Blast: The only EVM chain with native yield

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to Blast

Blast is a new Ethereum layer 2 network that has made waves after introducing the concept of native yield. Unlike other layer 2 solutions, Blast users can earn yield paid in crypto simply by having certain tokens in their wallets.

Blast is the only Ethereum L2 with native yield for ETH and stablecoins. Blast yield comes from ETH staking and RWA protocols. The yield from these decentralized protocols is passed back to Blast users automatically. The default interest rate on other L2s is 0%. On Blast, it’s 4% for ETH and 5% for stablecoins.

2. How Does Blast Work?

Blast yield income for decentralized finance (DeFi) users comes from the concept of Ethereum staking. Ethereum staking is a process on the Ethereum network whereby users can temporarily lock tokens to validate transactions.

Traditionally, managing staking requires individual attention from users. However, Blast simplifies this process by handling staking on behalf of its users within its ecosystem, making it an L2 platform with native yield.

When assets are bridged to the Ethereum mainchain within Blast’s network, they are automatically staked, initiating the interest-earning process. Blast’s smart contracts facilitate the collection of this interest, which is automatically redistributed to users in the form of ether (ETH) and stablecoins.

3. Challenges and Controversies Associated with Blast

(1) Centralization Concerns

The platform uses a multi-signature (multisig) wallet for asset custody, requiring three out of five signatures to authorize withdrawals. While this adds a layer of security, the anonymity of the signatories has raised questions about centralization.

(2) Security

Security concerns revolving around the Blast chain primarily stem from the use of Layer-2 scaling solutions and off-chain transaction processing. While these technologies enhance speed and efficiency, they introduce potential vulnerabilities that could impact the overall security of the blockchain.

4. Tokenomics: The BLAST Token

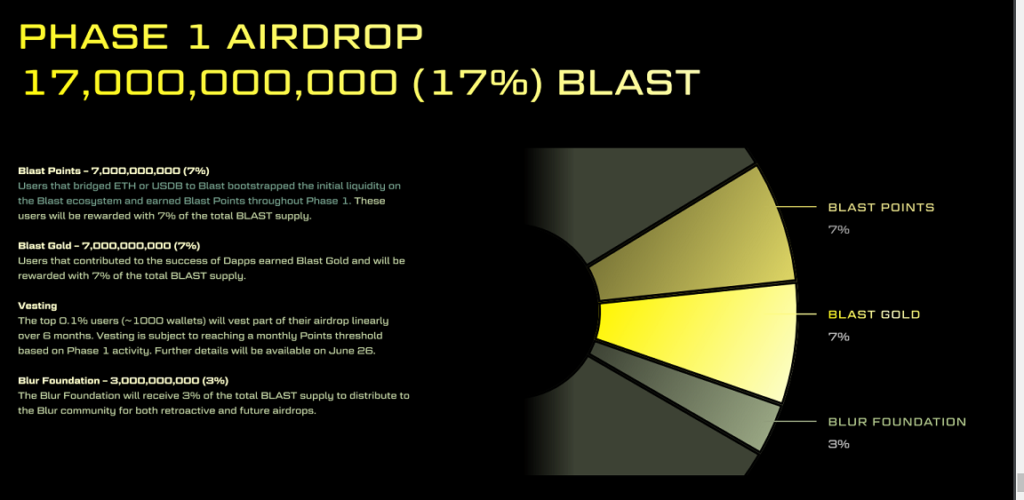

Blast’s native token BLAST airdropped on 26 June 2024. Blast (BLAST) has a total token supply of 100 billion. Of this, 25.5% will go to core contributors to the network, 16.5% to the network’s investors, 8% to the Blast Foundation to build infrastructure and grow the Blast ecosystem, while 50% has been set aside for community initiatives — including its initial airdrop.

The Blast Foundation dispersed 17 billion BLAST tokens in its ‘Phase 1’ airdrop on 26 June 2024. Individual user airdrop allocations have been pre-determined by the number of Blast Points they have earned. Of the 17 billion, 7 billion went to Blast Points holders, another 7 billion to those with Blast Gold, while the remaining 3 billion were allotted to the Blur Foundation.

The airdrop introduced the BLAST token as part of a larger reward system

- Blast Points: Users participate in this airdrop by bridging assets to Blast and inviting new members, thereby earning points, which are a measure of their contribution to the platform and determine the amount of BLAST tokens they were airdropped.

- Blast Gold: While users receive BLAST tokens, developers receive Blast Gold, a separate point system. This is to incentivize developers to build and innovate within the Blast environment. Since January 2024, the Blast incentives committee has distributed Gold on a two-to-three-week cadence and announces publicly when Gold has been distributed.

Gold is meant to be used as incentive for dApps growth, meaning that dApps should directly pass on 100% of any Gold they receive to their users. Additionally, they must integrate with the Blast Points API to do so.

An accompanying report stated that wallets ranked in the top 1,000 in terms of points will “vest part of their airdrop linearly” for six months, implying that these accounts will not be able to sell all of their tokens for another six months. Some Blast users have complained about the vesting requirement for the top 1,000 wallet holders.

5. Market Analysis

BLAST’s initial token airdrop in June 2024 distributed 17 billion tokens to users. The token debuted at around $0.020 but quickly experienced volatility, peaking at over $0.029 before settling around $0.020. This fluctuation was driven by both excitement and immediate sell-offs by airdrop recipients.

The initial surge was followed by a price decline. This decline was a typical market reaction following a large airdrop, where initial hype fades and selling pressure increases.

As of the latest data, BLAST is trading around $0.017. This price is a recovery from its lowest point but still below its initial high.

6. Conclusion

Blast aims to transform the crypto by providing a layer 2 solution with native yield. With its innovative features, such as the native yield offering and optimistic rollup technology, Blast is well-positioned to attract more users and developers.

However, the project must address security and transparency concerns to maintain trust and ensure long-term success. Besides, the project is still in its early stages and has much to prove, including liquidity efficiency and native yield arrangement over time. Monitoring ongoing developments and market sentiment will be crucial for making informed investment decisions.

Reference

https://coinmarketcap.com/currencies/blast

https://docs.blast.io/about-blast

https://assets.blast.io/en/q2-2024.pdf

https://unchainedcrypto.com/blast-on-ethereum

https://crypto.com/university/blast-blockchain-what-it-is-and-why-its-on-the-rise

https://cointelegraph.com/news/blast-airdrop-june-26-distributing-17-percent-early-users