XRP: A Blockchain for Business

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to XRP / XRP Ledger

The XRP Ledger is a decentralized blockchain that uses its own digital currency to process and record financial transactions. Launched in 2012, XRP is designed to serve as a bridge currency in transactions involving different fiat currencies. Its primary aim is to revolutionize international remittances by addressing the inefficiencies of traditional systems like SWIFT, offering faster transaction speeds and lower costs.

2. How does it work: Decentralized Ledger

- Consensus Algorithm: XRP runs on the XRP Ledger, which uses a consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA). The RPCA ensures that all participants in this payment network agree on the order and validity of transactions in a computationally-light way. Whenever any crypto market asset, such as XRP, is sent from one address to another, the network’s validators work together to confirm and validate that transaction. This agreement happens every few seconds in what are known as “ledgers.”

- Nodes and Validators: Nodes are computers or servers that maintain a copy of the entire blockchain and play a crucial role in keeping the network decentralized. Anyone can run a node to help ensure that no single entity controls the ledger. Validators (trusted nodes) ensure the ledger’s integrity without mining, enabling faster and cheaper transactions.

3. Tokenomics: XRP

Total Supply: XRP has a capped supply of 100 billion tokens. Approximately 50% of the supply remains with Ripple Labs for future development and partnerships.

Circulating Supply: As of now, the circulating supply is around 57 billion XRP.

Utility: XRP is used primarily for

- Transaction fees: XRP is used to pay transaction fees on the XRP Ledger. Each transaction requires a small amount of XRP to be burned and is done to ensure security and prevent spam.

- Bridge currency: XRP is used as a bridge currency, allowing instant currency conversion between different fiat currencies. For example, a bank can convert USD to XRP and then XRP to EUR within seconds.

4. Market Analysis

(1) Price & Market Cap Performance

- Live price: $2.35

- All-Time High: $3.40 (Jan 07, 2018)

- All-Time Low: $0.002686 (May 22, 2014)

- Live market cap: $134,744,003,379

- Circulating supply: 57.12B XRP

(2) Past performance

- 2017-2018 Boom: XRP saw exponential growth during the 2017 crypto bull run, driven by retail speculation and Ripple’s partnerships with financial institutions.

- SEC Lawsuit Impact (2020-2023): XRP’s price experienced significant volatility after the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, claiming XRP was an unregistered security. Despite setbacks, XRP recovered following Ripple’s partial legal victory in 2023.

- 2021: The overall bullish trend in the cryptocurrency market during 2021 led to increased speculative interest in various digital assets, including XRP. Investors anticipated potential positive developments in Ripple’s legal situation, contributing to price appreciation. Besides, XRP has gained traction as Ripple expanded ODL (On-Demand Liquidity) services globally, with strong adoption in regions like Asia and Latin America.

- Recent Surge: The recent surge in XRP’s price (recently flipping Tether and Solana to become the third-largest crypto) is attributed to optimism about the incoming White House administration, potential XRP ETFs, and Ripple’s partnerships with financial institutions. With the new leadership at the SEC, a financial institution that has often clashed with Ripple, a new change could see XRP and other cryptos face less or no government resistance moving forward, minimizing risk for investors.

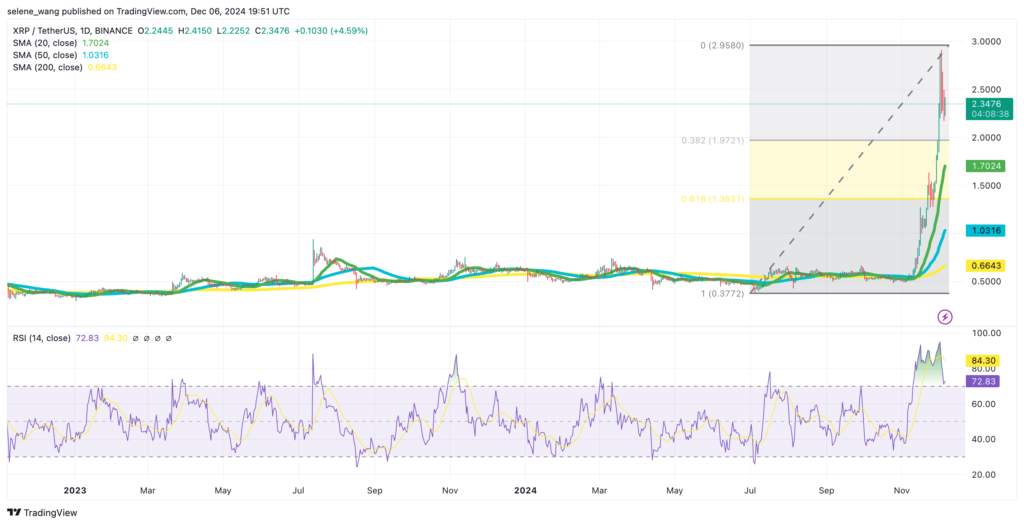

(3) Technical Analysis

- Relative Strength Index (RSI): The current RSI is 72.83. RSI above 70 indicates overbought conditions, suggesting that XRP is in a strong bullish phase but may be overextended in the short term. At this level, caution is advised as there could be a price correction or consolidation phase to cool off the momentum. However, in strong bull runs, RSI can stay overbought for extended periods.

- Moving Averages

- The price is currently well above the 20-day SMA, indicating strong short-term bullish momentum. This level could act as the first layer of support in case of a pullback.

- The significant gap between the current price and the 50-day & 200-day SMA reflects strong upward momentum. However, this also highlights a potential overextension in price, increasing the likelihood of mean reversion.

- Fibonacci Retracement

- The Fibonacci retracement is drawn from a recent low at 0.3772 to the recent high at 2.9580. XRP is trading at 2.3476, near the upper range of the Fibonacci levels.

- 0.382 Level (1.9721): This level is closer to the current price and may serve as immediate support if there is a minor pullback.

- Breaking the recent high of 2.9580 would indicate a continuation of the bullish trend, while failing to do so might lead to a retracement towards lower Fibonacci levels.

5. Summary

Ripple’s payment network and its native cryptocurrency, XRP, provide a fast, low-cost, and scalable alternative to traditional banking systems for cross-border transactions. With growing institutional adoption, Ripple aims to address inefficiencies in the global financial system.

While Ripple lab faces regulatory challenges and competition in the digital payments space, it continues to evolve through strategic partnerships, central bank digital currency (CBDC) initiatives, and enhanced blockchain functionality. The platform’s success depends on regulatory clarity, institutional adoption and its ability to maintain technical advantages in the digital payments space.

The recommendation is to buy XRP now, as the current momentum suggests strong bullish potential despite the possibility of a short-term retracement. Even if a temporary pullback occurs, XRP is likely to recover and continue climbing. The target price is set at $3, making it a favorable opportunity for gains. However, if the price retraces to $2.1, it’s advisable to exit and cut losses promptly to avoid further downside risks.

—

References:

https://coinmarketcap.com/currencies/xrp

https://xrpl.org/docs/introduction/what-is-xrp

https://www.kraken.com/learn/what-is-xrp-xrp