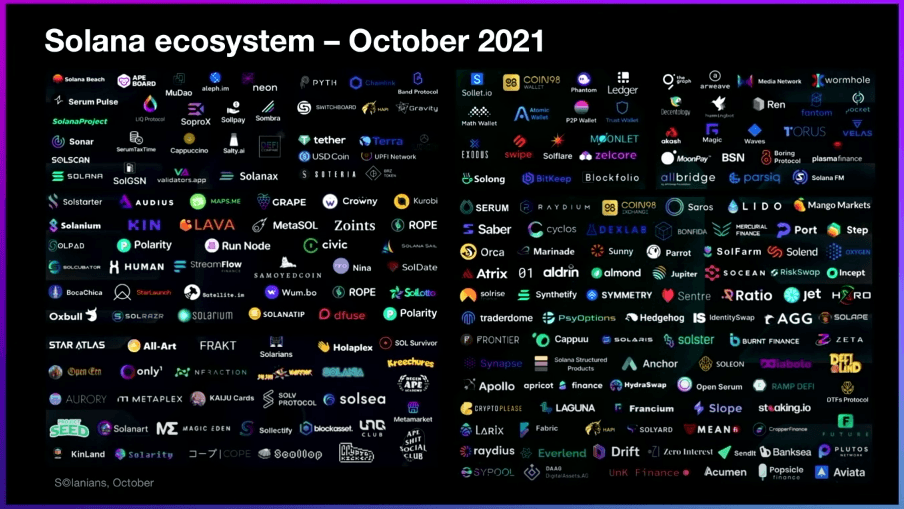

Solana is the fastest growing blockchain ecosystem globally, with the graphic above showing how the platform was able to transform from 70 projects to over 5,000 projects currently riding on the Solana chain. To understand why Solana is experiencing this historic surge, you have to compare SOL to its biggest competitor, ETH.

At the moment, ETH can process between 15 and 45 transactions per second, but that is expected to change drastically with the introduction of the Etherium 2.0 network update. An upgrade to ETH 2.0 is expected to roll out sometime in 2022; the hope is that their speed could increase to as much as 100,000 transactions per second. This transition is incredibly complex and far from a sure thing, while Solana is at peak speeds for the industry at 50,000 transactions/second already. By comparison, Visa is reportedly able to do 1,700 transactions per second, highlighting one of blockchain’s technological advantages over today’s means of commerce. The Achilles heel for Etherium has been soaring gas fees, which has resulted in an average transaction fee of $36.40 at the time of publishing (which can fluctuate greatly depending on transaction value). Fortunately, a successful launch of ETH 2.0 is expected to drop fees closer to where Solana is currently.

Solana (SOL): Solana boasts fast transaction times and minimal fees by utilizing both proof of stake and proof of history. They can handle as many as 50,000 transactions per second, and each one has an average cost of only $0.00025. The blockchain has a market cap of $28,090,353,742, making it the 8th largest chain to date. The Solana Foundation has announced that a total of 489 million SOL tokens will be released in circulation. At the moment, about 260 million of these have already entered the market.

The SOL token distribution is as follows: 16.23% went towards an initial seed sale, 12.92% of tokens were dedicated to a founding sale, 12.79% of SOL coins were distributed among team members, and 10.46% of tokens were given to the Solana Foundation. The remaining tokens were already released for public and private sales or are still to be released to the market. Solana has an average daily trading volume of $1.18 billion with a current inflation rate of around 6.5%. Solana has staking rewards that are set to decrease over time with a burn rate that is expected to increase over time, equating to Solana eventually becoming deflationary in an estimated eight years from today. Currently, Solana can be staked at 8% APY. This platform has also seen incredible interest from Private equity investors such as Andrezen Horowitz, who, in addition to other firms, has given the Solana blockchain over $400 million with its DApps such as the Phantom wallet, also raising over $100 million independently.

Since mid-July, when SOL became tradable, Solana has seen incredible growth upon announcing the launch of the Degenerate Ape NFT collection, as well as plans to incorporate future NFT gaming developments on its chain. Since SOL hit a high of $260, a collection of outages has caused the price to fall substantially to a current price of $85. We expect SOL to achieve a price substantially higher than its November peak in the next bull run. In the near future, a geopolitical conflict between Russia and Ukraine, in addition to the Fed raising the federal funds rates and stoping quantitative easing, will all push market prices lower before a bull run can exceed previous highs. A rough entry point would be around $70 in late March to early May. After this low, we expect the market to rebound quickly and drastically. Timing the market is difficult, so buying in now could save you from missing the bull run later. Volatility is temporary and in historical cycles; when geopolitical issues arise in addition to a Federal tightening policy, we see a one-month reactionary bear market followed by six months of recovery and then positive growth. Solana, like all cryptocurrencies, is a long-term investment. These new technologies are not set to be fully realized in the markets for another 8-10 years, so timing an exact entry point now is futile and short-sighted.

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell these assets. You should do your own thorough research before making any investment decisions.

References:

https://coinmarketcap.com/currencies/solana/

https://ih.advfn.com/crypto/Solana-SOL/chart

https://www.coinbase.com/learn/crypto-basics/what-is-solana