Mantra Coin: Security First Blockchain

By Jenny Yao | Crescent City Capital Market Analyst Intern

Introduction

MANTRA is a community-governed DeFi platform focused on staking, lending, and cross-chain DeFi products. MANTRA has developed a suite of DeFi products, including a multi-asset staking platform, a money market lending protocol, a gamified lottery pool, and a stablecoin minting protocol. Currently, this suite is built on Ethereum, but there are plans to develop cross-chain products for Binance Smart Chain, Polygon, and Polkadot in the future.

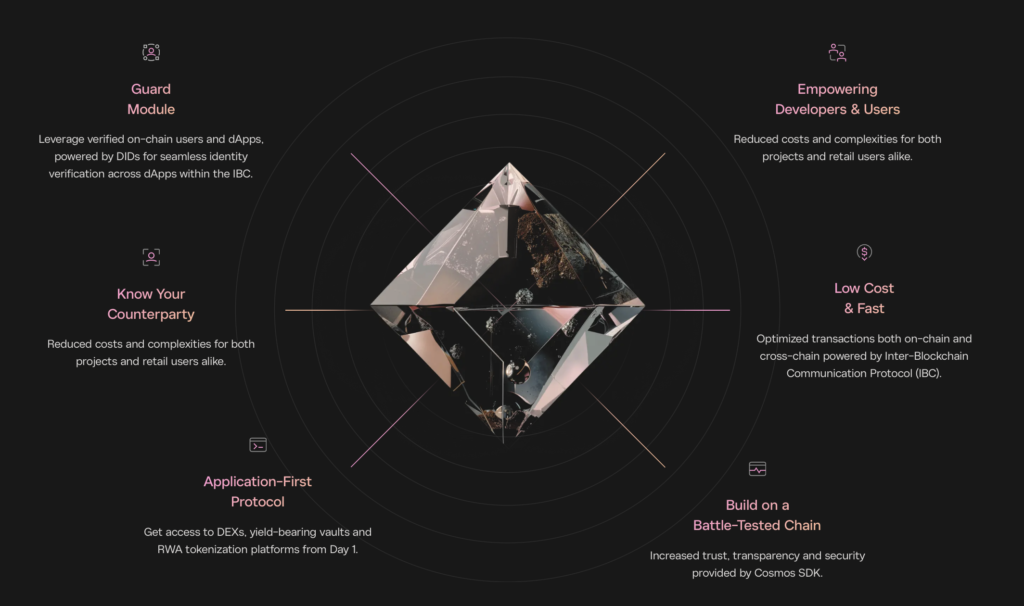

MANTRA Chain is built on the Cosmos SDK and is also working on constructing a protocol layer that supports various regulated activities. This includes on-chain identity verification, permissioned access to products, and connectivity with the fiat currency/banking world through on/off-ramps. MANTRA Chain is designed specifically for this purpose: to enable permission less Web3 application development on a high-performance, scalable blockchain architecture, while also providing a toolkit for building regulated, compliant, and permissioned applications.

Characteristics

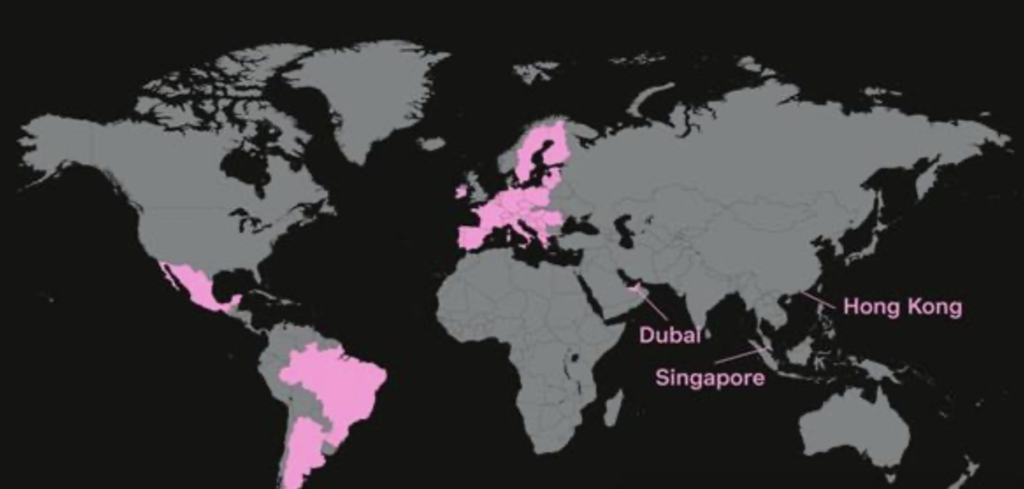

Applications built on MANTRA Chain will benefit from a compliant environment, allowing for the creation and access of regulated digital assets and the establishment of a transparent ecosystem. By securing its first financial license in the UAE, MANTRA aims to position itself at the forefront of the rapidly evolving Real World Assets (RWA) industry in the Middle East and Asia. MANTRA’s 2024 goal is to tokenize a diverse range of asset classes, including real estate, private market funds, private equity, artwork, and government bonds.

Interoperability: Tendermint is utilized as the consensus protocol to construct the first zone on the Cosmos Hub. This hub can connect to numerous other zones, like MANTRA Chain, and communicate through its IBC protocol, which functions like a blockchain’s virtual UDP or TCP. MANTRA Chain will enable the secure transfer of tokens from one zone to another via the Cosmos Hub without the need for exchanges or trusted third parties between zones.

How Does Mantra Work

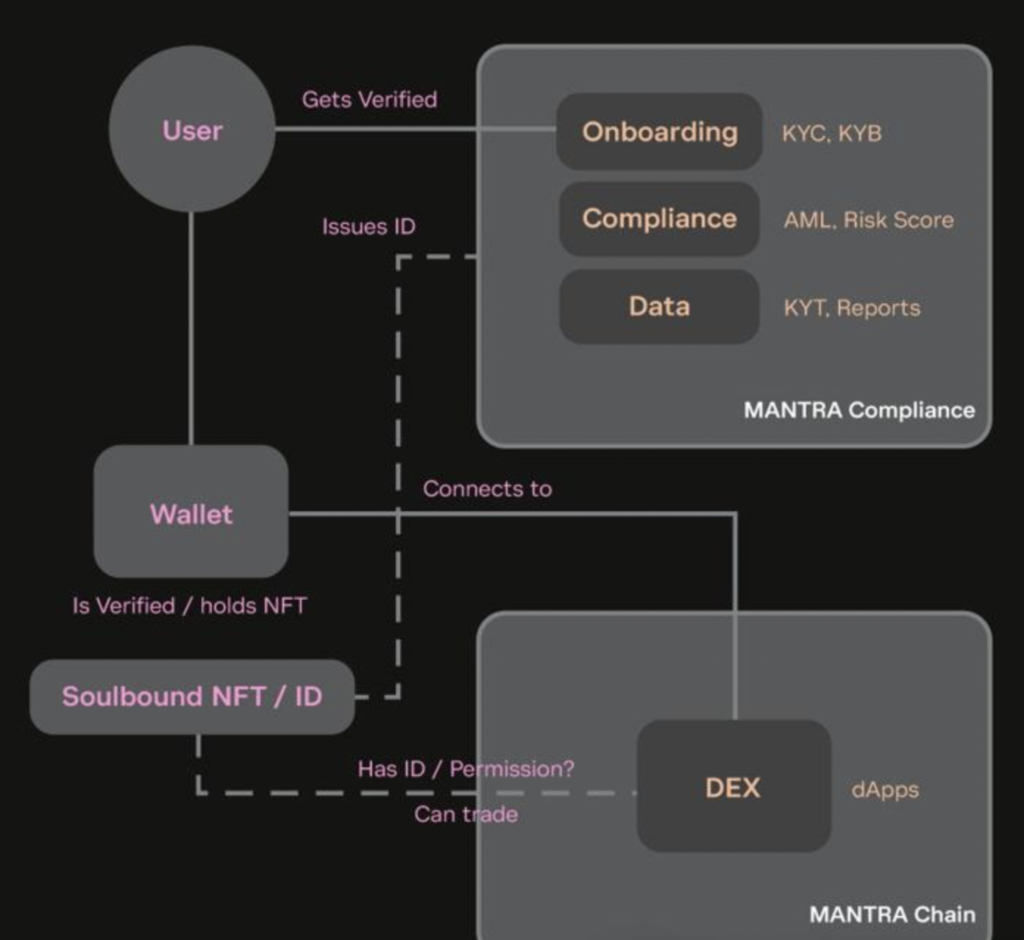

Identity and Verification:

- KYC/KYB: Know Your Customer and Know Your Business procedures.

- Business Verification (KYB): Validating businesses.

- Wallet Address Verification: Ensuring the authenticity of wallet addresses.

- Sanctions/Negative Media Lists: Screening against sanctions and adverse media.

- AML Screening: Anti-Money Laundering checks.

Reusable KYC:

- DID/Soulbound NFT: Continuous user profiles for AML checks and risk scoring.

Transaction Monitoring:

- Know Your Transaction (KYT): Monitoring transactions for compliance.

Decentralized Identity (DID) on the Blockchain:

As part of MANTRA’s compliance, the on-chain Decentralized Identity (DID) system provides a secure, efficient, and reusable way to verify individual identities to meet regulatory KYC/AML requirements. Once a user’s identity is verified, MANTRA Compliance issues a Soulbound NFT/ID.

Soulbound NFT/ID:

A unique, non-transferable token bound to a specific user’s identity, serving as proof of identity. This token can be used for various purposes, including KYC verification with third parties. By issuing a Soulbound NFT/ID, the platform ensures that personal information is not duplicated and the user’s identity is stored only once. This streamlines the KYC process, making it more convenient and efficient by eliminating the need for repeated KYC procedures.

Mantra Asset

MANTRA Assets is a user-friendly dApp that leverages the MANTRA Token Service SDK, enabling entities to issue secure tokens on the MANTRA network. The idea behind MANTRA Assets is to provide a platform where businesses, organizations, and individuals can easily launch secure tokens representing real-world assets such as securities or other financial instruments.

Through MANTRA Assets, entities can define the characteristics of their tokens, including the name, symbol, number of tokens to be issued, and the amount of dividends or royalties. MANTRA Assets also offers a range of tools to help entities manage their secure tokens, such as tracking token ownership, granting or revoking permissions, and transferring tokens to others. Additionally, MANTRA Assets can automate certain processes, like distributing dividends to token holders.

Market Analysis

Since its launch in 2020, the coin has experienced a rollercoaster of price fluctuations, illustrating the volatile nature of the crypto market. Mantra entered the market with a price point that reflected the early stages of a new cryptocurrency. Between Oct. 12, 2020, and March. 15, 2021, the price of OM went from a low of $0.01726 to a high of $0.8606, reflecting a near 5000% increase in value.It has largely stayed below the $0.2 level from December 2021 to early 2024, when it started showing remarkable resilience and growth due to the recent surge felt across the wider crypto market. Starting its ascent from a modest $0.03 in December 2023, the coin’s price trajectory saw a robust move towards $0.132 in January 2024 despite encountering resistance that led to its first substantial pullback in over a month.

The live MANTRA price today is $0.664127 USD with a 24-hour trading volume of $9,843,288 USD. MANTRA is down 2.91% in the last 24 hours. The current CoinMarketCap ranking is #116, with a live market cap of $547,878,601 USD.

Summary

This project is a compliance-focused DeFi initiative, but its progress has been very slow. Despite being in development for four years, the project has yet to produce a single AMM (Automated Market Maker). The four main products mentioned previously have yet to materialize, although the roadmap indicates that the mainnet is scheduled to launch in the second quarter of 2024. This announcement likely spiked the token price significantly.

Focused on a secure RWA Layer 1 blockchain, MANTRA has seen significant gains, leading the gainers’ chart with a 20.5% increase. This surge pushed MANTRA to a record high of $1.09 today, breaking its previous record set in April 2024, two years earlier. The recent bullish trend followed the announcement of an incentive-based multi-chain USDY vault. This collaboration between MANTRA and the Ondo Foundation allows USDC contributors to earn low-risk, short-term U.S. Treasury yields. The vault is set to open on Ethereum and Base Chain in June 2024.

While predictions vary slightly, the overall outlook suggests significant growth potential, albeit amidst the typical volatility of the crypto market.

References

https://coinmarketcap.com/currencies/mantra

https://crypto.news/mantra-om-price-prediction

https://www.coinbase.com/price/mantra-dao

https://coincodex.com/crypto/mantra-dao/https://www.ccn.com/analysis/mantra-om-price-prediction/