Week of August 26, 2019 Market Analysis

By Crescent City Capital Team

In the broader cryptocurrency complex, the story continues to be one of widening spreads. The relative value of Bitcoin (BTCUSD) versus its two primary alternative counterparts, Litecoin (LTCUSD) and Ether (ETHUSD) has widened significantly over the last several months. We first noted this trade in late July, and it has gained momentum since then.

The Ether-Bitcoin spread (ETHBTC) fell below 0.01725 last week (~58 Ether equates the value of 1 Bitcoin). Similarly, the Litecoin-Bitcoin spread dropped to nearly 0.0065 (~154 Litecoin equates to the value of 1 Bitcoin). These moves can be seen in Charts 1 and 2 below (Source: Trading View).

Since July 1st, Ether and Litecoin has lost nearly -25.9% and -32.6% of their value relative to Bitcoin, respectively. This is especially remarkable after LTCUSD led the advance in cryptocurrencies earlier in the year, with a year-to-date price increase 89 percentage points higher than BTCUSD, as of April 6th.

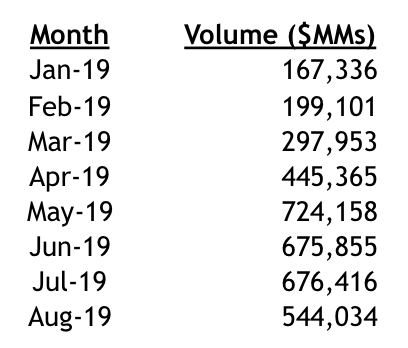

Given the precipitous decline in the alternative cryptocurrencies, its encouraging to note that BTC has held up fairly well over the last several weeks. The decline in total volume also suggests that heavy handed buyers and sellers might have been out of the market over the past month. Table 1 below shows the total volume of BTCUSD traded in the month of August 2019 (adjusted to account for two days remaining), versus the last twelve months. The month of August has seen an approximate -20% decline in volume, in USD terms, versus the three prior months, registering approximately $554 billion in trades. (Source: Coinmarket Cap).

It is not unusual for markets of any variety, crypto or otherwise, to consolidate and retrace after significant run-ups, such as that seen in the first six months of 2019; whether the moderately soft performance of BTCUSD since July 1st, and significant declines in alternative cryptos, extends into the future remains to be seen. Market dynamics are constantly changing, and some analysts have suggested that the loss in value of ETHUSD and LTCUSD relative to Bitcoin will extend. Regardless, with August’s global BTCUSD volume up 160% versus the average seen in January through March of this year, the theme of the market continuing to develop and attract new capital is intact.