Ondo Finance: A Wave of RWAs Tokenization

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to Ondo Finance

Ondo Finance is a platform dedicated to tokenizing real-world assets (RWA). Ondo Finance improves the current DeFi-to-TradFi rails and offers access points to real-world assets, bringing institutional-grade products on-chain. Through innovative financial products, Ondo aims to bridge the gap between digital assets and the real economy. Ondo specializes in the US debt market and provide native access to traditional securities and associated exchange liquidity for onchain investors and protocol developers.

2. Ondo’s products: Tokenization of RWAs

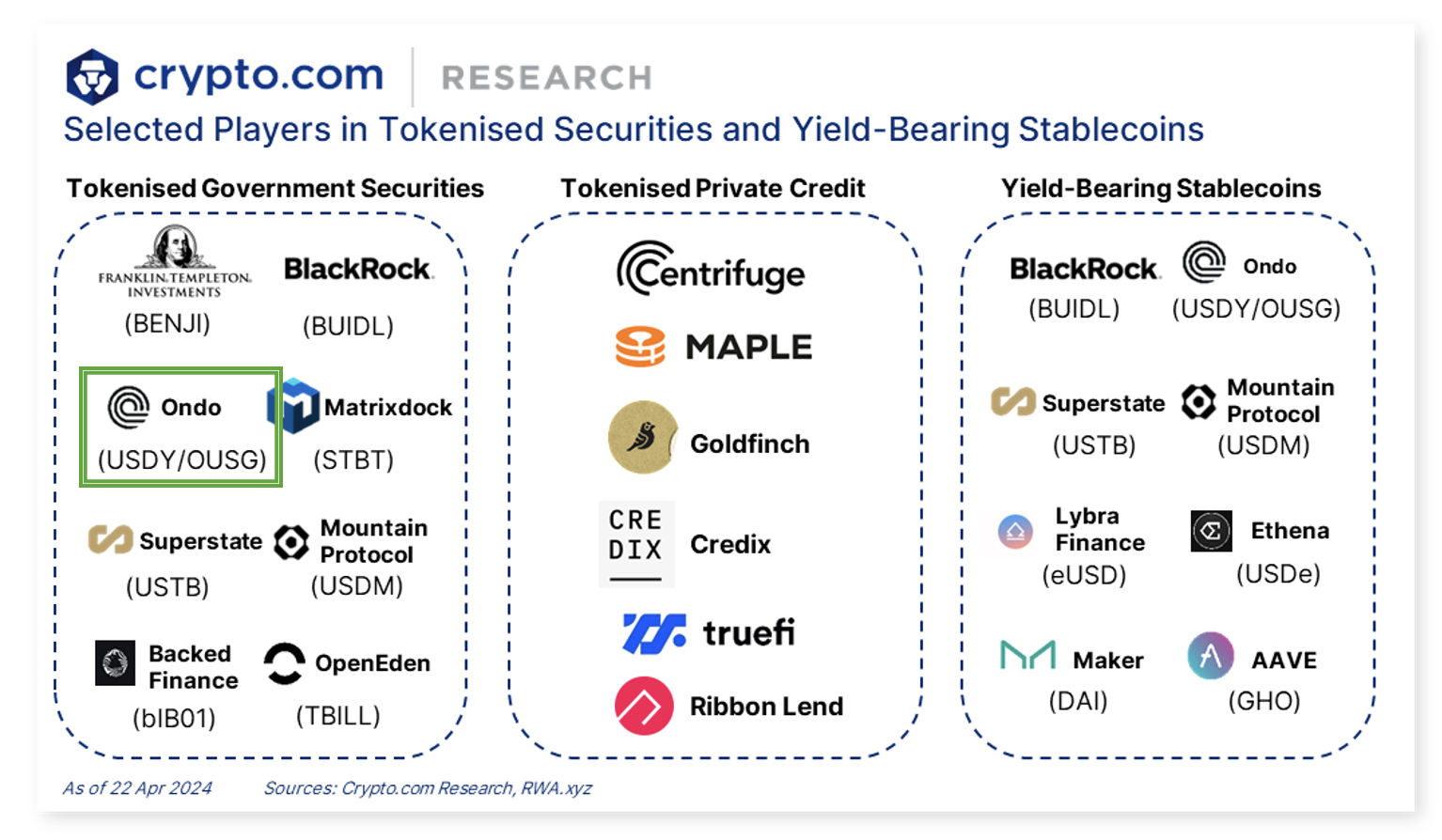

Traditional finance (TradFi) and cryptocurrency markets have historically been seen as two distinct sectors. However, in the past few years, there has been growing interest and developments spanning across the two sectors — real-world assets (RWAs) is one of them. RWAs allow for the blending of traditional finance with blockchain technology, enabling broader liquidity and innovative financial products.

Tokenization of RWAs is the process of converting these assets into digital tokens by leveraging blockchain technology. RWAs tokenization signifies a bridge between TradFi and the digital asset space.

The principle behind RWAs is that virtually any asset of value can be tokenized and transferred onto the blockchain (e.g. currencies, commodities, stocks, and bonds), making cross-border transactions more straightforward and providing investors with 24/7 access to a global assets market. This removal of geographical limitations and reduction in intermediary involvement broadens the investor base for assets. RWAs are seen as a significant market opportunity within the blockchain space, with potential valuations reaching into trillions.

At the forefront of this sector is Ondo Finance, boasting a market capitalization of $1.7 billion. Ondo Finance has already deployed several RWA products.

- Approximately one year ago Ondo launched OUSG (Ondo Short-Term US Government Treasuries), the world’s first tokenized US Treasuries product, which wrapped a BlackRock Treasuries ETF. Investing in US Treasury bills is an ultra low-risk investment option that delivers a stable return while offering deep liquidity. US Treasury bills are widely considered to be the lowest-risk and most liquid investment options available. These characteristics make them an attractive investment option for investors who are seeking safety, stability, and liquidity. Ondo launched OUSG in part out of a belief that the RWA space should focus on tokenizing assets that have deep existing liquidity as those assets would make better collateral in DeFi.

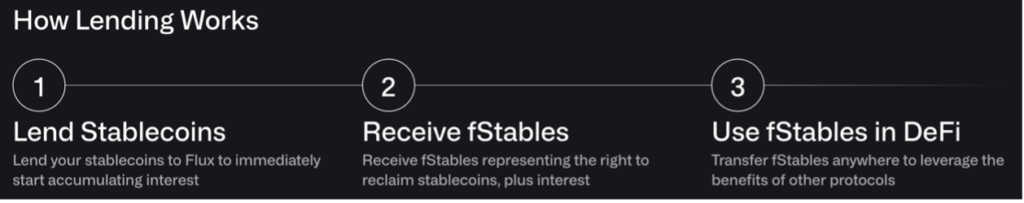

- Around the same time, they developed Flux Finance, a lending protocol supporting OUSG collateral, to showcase some of this utility. Flux is effectively an implementation of US Treasury repo markets that is autonomous, global, transparent, and accessible to all stablecoins holders. OUSG and Flux have been an early success with over $200M in combined assets.

- Ondo have since expanded to other forms of tokenized US Treasuries with slightly different target demographics and use cases, including OMMF, the tokenization of money market funds focused partly on institutional settlement, and USDY, the yield-bearing substitute for conventional stable coins.

3. Market Analysis

The live Ondo price on May 27th is $1.25 USD with a 24-hour trading volume of $243,842,651 USD. Ondo is up 2.46% in the last 24 hours. The current live market cap is $1,734,510,478 USD. It has a circulating supply of 1,389,759,838 ONDO tokens.

The Ondo price reached an all-time high of $1.31 on May 26, 2024. It came amid the U.S. Securities and Exchange Commission (SEC) approving spot Ethereum exchange-traded funds (ETFs).

Ondo price has been on a bullish streak since inception in January, with a sustained series of higher highs, which indicates an upward trend in the future. The entire RWA sector has also experienced substantial growth over the last several months. Asset tokenization is still at its inception point. While still early, the RWA space is one to watch closely as a potentially significant growth driver for crypto in the coming years.

Now in a price discovery phase, investors expect the bullish momentum to continue driving it upward. Given the vast potential, these developments may just mark the beginning of the tokenization movement within traditional finance. Despite existing market uncertainties, the token’s performance suggested that investing in ONDO is a good option.

Reference

https://coinmarketcap.com/currencies/ondo-finance

https://crypto.com/research/rwa-tokenisation-april-2024