Ethena: Revolutionizing Stablecoins with Decentralized Innovation and High-Yield Opportunities

By Jenny Yao | Crescent City Capital Market Analyst Intern

Introduction

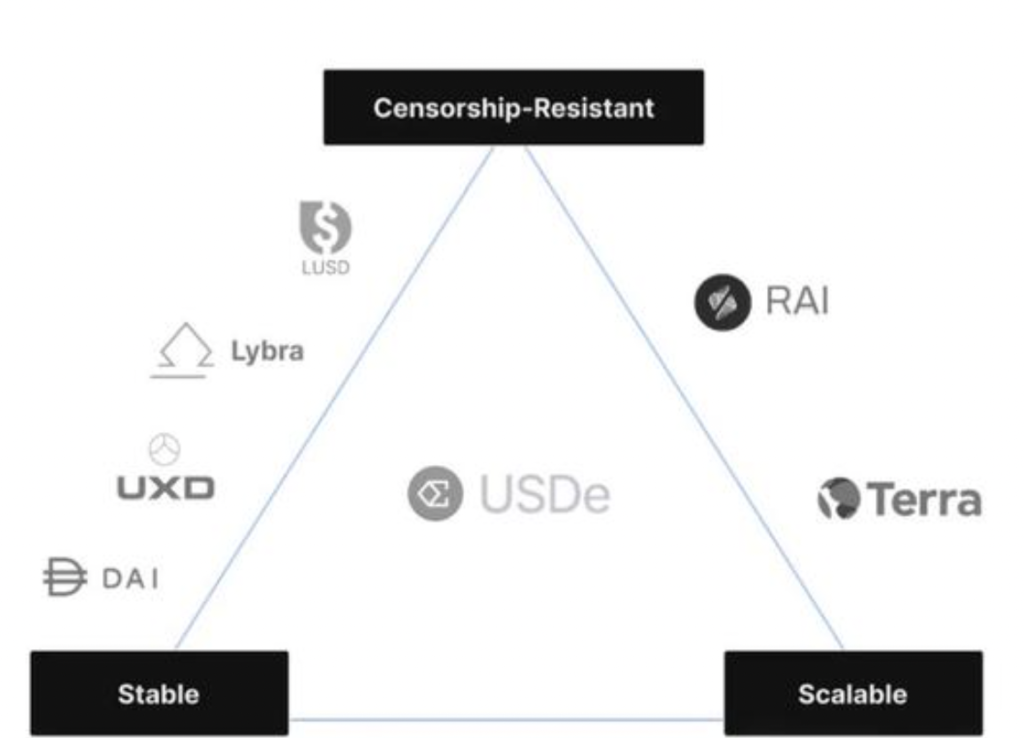

Ethena is a synthetic dollar protocol built on Ethereum, offering a crypto-native solution for currencies that do not rely on traditional banking infrastructure, as well as a globally accessible dollar-denominated savings tool—an “internet bond.” Ethena’s synthetic dollar, USDe, will provide the first censorship-resistant, scalable, and stable crypto-native solution for funds achieved through hedged staking of Ethereum collateral. USDe will be fully supported transparently on-chain and freely composable across DeFi. The stability of USDe’s peg will be ensured by using delta-hedged derivative positions to counterbalance the collateral held by the protocol. The “internet bond” will combine yields from staking Ethereum with funds and basis from perpetual and futures markets to create the first on-chain crypto-native “bond,” serving as a dollar-denominated savings tool for users in jurisdictions where permitted.

Interest in decentralized stablecoins has waned since the collapse of Terra and its associated UST and Anchor protocols in 2022. However, with the continuous development of web3, there is constant rotation and innovation between sectors. Now, the Greythorn team sees projects like Prisma, Liquity, and Lybra at the forefront of innovation in the LSD/CDP domain. Meanwhile, Maker and Curve maintain stability in terms of total value locked (TVL). Many experts are questioning whether EthenaLabs’ new project, USDe, can avoid leading investors into a situation similar to Anchor while maintaining its ~27% annual percentage yield (APY). EthenaLabs reignited DeFi enthusiasm on July 12, 2023, by announcing funding to create a dollar-pegged digital currency using LST (stETH).

Why are USDe and Stablecoins Important?

USDe is a stablecoin created by Ethena that maintains a 1:1 exchange ratio with the US dollar at all times. It aims to become a censorship-resistant, scalable base asset for use in DeFi applications, combining staking yields from Ethereum with returns from the futures market. Stablecoins have become key players in the decentralized currency market, significantly impacting market dynamics. They are a crucial component of both spot and futures market trading. On both centralized and decentralized platforms, stablecoins play an important role in facilitating trades and enhancing the stability of the crypto market, especially amid ongoing market volatility.

In the past two years, the stablecoin sector has achieved significant growth, with on-chain transaction volumes exceeding $9.4 trillion this year. Stablecoins represent two of the top five assets in DeFi, accounting for over 40% of the total value locked (TVL). They dominate trading activities, with data showing that over 90% of order book trades and more than 79% of on-chain transactions involve stablecoins. AllianceBernstein, a leading global asset management company with $725 billion in assets under management (AUM), predicts that the stablecoin market could reach $2.8 trillion by 2028. This projection indicates a substantial growth opportunity from the current market value of $138 billion, which previously peaked at $187 billion.

The growing acceptance of stablecoins and their consistent performance in both centralized and decentralized environments highlight their indispensable role in the crypto ecosystem. Optimistic estimates suggest a potential growth rate of up to 2000% in this sector, presenting significant opportunities for investors and market participants to engage with projects like EthenaLabs’ USDe. Specifically, USDe aims to meet this growing demand by providing a censorship-resistant, scalable, and stable market option.

Why Ethena?

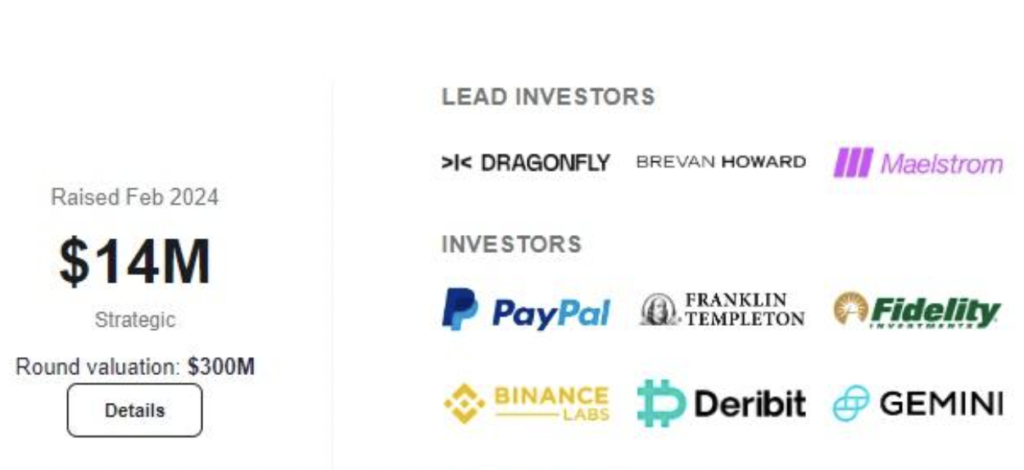

The Ethena team, under successful leadership, has completed three rounds of funding, attracting significant participation from centralized exchanges, market makers, DeFi innovators, and traditional financial institutions. This broad support underscores the project’s credibility and potential impact on the ecosystem. The team demonstrated excellent planning and coordination skills under tight deadlines, ensuring the protocol was ready for mainnet launch. They prioritized risk management and security, conducting thorough audits before release. The success of the Shard airdrop event highlighted market interest in decentralized stablecoins. Since early December 2023, the total value locked (TVL) has increased by 135 times, reaching over $410 million, marking an impressive start for the initiative.

This momentum indicates a strong demand for products like USDe, attracting significant TVL and the attention of investors who support its vision. As USDe progresses, it aims to introduce the next billion dollars in TVL to the DeFi sector, potentially opening up new opportunities similar to those seen during the Luna cycle. This raises the question: does this mark the beginning of another transformative phase in decentralized finance?

Market Analysis

After the launch of ENA, its price stabilized at $0.8 from $0.5. Stablecoins are one of the most important tools in the crypto market. All major trading pairs on centralized and decentralized platforms’ spot and futures markets are priced in stablecoins, with over 90% of order trades and more than 70% of on-chain settlements priced in stablecoins. USDT is currently the most widely used stablecoin, with a market cap of $100 billion. However, its centralization has been criticized and is seen as a potential risk.

Ethena is developing a decentralized stablecoin protocol. USDe is fully backed, on-chain, scalable, and censorship-resistant, providing a crypto-native, yield-generating, dollar-denominated savings tool. Ethena’s bearish trend has become critical as its market cap dropped from $1.33 billion to $1 billion in the last 60 days. Additionally, the price of the ENA token has been in a bearish trend over the past few weeks, failing to maintain the psychological threshold of $1.

Furthermore, attempts at a bullish reversal failed with an inverted head and shoulders pattern. Although the neckline at $0.96 was broken, a sudden surge in supply at the $1 mark caused the price to drop rapidly. The bearish turn brought the altcoin down to the support level of $0.65, and it is currently trading at $0.70. Moreover, Ethena saw an intraday rise of 1.48%, providing an opportunity for dip-buying by over-the-counter traders.

With the drop to the $0.65 threshold and Ethena’s critical support level, the possibility of a bullish reversal is high. However, the death cross in the 4H chart and the broader market slowdown warn of a potential decline.

Summary

Through arbitraging the price differences between spot assets and futures instruments, basis trading has a long history and wide application. In the crypto market, this trading method is particularly mature, with longs typically paying rates to shorts to maintain positions, which means perpetual contract prices usually exceed spot prices. Ethena, as an open-ended hedge fund, adopts this strategy and tokenizes its trading collateral into the USDe stablecoin. By shorting an equivalent amount of ETH, Ethena creates a delta-neutral portfolio, ensuring the net asset value does not fluctuate with market movements. This strategy allows Ethena to benefit from staking ETH and financing rates.

Since its public debut in February 2024, Ethena has garnered industry attention with its innovative DeFi approach, attracting investment support from Binance Labs and other major stakeholders. Furthermore, Ethena’s strategic partnership with derivatives trading platform MirrorX has expanded its market influence and accessibility. Through integration with the Binance exchange, institutional clients like Ethena can access a range of products from MirrorX without restrictions, facilitating seamless settlement of derivatives positions and opening doors to various products and markets within the Binance ecosystem.

The market demand for stablecoins is enormous. If Ethena can address issues of stability and decentralization while continuously providing stakers with yields of up to 35% APY, it is poised for tremendous success.

References

https://coinmarketcap.com/currencies/ethena