aelf: Converge AI and Blockchain

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to aelf

aelf is a high-performance, cloud-native, layer-1 blockchain with Mainnet nodes in cloud data centers. It supports parallel smart contract execution, microservices, and scalable MainChain and multi-SideChains architecture. The cross-chain design enables fast data interaction, and its hybrid SideChain model reduces costs and boosts network performance.

2. How does it work: Cross Chain

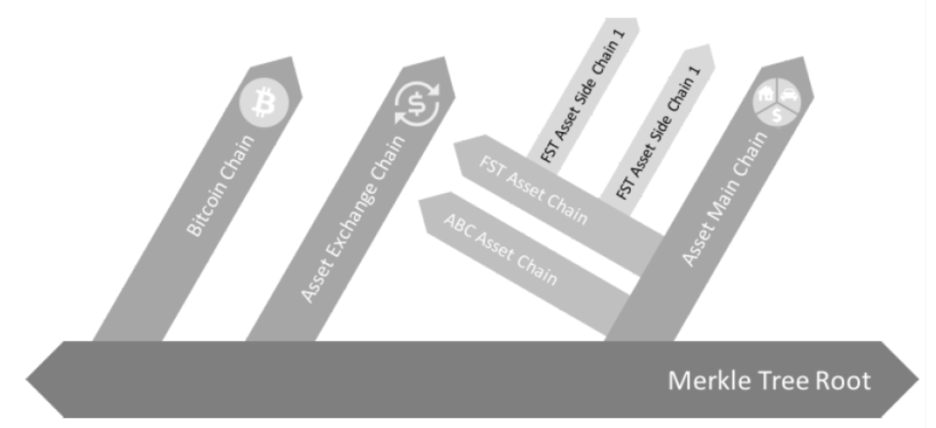

One of the major issues with current blockchain systems is scalability. This is mainly due to congestion problems in existing blockchains. The core problem is that when a single chain needs to sequentially order and process transactions, a popular dApp consuming a lot of resources can negatively impact other dApps.

To address this issue, aelf introduced side chains in its initial design. The concept is that each side-chain handles one or more similar business scenarios, distributing different tasks across multiple chains to improve overall processing efficiency.

Side-chains are designed to be independent and specialized, ensuring that the dApps running on them perform efficiently and smoothly. There is a network link between the main-chain node and side-chain nodes, with communication indirectly facilitated through a Merkle root.

Side chains are isolated but still need a way to interact with each other. To enable cross-chain verification scenarios, aelf introduces a communication mechanism through Merkle roots and indexing.

3. Tokenomics: The ELF Token

ELF: The main token on the aelf platform, used for transaction fees, SideChainindexfees, production nodes deposits, voting, and block rewards.

The ELF token has a maximum fixed supply of 1 billion tokens that have been fully minted. As a result, no new tokens can be created. Instead, ELF tokens are distributed to network participants through staking rewards at a continuously decreasing rate.

Following the ICO, ELF tokens were distributed in the following allocations:

- 16% – Team allocation

- 10% – Advisors and partnerships

- 12% – PoS and PoW Rewards

- 25% – aelf foundation

- 25% – Sale

- 12% – Marketing and airdrops

4. Possible Competitors

aelf is not the only cryptocurrency project that aims to increase scalability and ease network congestion and bottleneck effects using sidechains. Using sidechains enables networks to scale in a common solution that helps blockchains achieve greater transaction finality and throughput. The Polygon network is a great example of this innovation, and is currently a larger and more well-known competitor.

5. Market Analysis

Price & Market Cap Performance:

- Live price: $0.4074

- All-Time High: $2.60 (Jan 09, 2018)

- All-Time Low: $0.03546 (Mar 13, 2020)

- Live market cap: $295,523,383

- Circulating supply: 725,800,324 ELF coins

Past performance:

The aelf network was originally founded in 2017 by Ma Haobo. After receiving funding through initial rounds in late 2017, the aelf development team began development on the aelf blockchain in 2018, with the public testnet going live in June 2018. The aelf testnet underwent multiple iterations before the aelf mainnet was finally launched in Dec 2020.

The aelf mainnet continued to undergo numerous functionality tests and security audits throughout 2021, with the integral token swap going live in Sep 2021. Because the ELF token was originally distributed as an ERC-20 token on the Ethereum network, it wasn’t compatible with the aelf network. The token swap allowed investors to swap their ERC-20 ELF tokens to ELF mainnet tokens at a 1:1 ratio and begin using the aelf ecosystem.

In Augest 2024, they announced a strategic partnership with ChainGPT, a leading provider of AI-powered infrastructure and tools for the Web3 space. This collaboration marks a significant step forward in their mission to enhance our blockchain’s performance and efficiency by leveraging the powers of AI, all the while driving innovation in the decentralised ecosystem.

Technical analysis:

- Moving Averages (SMA) Analysis: The 50-day SMA is very close to the 20-day SMA, indicating a period of consolidation where the market is trying to establish its next direction. The long-term SMA is at $0.5042, which remains above both the 20-day and 50-day SMAs. This indicates that the overall trend continues to be bearish.

- Relative Strength Index (RSI) Analysis: The RSI is currently at 36.71, which is in the neutral to slightly oversold territory. The RSI’s drop to 36.71 from previous higher levels indicates that the bearish momentum has been strong. However, the proximity to the oversold level might suggest a potential for a short-term bounce.

In summary, while there might be a short-term opportunity due to the oversold RSI, the overall trend for Aelf (ELF) remains bearish. It may be prudent to wait for confirmation of the end of the current consolidation phase before entering any long positions. This cautious approach will help mitigate the risk of further declines in a still uncertain market environment.

6. Summary

Aelf is a high-performance, cloud-native, Layer-1 blockchain designed to enhance scalability and efficiency through its unique MainChain and multi-SideChains architecture. This setup supports parallel smart contract execution and microservices, addressing the congestion issues commonly faced by traditional blockchains.

Given the current technical indicators, Aelf (ELF) presents a mixed outlook. While the RSI suggests a potential short-term opportunity due to its oversold status, the overall trend remains bearish, with prices consistently below key SMAs. With signs of uncertainty, it may be wise to wait for clearer signs of the end of the current consolidation phase.

If, after the consolidation phase (possibly within one to two months), the price rises to $0.60, it would be a favorable entry point for investment, with a potential exit target of $0.91. If the price fails to rise, further analysis will be necessary to reassess the situation.

Reference:

https://coinmarketcap.com/currencies/aelf

https://www.okx.com/learn/what-is-aelf