“Unveiling Aevo”: A Comprehensive Analysis of a Next-Gen Decentralized Derivatives Platform

By Jenny Yao | Crescent City Capital Market Analyst Intern

Introduction Of Aveo

Aevo is a decentralized derivatives trading platform focused on options and perpetual trading. It operates on Aevo L2, a custom Ethereum rollup built using the Optimism stack. This allows Aevo to support over 5,000 transactions per second, with a cumulative trading volume exceeding $30 billion. Aevo is considered a hybrid exchange. As a layer-2 network order book-style options exchange, Aevo features unified margin functionality, and its clearing process is similar to that of a centralized exchange. Aevo operates with an off-chain order book and on-chain settlement. This means that once an order is matched, the trade is executed and settled through smart contracts. Aevo is also a hybrid business platform, offering various services such as perpetual futures and lending in addition to options. Beyond its core business, Aevo has built financial products similar to Lyra, forming a financial matrix. With the completion of its infrastructure, the on-chain options sector is gradually maturing.

Main Products Under Aveo

Aevo currently offers three main products, each designed to provide users with diverse trading options and flexible risk management.

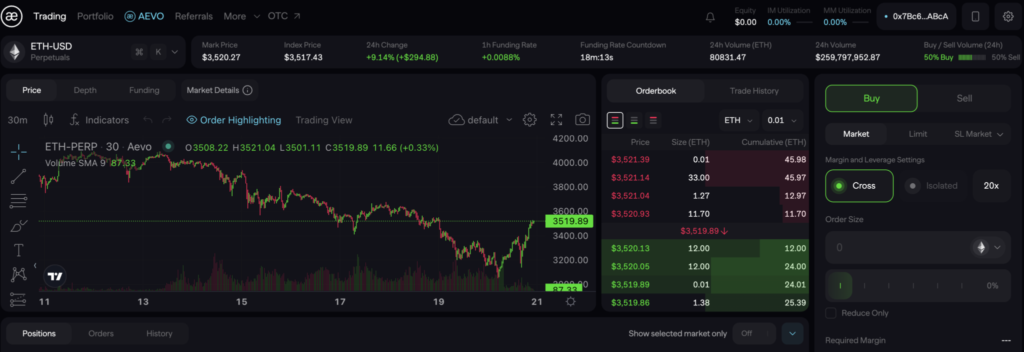

1.)Perpetual contracts

one of Aevo’s core products, allowing users to trade long or short on crypto assets with up to 20x leverage. Aevo supports perpetual contracts for various cryptocurrencies, including but not limited to BTC (Bitcoin), ETH (Ethereum), SOL (Solana), and AVAX (Avalanche).

Features: – High Leverage: Up to 20x leverage, providing users with greater capital efficiency.

– Diverse Assets:Supports a wide range of mainstream and popular crypto assets to meet the needs of different investors.

2.) Options

Aevo offers an on-chain options order book where users can buy and sell call and put options for crypto assets. These options come with various strike prices and expiration dates to accommodate different trading and investment strategies, including weekly, bi-weekly, and monthly expirations for ETH and BTC options.

Features: – Variety of Choices: A range of strike prices and expiration dates provides more strategy combinations.

– On-Chain Security: The options order book operates on-chain, ensuring transparency and security in trading.

3.) Pre-Launch Token Futures

Aevo offers futures markets for tokens that have not yet been released, allowing users to trade these tokens before they officially launch. Once the tokens go live on a centralized exchange (CEX), Pre-Launch Futures automatically convert to regular perpetual futures.

Features: – Early Trading: Users can trade before the official token release, seizing market opportunities.

– Automatic Conversion: After the token launch, Pre-Launch Futures automatically convert to perpetual futures, simplifying the process.

How Does Aveo Work?

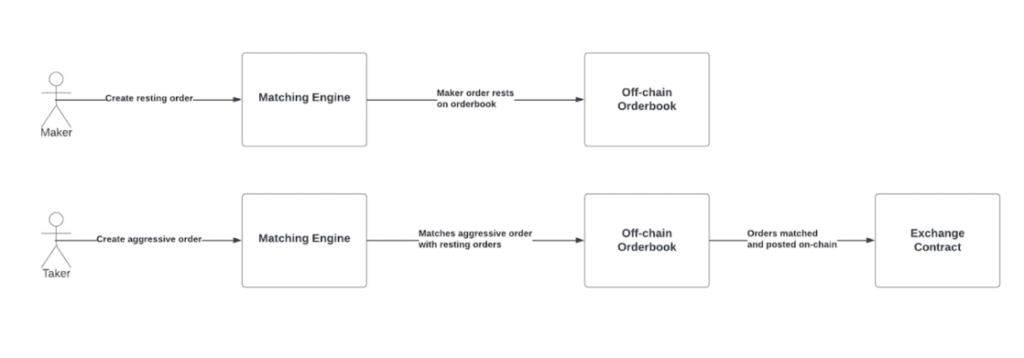

Aevo’s operations combine decentralized finance (DeFi) technology with an innovative trading framework, providing a secure and efficient platform for derivatives trading, including options and cryptocurrency futures. At its core, Aevo utilizes a sophisticated technical architecture that seamlessly integrates off-chain and on-chain elements to optimize performance and security.

Off-Chain Order Book and Risk Engine: Aevo uses an off-chain order book, allowing traders’ orders to be matched quickly without interfering with the blockchain. This system is combined with a risk engine that assesses orders based on the portfolio’s margin requirements, ensuring traders maintain sufficient collateral, thereby enhancing the platform’s security and integrity.

On-Chain Settlement: Once orders are successfully matched off-chain, they are settled on-chain within Aevo’s smart contracts. This approach combines the speed of off-chain processing with the transparency and security of blockchain settlement, ensuring efficient and transparent transactions.

Layer 2 Architecture: Aevo operates on a custom Layer 2 (L2) rollup built on the OP stack, rolling up transaction data to Ethereum. This L2 solution facilitates high-throughput, low-latency trading while inheriting Ethereum’s robust security features, ensuring the reliability and efficiency of transactions.

Liquidation: The platform’s liquidation process is designed to protect the overall health of the system and traders’ positions. When a trader’s portfolio fails to meet margin requirements, the liquidation procedure is initiated. The liquidation engine incrementally reduces positions to recover balances and, if necessary, calls on the insurance fund to cover any shortfalls, ensuring system stability and the security of users’ funds.

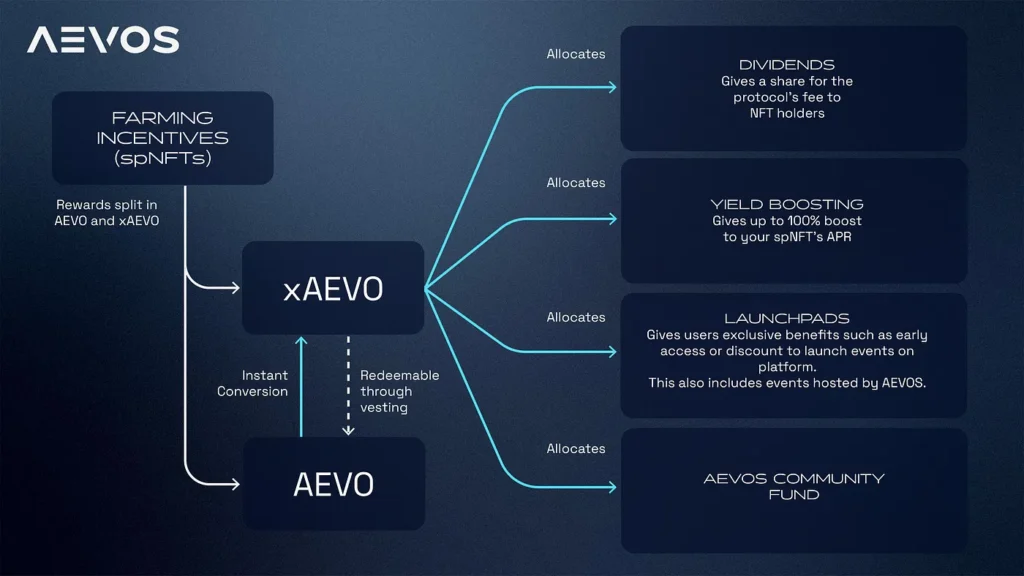

AEVO Tokenomics

Aevo was created by the same team behind Ribbon Finance, a pioneering DeFi options protocol that has processed over $10 billion in options volume through automated option vaults. Ribbon’s option vaults have reached an all-time high TVL of over $350 million and have earned more than $50 million in premiums for depositors. In late 2023, the Ribbon team decided to expand from option vaults to a full-fledged decentralized options and perpetual contracts exchange, leading to the creation and launch of Aevo.

Before $AEVO, Ribbon’s governance token was $RBN, which was widely circulated in the market. The 45% of $RBN previously held by the DAO will be exchanged 1:1 for $AEVO. The AEVO committee will manage these funds, following the RGP-33 governance proposal with the following fixed allocations:

– 16% for Rewards: Aimed at boosting user engagement and liquidity through airdrops and marketing activities, managed by the Growth and Marketing Committee.

– 9% for Token Liquidity: Ensuring stable liquidity on decentralized and centralized exchanges, managed by the Treasury and Revenue Management Committee.

– 5% for Community Development: Used for community activities and rewards to encourage active participation, overseen by the Growth and Marketing Committee.

– 16% Reserved: Kept for future DAO needs, with 2% allocated annually to Aevo project contributors.

Market Analysis

In the past 24 hours, Aevo’s price has fluctuated by +14.89%. Currently, the conversion rate of AEVO to USD is $1.04/AEVO, and Aevo’s circulating supply is 851,999,868 AEVO. Therefore, Aevo’s current market capitalization is $886,079,863. Over the last year, Aevo’s price has seen highs of $3.70 and lows of $0.80.

According to our current Aevo price prediction, the price of Aevo is expected to rise by 224.51% and reach $3.40 by July 1, 2024. Based on our technical indicators, the current sentiment is bullish while the Fear & Greed Index is showing 73 (Greed). Aevo recorded 10/30 (33%) green days with 21.71% price volatility over the last 30 days. According to the Aevo forecast, it is currently a good time to buy Aevo.

Summary

As a decentralized derivatives exchange, Aevo has rapidly emerged as a major participant in the DeFi derivatives space, possessing tremendous potential to reshape the financial landscape and bring new opportunities to investors and traders.

Looking ahead, the analysis predicts a substantial price surge for Aevo, supported by technical indicators and market sentiment. The overall sentiment in the market appears bullish, with a notable level of investor confidence reflected in the Fear & Greed Index.

Aevo’s recent performance reflects a trend of price gains on select days, indicating potential opportunities for investors. In conclusion, the analysis suggests that current market conditions may be favorable for those considering investments in Aevo, given the anticipated growth trajectory and positive sentiment.

References

https://coinedition.com/aevo-price-prediction

https://pintu.co.id/en/academy/post/what-is-aevo https://aevosprotocol.medium.com/aevoss-dual-token-structure-explained-8ffa532852d9