DeXe: Path to the Ideal DAO

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to DeXe

DeXe Protocol is an innovative decentralized autonomous organization (DAO) infrastructure platform designed to empower users with advanced Web3 governance solutions. DeXe has seen the limitations and weaknesses in early DAO structures and are trying to offer a transformative solution. Through DeXe, users can build and manage high-level Web3 products across multiple blockchains, leveraging the strength of decentralized communities.

2. How does it work: Plato’s cave

Voting and Consensus

- Consensus-based decision-making mechanism where every vote is important

- Quorum always represents the majority, even with a low circulating supply of tokens

- Similar to Socratic dialogue, multiple viewpoints are considered before a decision is reached

Ideal DAO

- Each member’s vote counts

- Decentralized governance to everyone’s benefit

- Resistant to corruption and prioritizing personal interests over general benefit

- Free from plutocracy

Philosopher kings

- Like with Plato’s philosopher-kings, governance by experts or experienced members

- Decisions are made from experience and knowledge, but DAO members can always vote on them

3. Tokenomics: DEXE

The DeXe token, DEXE, is a native governance token for the DeXe DAO, enabling decentralized decision-making. Through DEXE, members can propose, vote, and carry out governance actions in a transparent and efficient manner. This token fosters an inclusive and meritocratic decision-making culture.

Moreover, DEXE is a multichain token currently available on two networks and plays a pivotal role in the treasury, enhancing community engagement and participation through its utilities and redistribution mechanisms.

4. Market Analysis

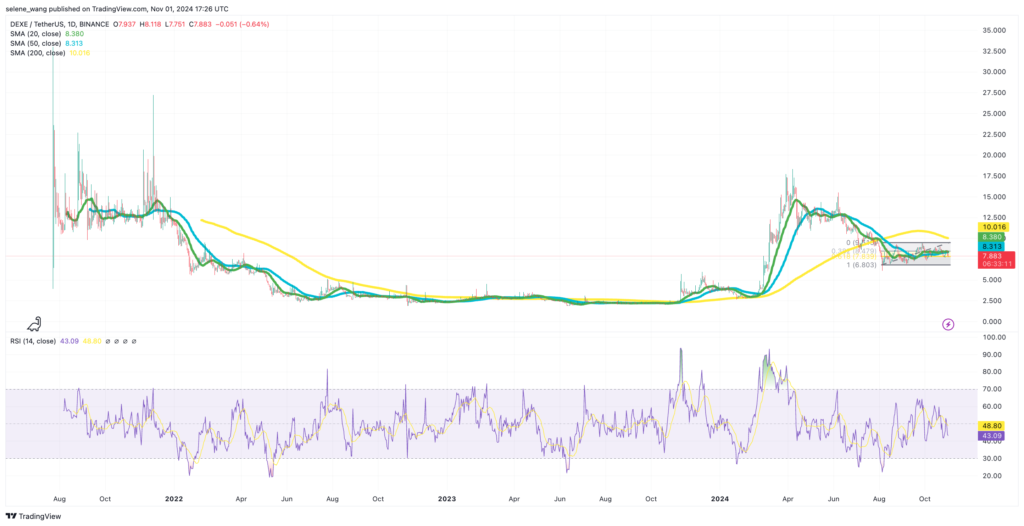

(1) Price & Market Cap Performance

- Live price: $7.87

- All-Time High: $32.38 (Mar 08, 2021)

- All-Time Low: $0.6716 (Nov 06, 2020)

- Live market cap: $449,385,628

- Circulating supply: 57,103,247 DEXE coins

(2) Past performance

- Initial Surge (Early 2021): After launch, DeXe saw a rapid increase in price. This likely corresponds to initial excitement and adoption, as well as DeFi’s growing popularity at the time. New projects often experience a surge when they debut on exchanges, driven by investor speculation and interest in unique features like DeXe’s decentralized social trading model.

- Price Drop and Stabilization (Mid to Late 2021): After the initial excitement waned, the price dropped and stabilized. This phase could be due to profit-taking by early investors, as well as broader market adjustments. Many new projects undergo a “price correction” phase as the market settles.

- Secondary Peak (July 2021): DeXe experienced a significant price spike in July 2021. This surge is largely attributed to the Binance listing of the DEXE/USDT trading pair. Listings on major exchanges like Binance often lead to increased accessibility, liquidity, and visibility, drawing in new investors and driving up demand. This event likely created a surge of interest, pushing the price to its secondary peak.

- Extended Correction and Bearish Phase (Late 2021 to Early 2023): After the July peak, DeXe’s price declined, reflecting a broader downtrend in the DeFi and crypto markets as a whole. The initial excitement of the Binance listing waned, and DeFi tokens experienced a cooling-off period, impacted by market corrections and lower trading volumes. This period saw DeXe stabilizing at lower levels as speculative interest decreased.

- Renewed Growth (2024): In 2024, DeXe showed renewed price growth. This resurgence could be due to a combination of factors, including potential upgrades, partnerships, or broader trends in the DeFi market. DeXe’s ongoing development and improvements to its protocol may have attracted renewed attention from investors looking for innovative DeFi projects.

(3) Technical Analysis

- Relative Strength Index (RSI): Although it’s not yet in the oversold territory (typically below 30), the RSI being under 50 suggests that sellers are slightly in control.

- Moving Averages

- SMA (20): The 20-day simple moving average (SMA) is currently at 8.38, suggesting a short-term resistance level. The price is oscillating around this level, indicating potential consolidation or indecisiveness in the market.

- SMA (50): The 50-day SMA at 8.31 is close to the current price level, reinforcing the short-term resistance zone.

- SMA (200): The 200-day SMA at 10.02 lies above the current price, suggesting that DEXE remains in a broader bearish trend in the long term. The price would need to break above this level to signal a potential shift in long-term trend momentum.

- Fibonacci Retracement

- 0.618 Fibonacci Retracement Level (8.213): This level, which aligns closely with the 20- and 50-day SMAs, acts as a critical support zone. If DEXE holds above this level, it might signal a base forming for a potential upward move. A breakdown below this level could see further bearish pressure.

- 0.382 Fibonacci Retracement Level (9.56): This level provides an immediate resistance target if DEXE begins to rally. A break above this could signal strength and potentially target the 200-day SMA.

5. Summary

DeXe Protocol represents a bold step towards decentralizing financial management by enabling users to participate in DAOs (Decentralized Autonomous Organizations) that operate independently of traditional authorities. DeXe Protocol is built on the fundamental principle of financial empowerment, giving users a transparent, decentralized alternative to traditional finance, where they have both control and ownership of their investments and the platform’s direction. Instead of relying on financial institutions as intermediaries, users can participate in decisions, retain control of their assets, and engage in transparent governance.

From a technical standpoint, DeXe is under considerable pressure at these resistance levels, and breaking through them is challenging. This may not be an ideal time to buy. It could be more strategic to wait for a confirmed breakout above key resistance (such as $8.38) or for a pullback to a lower support level, which could offer a better risk-reward ratio.

Reference

https://coinmarketcap.com/currencies/dexe

https://whitepaper.dexe.network/