Jito: A Liquid Staking Solution

By Selene Wang | Crescent City Capital Market Analyst Intern

1. Introduction to Jito

Jito is the liquid staking service for Solana that distributes MEV (maximum extractable value) rewards to holders. The Jito Stake Pool enables users to stake their Solana tokens in exchange for a liquid stake pool token (JitoSOL). The JitoSOL token provides liquidity while earning a combination of staking rewards and MEV rewards.

Jito’s liquid staking token is unique in two ways:

- JitoSOL provides additional rewards to users from MEV transactions happening on Solana

- Jito exclusively stakes with validators that run software designed to improve network performance. The improvements from the introduction of an auction mechanism so network congestion is less likely.

JitoSOL automatically accrues value from staking and MEV rewards. The token allows users to earn yield while also maintaining capital efficiency via DeFi integrations. JitoSOL holders can earn yield from validators while also accruing interest in lending protocols or yield farming. Jito’s goal is to provide the best yield for JitoSOL while improving Solana’s network

2. JitoSOL Liquid Staking

– Liquid Staking Basics: The most capital efficient way to earn rewards on SOL

Staking is the process by which a SOL token holder (such as someone who purchased SOL tokens on an exchange) assigns some or all of their tokens to a particular validator or validators, which helps increase those validators’ voting weight. There are two ways to participate in staking: by directly staking to a validator, or by delegating to a stake pool. In both cases, delegators still control all staked tokens that they may have chosen to stake.

Unlike traditional staking, where assets are tied up and inaccessible, liquid staking gives you a tradable asset in return which represents your staked JTO crypto. This means you can earn staking rewards without giving up the ability to trade or use your assets. This approach enhances flexibility and capital efficiency for investors.

– Maximum Extractible Value

Maximum extractable value (MEV) describes profit opportunities priveledged entities can extract attributable to the specific order of transaction execution. For example, a large swap on Orca can lower the pool’s price below that of Raydium or Serum. Traders will race to profit from that price difference and this arbitrage is considered MEV.

Alternatively, a large account on Solend may be near liquidation. Liquidation bots will vie to be the first to process that liquidation as soon as the price threshold is exceeded. These liquidation profits are another form of MEV.

MEV is a natural byproduct of financial markets with infinite examples in traditional finance and daily life. When Taylor Swift announces a new concert and fans rush to buy tickets directly to avoid reseller markups, that is also MEV.

The Jito Foundation’s mission is to ensure that MEV is efficiently extracted and shared with stakers and validators because it increases the security and denctralization of Solana.

3. How does Jito work

(1) Deposit your Solana: You start by depositing your Solana coins into Jito’s platform. This gives Jito permission to use your crypto for staking and MEV capture.

(2) Jito pools and delegates your SOL: Jito combines your Solana with other users’ tokens into a large pool. This pool is then delegated to validators, who are responsible for securing the Solana network.

(3) Earn staking rewards: As a reward for contributing to network security, you earn regular staking rewards. These rewards come from the network itself and are distributed based on the amount of Solana you’ve staked.

(4) MEV capture for extra yield: Jito actively seeks out opportunities to capture MEV. MEV is essentially extra gains that can be extracted from certain blockchain transactions. Jito uses a proprietary system known as the Jito Block Engine to analyze transaction data and strategically order transactions to maximize MEV capture. This additional yield is then shared with you, boosting your overall earnings.

(5) Receive JitoSOL: In exchange for your deposited Solana, Jito gives you JitoSOL tokens. These tokens represent your staked Solana and allow you to enjoy benefits like bonus liquidity and the benefit of dual rewards.

4. JTO token

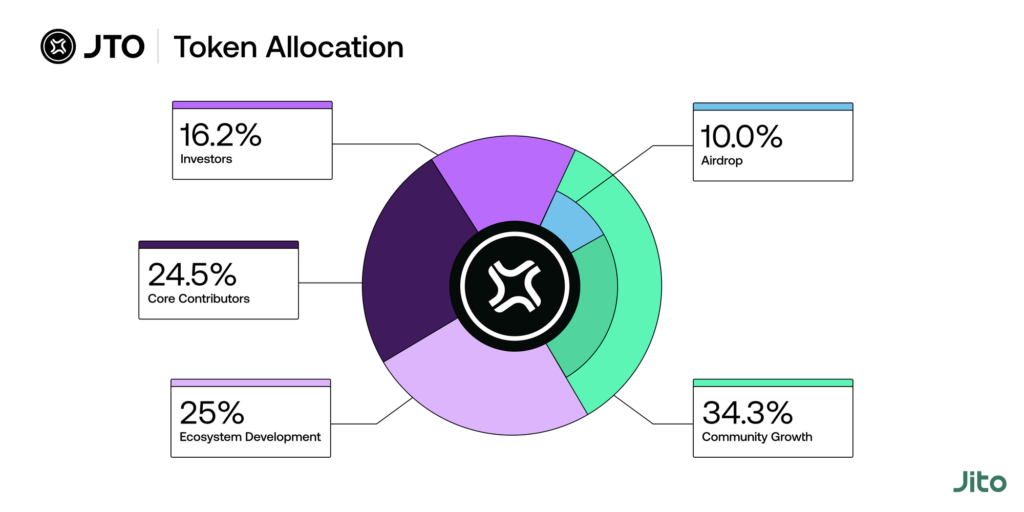

With a total supply of 1 billion, JTO will be distributed as follows:

- Community growth: 24.3% — to be managed by DAO governance on the Realms platform.

- Ecosystem development: 25% — to be used for funding communities and contributors aiding the project’s growth.

- Core contributors: 24.5% — to be allocated to the Jito team, which includes Jito Foundation employees, partners, and other internal project contributors.

- Investors: 16.2% — to be distributed over three years with a one-year cliff.

- Airdrop: 10% — 90% of which will be immediately accessible on distribution day, while the remaining 10% unlocks over a year.

The use of JTO:

- Jito Staking: JTO crypto token holders can set fees for the Jito stake pool and directly influence the profitability and attractiveness of staking within the network.

- Delegation Strategy Updates: By adjusting the parameters of StakeNet programs, token holders refine delegation strategies to optimize network performance and rewards.

- Treasury and Revenue Management: The JTO coin community oversees the DAO’s treasury, including JTO tokens and fees generated from JitoSOL.

- Protocol and Product Development: Token holders contribute to the ongoing development and improvement of Jito Network’s protocols and products.

5. Market Analysis

Price & Market Cap Performance:

- JTO Current Price: $3.28

- All-Time High: $5.28, All-Time Low: $1.43

- 24-hour trading volume: $35,661,386 USD

- The current CoinMarketCap ranking is #161, with a live market cap of $402,232,369 USD. It has a circulating supply of 122,542,076 JTO coins.

For the last 7 days, JTO has been in a downward trend. The overall trend includes a few ups and downs since inception. With only 6 months of limited past price data, the future price trajectory remains uncertain.

6. Summary

Jito’s liquid staking solution presents a compelling alternative to traditional staking on Solana. By offering liquidity, enhanced rewards through MEV capture, and access to DeFi opportunities, Jito unlocks the full potential of users’ staked assets. To date, Jito Labs is actively innovating and improving beyond its current offerings. For example, Jito plans to integrate and bridge with a wider range of DeFi protocols. As the platform evolves and integrates with the fast-growing DeFi ecosystem, Jito has potential and could play a pivotal role in shaping the future of staking on Solana and beyond.

JitoSOL continues to dominate the LST ecosystem on Solana and its collateral weight has been increased to reflect this deep liquidity. JitoSOL now has the highest weight of any LST on the platform at 75%. Considering the current low-price level and high potential of Jito, it could be an opportune moment to enter the market.

Reference

https://coinmarketcap.com/currencies/jito

https://www.jito.network/docs/jitosol/overview

https://www.coinex.com/en/blog/6815-what-is-jito-jto-token

https://www.okx.com/learn/what-is-jito

https://twitter.com/marginfi/status/1798792678244491264