Week of May 20th, 2019 Market Analysis

By Jing Zhu | Crescent City Capital Market Analyst Intern

Bitcoin’s momentum could slow down in the near future. From April 22 to May 22, Bitcoin price has increased by about $2700. Given that this 30-day interval has been marked by steady overall increase, some traders anticipate that there may be healthy pullbacks based on Bitcoin’s historical performance in the past three years. Josh Rager, a cryptocurrency trader and analyst, predicts that Bitcoin price could drop by as much as 30%, but remains optimistic about buying opportunities. Other traders believe that the momentum might not slow down. BKCM Capital CEO Brian Kelly explains, “The big picture here is we’re starting to enter this cycle where you get a supply cut. Every four years the supply of Bitcoin gets cut in half, you generally have a rally a year into it and a year out of it, and so we’re just at the beginning of that stage…You got this combination of a lot of demand coming in and we are heading into a period where we are going to have a supply cut and that’s generally very bullish”. In general, some traders are confident of Bitcoin’s continued surge, while others expect a price correction.

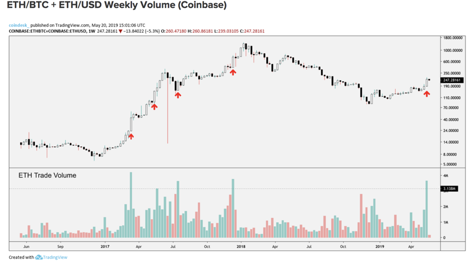

Ethereum Weekly Trading Volume Highest Since 2017

This week, Coinbase recorded Ethereum’s market cap of $904.1 million. Total weekly volume has also increased dramatically since December 11th, 2017. Not including this week, there have been four other times in the past year where Ethereum has exceeded the ETH trade volume of 3.13 million, as indicated by the red arrows. This shows that the Ethereum rally might be sustainable and that retail investors have once again entered the market after their declining interest in falling prices.

Litecoin Exhibits Bullish Patterns

The ascending triangle formed by Litecoin price indicates a continuation pattern, which means that the market will most likely continue its upward trend after consolidation. This bullish trend might make it possible for Litecoin to break $175. Traders expect Litecoin to consolidate at around $175 but true resistance could be experienced at the $220 mark. Bulls should expect Litecoin to trade around that price this August.

$30 Million Ponzi Scheme Involving Diamond-Backed Cryptocurrency

According to the Wall Street Journal, the SEC discovered that Argyle Coin LCC and its principal, Jose Angel Aman, used investor funds to run a Ponzi scheme. Argyle Coin LLC is a company that offers cryptocurrency investment backed by diamonds. Aman told his investors that he would use the fund to procure and resell diamonds for a profit. He promised an investment return of 24% and return of principal within two years. However, Aman used the money to pay prior investors from his other two companies. He also continued this scheme by creating the cryptocurrency Argyle Coin, which he claimed was risk-free because the investors’ principal would be protected by diamonds. The SEC determined that Argyle Coin does not have the diamonds and charged Aman with violating antifraud provisions of federal securities laws.

Circle Lays Off 10% of Staff Due to U.S. Regulation

Circle, which is the parent company of crypto exchange Poloniex, has announced that it will lay off 30 employees. Jeremy Allaire, the CEO of Circle, tweeted that the “organizational changes” are a result of “an increasingly restrictive regulatory climate in the United States”. The overall public response has been negative. Some theorize that Circle laid off those 30 employees to make room for lawyers and compliance officers.

1. “Bitcoin Price Roars Loud But Could Quickly Unravel to 30% Plunge: Analyst” by Joseph Young for CNN published 5/22/19

2. “Coinbase Records Highest Weekly Ethereum Trading Volume Since 2017” by Sam Ouimet for Coindesk published 5/20/19

3. “Why Litecoin Will Skyrocket 140% in Less than 3 Months and Hit $220” by Kiril Nikolaev for CNN published 5/22/19

4. “SEC Halts Alleged Ponzi Scheme Involving Diamond-Backed Cryptocurrency” by Mengqi Sun for WSJ 5/23/19

5. “Jeremy Allaire’s Circle Lays of 10% of Staff amid Prickly US Regulation” by P.H Madore for CNN published 5/22/19